A slow-motion flight to safety is underway across the currency markets this morning, as a bloodbath in the precious metals complex extends into a second week. Equity futures are pointing to further losses at the North American open, the US dollar is climbing against all of its major rivals as traders exit risky positions across a range of asset classes, and commodity-sensitive currencies like the Australian dollar, Canadian dollar, and Swiss franc are coming under selling pressure.

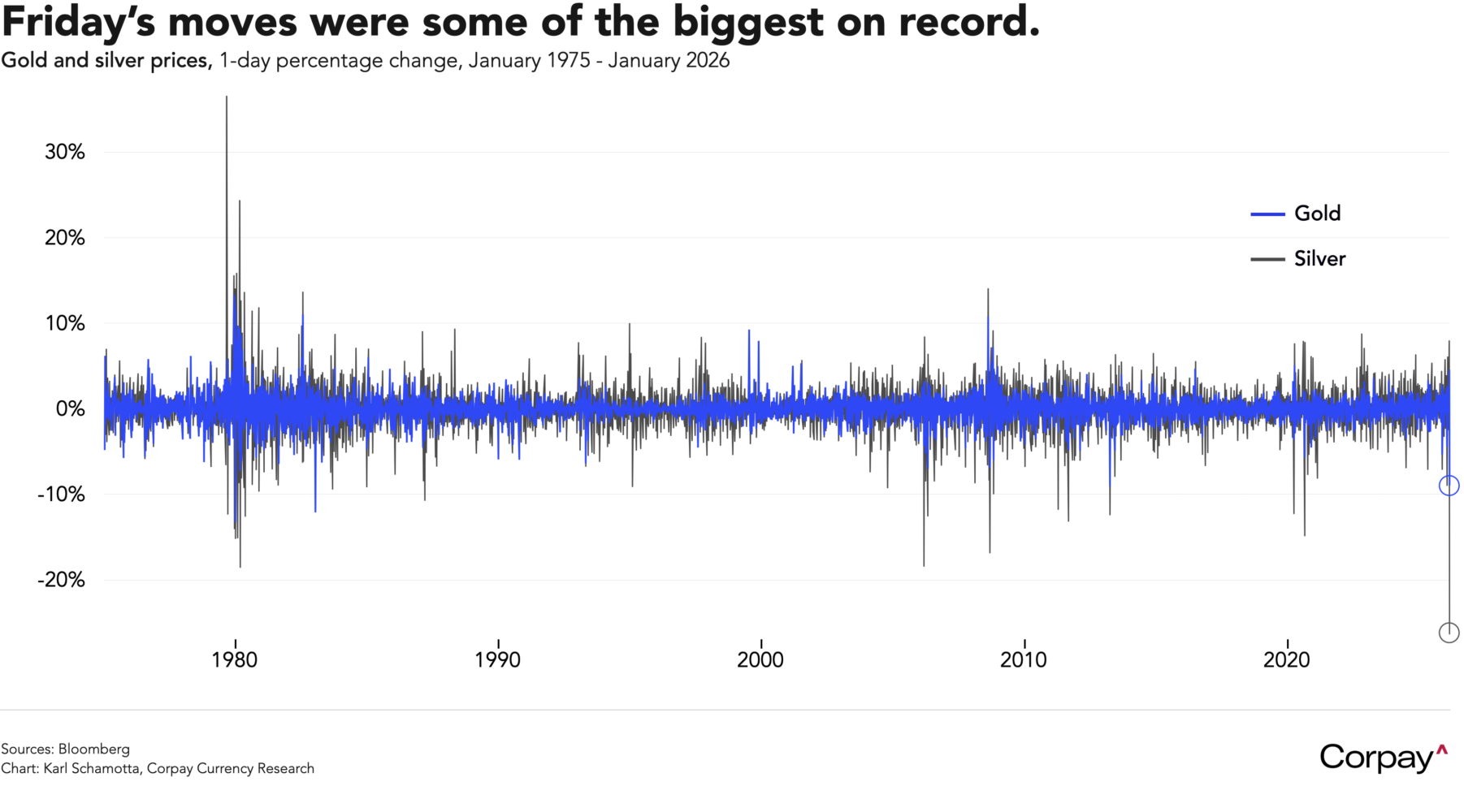

Gold and silver prices suffered their biggest selloff in years on Friday, prompting many observers to suggest that the “debasement trade” was in the process of imploding. Gold tumbled by the most in a decade, and silver dropped by the most on record after US president Donald Trump said he would nominate former governor Kevin Warsh to head the Federal Reserve, allaying fears of an inflationary overheat under more dovishly-partisan leadership.

I’m not convinced this was really a Warsh-out*. Odds on two or more rate cuts over the next year have risen slightly, long-term yields are holding steady, and inflation breakevens are essentially unchanged from pre-nomination levels, suggesting that market expectations for price stability have shifted only marginally.

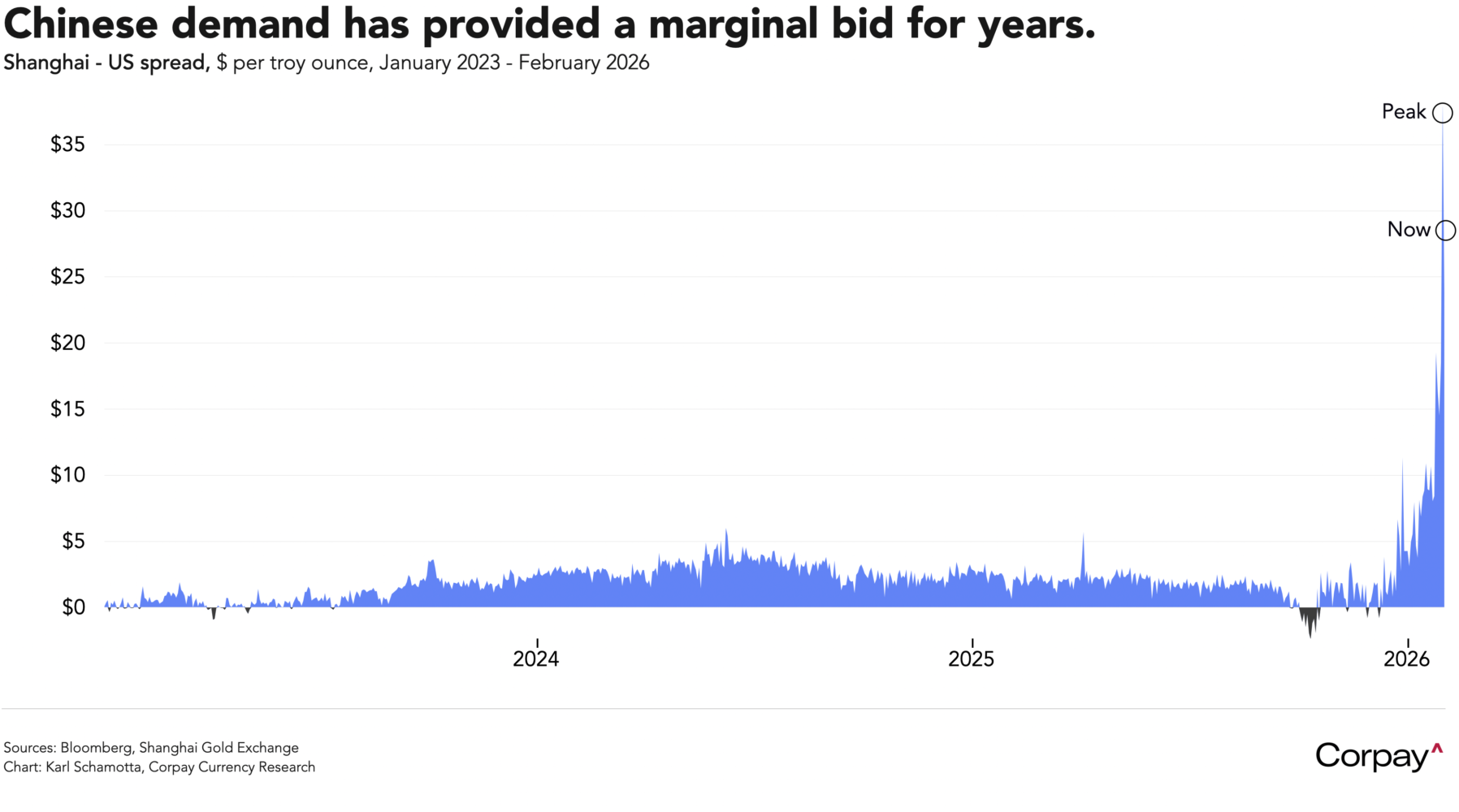

Instead, shifting conditions in Chinese markets could be at fault. In my view, Chinese investors facing negative real deposit rates and seeking an alternative to the country’s real estate market began piling into precious metals several years ago, driving cross-Pacific spreads higher and leading to reflexive** narratives among Western investors, particularly in silver, where thinner liquidity magnified price moves. Whether that demand is slowing due to a collapse in commodity trading houses, a seasonal drop in purchases around the Lunar New Year holiday, or a more profound reappraisal of return prospects, the Shanghai premium is coming down and global investors are stampeding for the exits, triggering forced selling among exchange-traded funds and other leveraged players. This correction could prove durable, but its longevity will largely depend on investor psychology, not any change in underlying fundamentals.

The yen is back under pressure after Prime Minister Sanae Takaichi said a weaker currency could help support Japan’s struggling exporters, dampening expectations of coordinated intervention and refocusing attention on the coming election. Implied volatility is rising ahead of this weekend’s snap poll, as Takaichi seeks to translate spectacularly-high personal approval ratings into a stronger mandate for the Liberal Democratic Party-led coalition. A decisive win could give her scope to expand fiscal stimulus, risking higher inflation and weaker demand for long-dated Japanese government bonds.

This week’s calendar is packed with potential event risks.

In the US, members of Congress are returning to Washington today to pass a deal agreed between President Trump and Democratic leadership last week, with the resulting legislation expected to carve out the Department of Homeland Security and fund the rest of the government through to the end of September. The Institute for Supply Management’s surveys should show business activity improving slightly in early January, even as inventories are wound down. Tomorrow will bring the Job Openings and Labor Turnover report—delivering insight into how demand and supply balances are evolving in job markets—and Thursday’s weekly jobless claims number will help set the stage for Friday’s non-farm payrolls release, which could muddy the waters somewhat, given that it will incorporate major adjustments to population estimates. Missteps—in the halls of Congress or in labour market data—could see the dollar’s selloff resume.

The Bank of England and European Central Bank are expected to stay sidelined, but investors will be watching closely for any evidence of discomfort with recent currency appreciation—recent gains in both the pound and the euro risk impacting inflation over the next year, and officials could choose to engage in some light jawboning, particularly during press conferences.

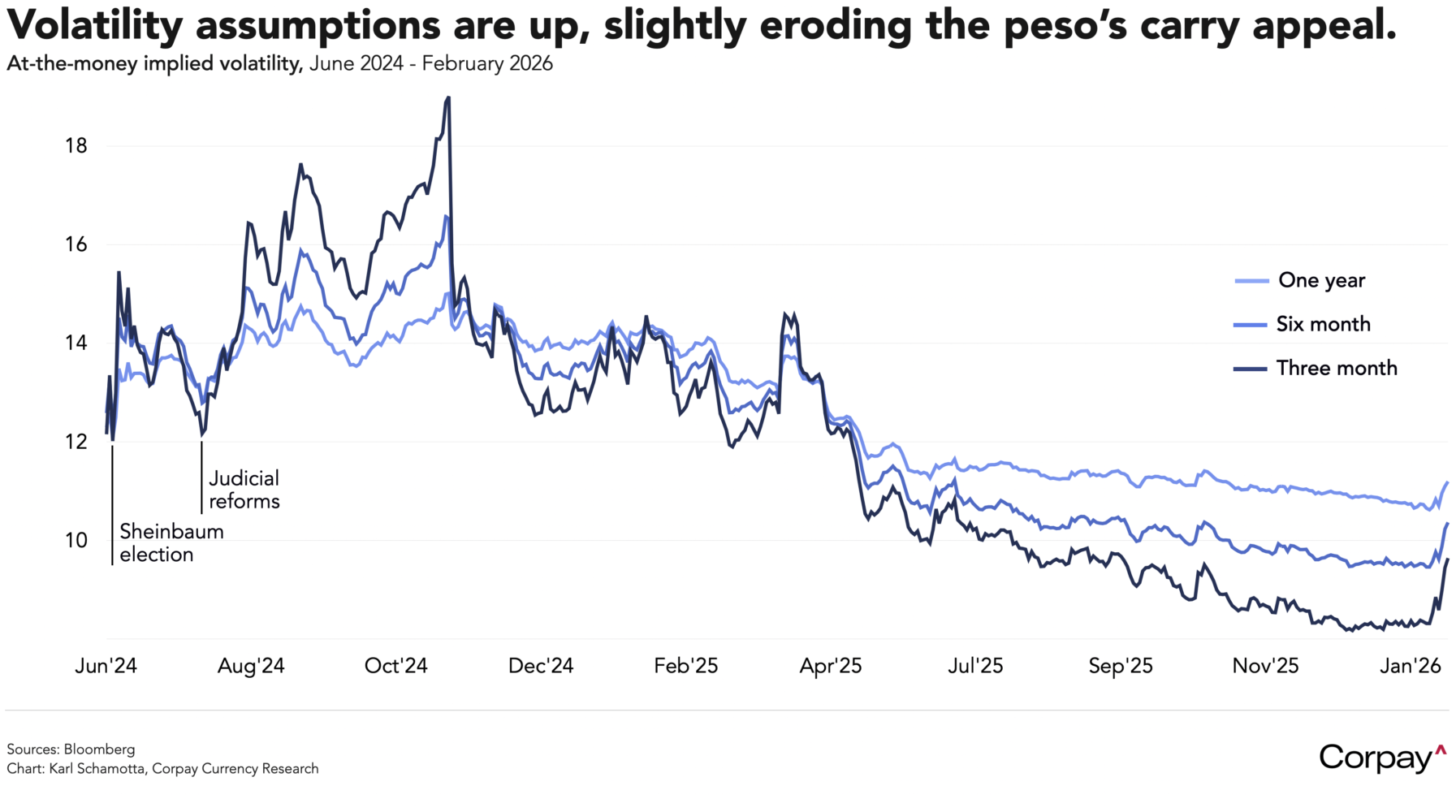

Mexico’s central bank is also almost universally seen leaving policy unchanged on Thursday, with the overnight rate staying at 7 percent for now as officials attempt to balance growth and inflation trade-offs. The economy faces headwinds from weak domestic demand, falling remittances and subdued investment, while firm wage growth, higher import prices and rising tax burdens are keeping inflation above target and limiting Banxico’s room to manoeuvre. Markets expect policymakers to broadly track the Federal Reserve’s easing path later this year, preserving wide rate differentials with the US, but—if sustained—last week’s rise in implied volatility could nonetheless blunt the peso’s carry appeal and cap near-term gains.

Canada’s January jobs report will land on Friday, and no one is expecting it to blow the doors off. After a series of better-than-anticipated releases, economists think still-weak hiring expectations will translate into a barely-positive print, reflecting deep business uncertainty about what the future will bring for the country’s trade relationships. Last week’s selloff in the Canadian dollar looks overdone—the currency’s gearing to commodity price changes tends to be fairly short-lived—and we expect a modest correction this week as a sense of calm returns, but sharp gains look unlikely against a still-restive political backdrop.

*I’m here all week, try the veal.

**George Soros’s theory of “reflexivity” holds that in financial markets, prices can impact fundamentals in a self-reinforcing feedback loop, so markets do not merely reflect reality but actively shape it.