• Holding on. No change in rates by US Fed. US equities & bond yields consolidate. USD index ticks up, but AUD outperformance continues.

• RBA hikes. Stronger CPI boosted RBA rate rise bets. Hike next week ~70% priced, 2 moves baked in by year-end. AUD up at Feb ’23 levels.

Global Trends

Markets were calmer overnight compared to the bursts of volatility that have washed through recently. US equities consolidated with the S&P500 up near record highs while US bond yields were range bound with the 10yr rate close to its 1-year average (now ~4.24%). In FX, the USD index clawed back ground against the major alternatives with EUR slipping under ~$1.20, GBP drifting towards ~$1.38, and USD/JPY rising a bit (now ~153.38). That said, the NZD bucked the trend by nudging up further (now ~$0.6049) and the AUD also rose (now ~$0.7027) thanks to relative outperformance on the cross-rates after yesterday’s stronger Australian CPI boosted RBA rate hike expectations.

In terms of the news flow, as expected the Bank of Canada and US Federal Reserve kept interest rates steady. BoC Governor Macklem didn’t offer forward guidance and declined to comment about the timing or direction of the next move, citing elevated uncertainty. With respect to the US Fed two members (President Trump’s appointee Miran and Waller who has been in the running to be the next Chair) voted for another rate cut but the rest of the committee chose to keep policy unchanged given the US economy is expanding at a “solid pace”, unemployment had shown “some signs of stabilizing”, and with inflation still “somewhat elevated”. Notably, the Fed removed commentary about downside risks to the jobs market. Chair Powell also reiterated that policy is “appropriate” and that the Fed is well positioned to wait for more data before acting again. Markets are fully pricing in the next Fed rate reduction by July.

In addition to the Fed decision there were also interesting comments by officials about recent FX moves. After President Trump’s comment yesterday that he thinks the USD’s decline is “great” Treasury Secretary Bessent stressed the US still has a strong USD policy. He added that the US is “absolutely not” intervening in USD/JPY. Over in Europe, a couple of ECB officials indicated the jump in the Euro hasn’t gone unnoticed with currency appreciation having macro impacts (such as lowering inflation and growth) that might trigger an offsetting policy response (i.e. rate cut) down the line. These are the second order consequences other central banks might need to grapple with if the USD continues to weaken materially.

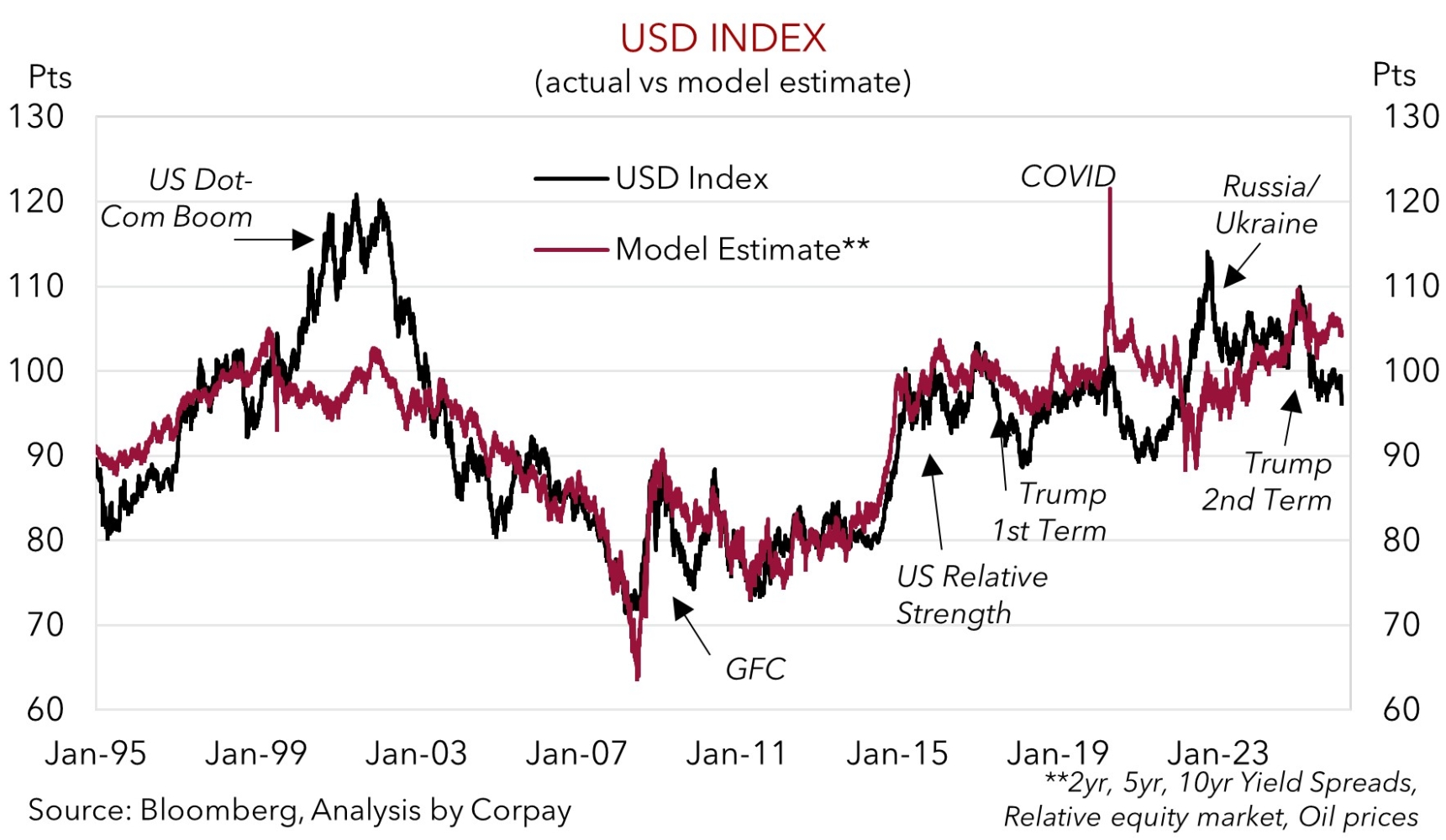

We remain of the view that the USD should depreciate further over the medium-term because of cyclical and structural headwinds such as slower US growth and the US’ large ‘twin deficit’ vulnerability. However, over the near-term, given its recent sizeable and rapid decline, we think the USD has scope to bounce back a little. As our chart shows, the USD is tracking below our ‘fair value’ model estimate and a run of more positive US data over the next week or so could see it rebound.

Trans-Tasman Zone

The AUD has remained firm, with relative strength on the cross-rates helping to override a modest rebound in the USD index overnight (see above). At ~$0.7027 the AUD is at the upper end of the range occupied since mid-February 2023. The NZD has been dragged along for the ride with it at a ~6-month high (now ~$0.6049). In terms of the crosses the AUD has recorded gains of ~1% versus the JPY and EUR, and strengthened by ~0.2-0.6% versus GBP, NZD, CAD, and CNH. In level terms, AUD/EUR (now ~0.5884) is at a ~10-month high, AUD/CNH (now ~4.8797) is where it last traded in mid-2024, AUD/GBP (now ~0.5093) is around the upper end of its 1-year range, and AUD/JPY (now ~107.78) is not far from its cyclical peak.

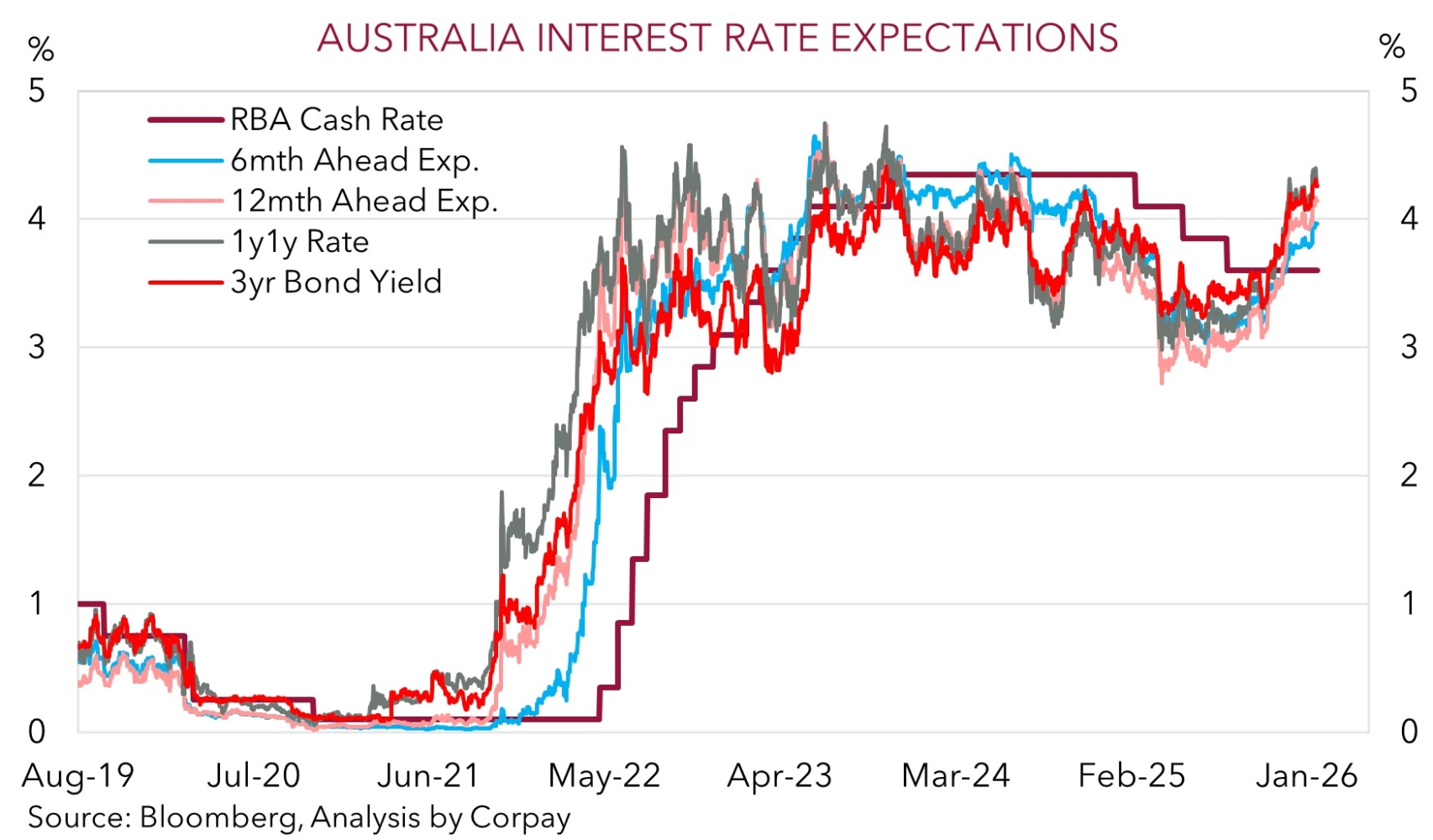

The firm Australian inflation pulse and RBA rate hike expectations have underpinned the AUD. Q4 CPI showed price pressures remain firm with headline and core inflation coming in above the RBA’s predictions. Core inflation (on the quarterly basis which the RBA is still focusing on) accelerated to ~3.4%pa with much of the inflation domestically generated. With the Australian economy still operating at a high level (as illustrated by above average capacity utilization and low unemployment), and private sector growth picking up inflation is a hard nut to crack. Bottom line, the current level of interest rates won’t get it done. RBA settings need to be more ‘restrictive’ to cool growth and get demand and supply back into balance for inflation to slow to the middle of the 2-3% target on a sustained basis.

A RBA U-turn and rate rise next Tuesday appears on the cards, in our view. The market has shifted this way with a hike in February now deemed a ~71% chance and 2 increases priced in by year-end. Over the medium-term we remain of the view that diverging economic trends between Australian and the US, and widening yield differentials, should continue to be AUD supportive. However, given the AUD’s rapid jump over the past few weeks it may pause for breath and drift back a bit heading into next week’s RBA meeting. Indeed, up near current levels in the AUD and based on where interest rate expectations are tracking the RBA ‘recalibration’ story looks largely baked in. Things have moved quicker than we were anticipating, but in terms of levels, as outlined recently, we believe ~$0.71 could be a ceiling for the AUD. Interest rate differentials have already widened and over time people will also need to consider the negative impact of higher rates on Australian growth and unemployment.