After delivering an aggressive series of interest rate cuts over the past ~18-months in a bid to revive NZ’s economic fortunes, it wasn’t a surprise to see the Reserve Bank of NZ hold the Official Cash Rate steady at 2.25% today. Rather, the focus was on the RBNZ’s updated thinking about the outlook, especially as this was also new Governor Breman’s first meeting in charge.

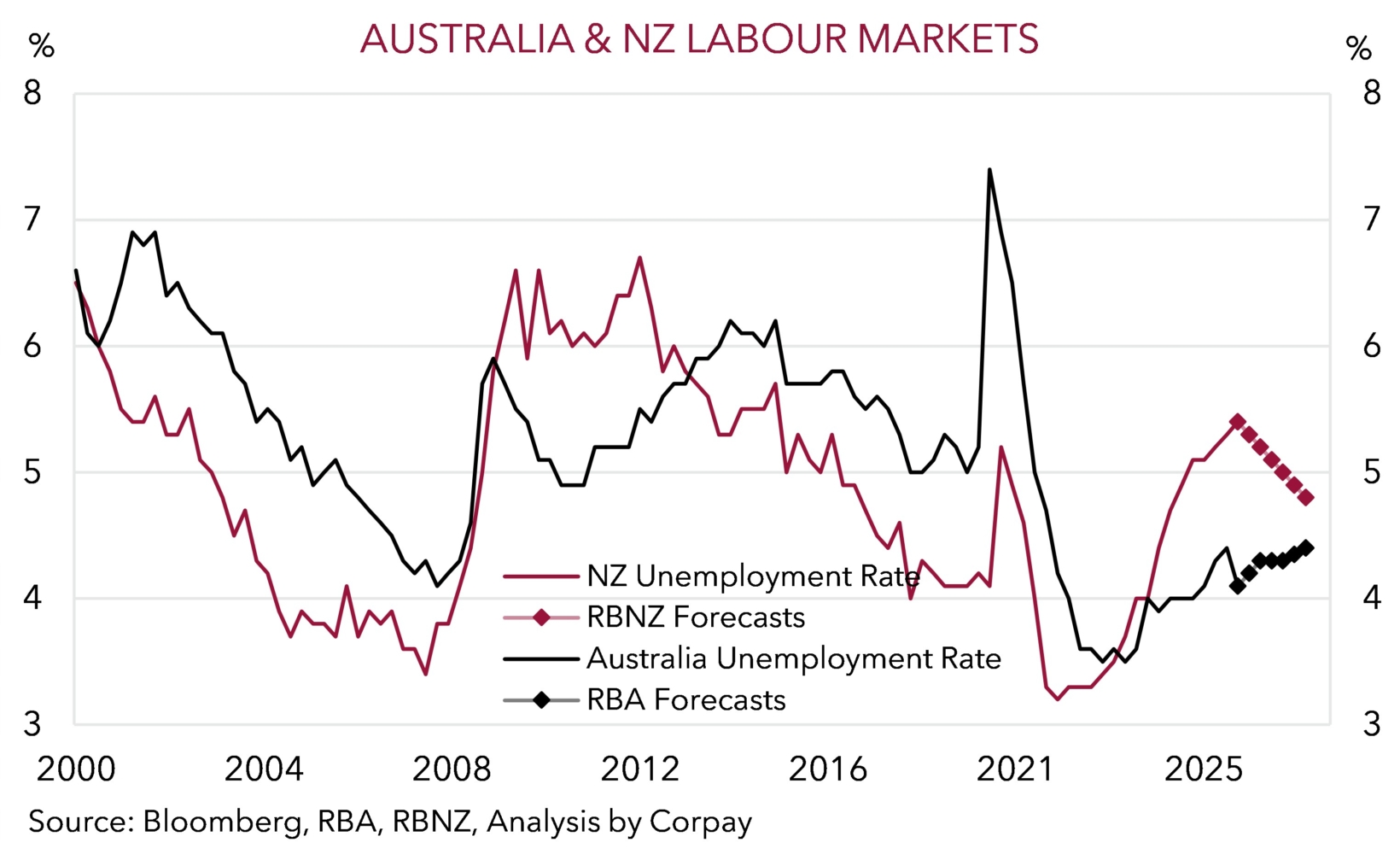

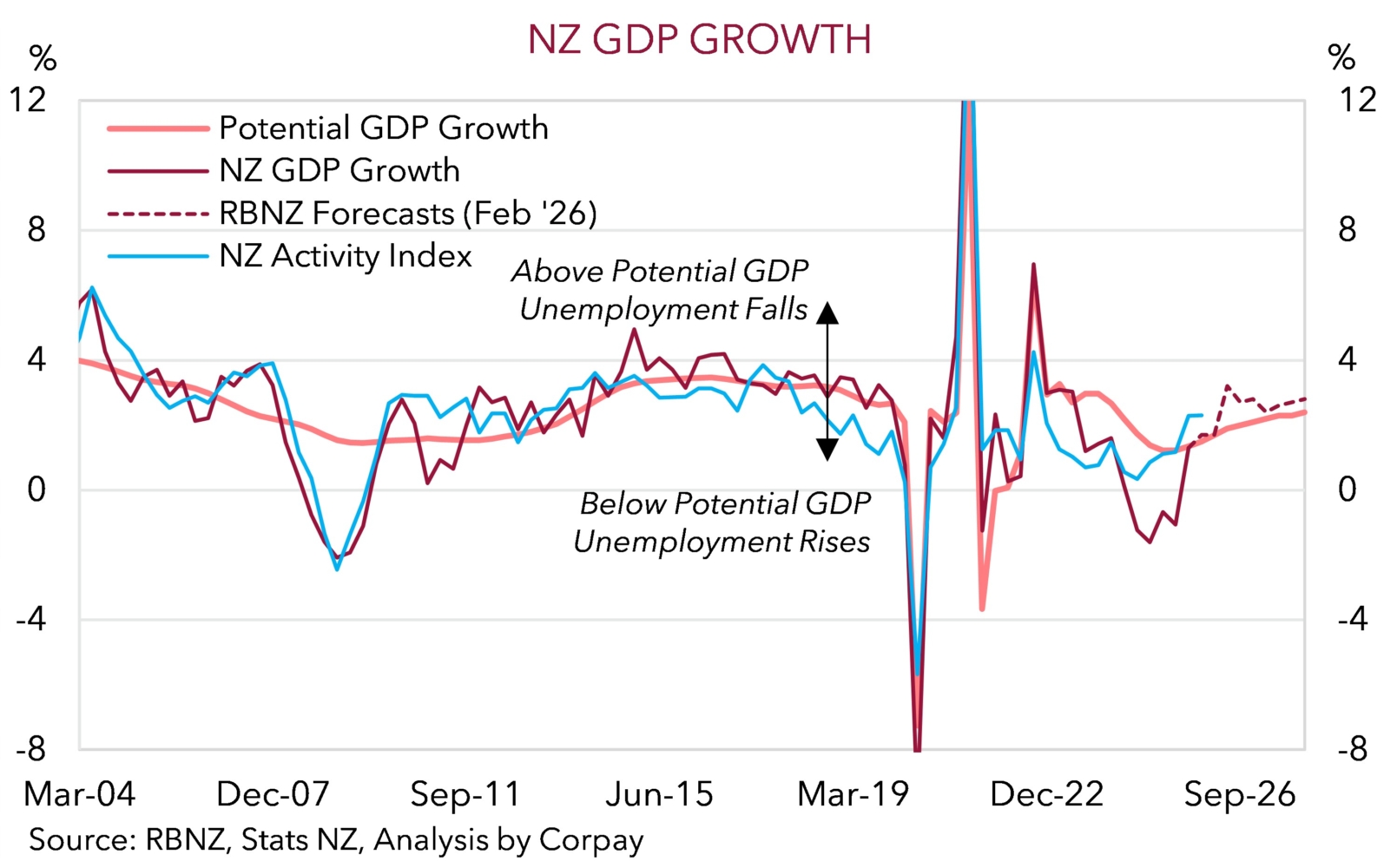

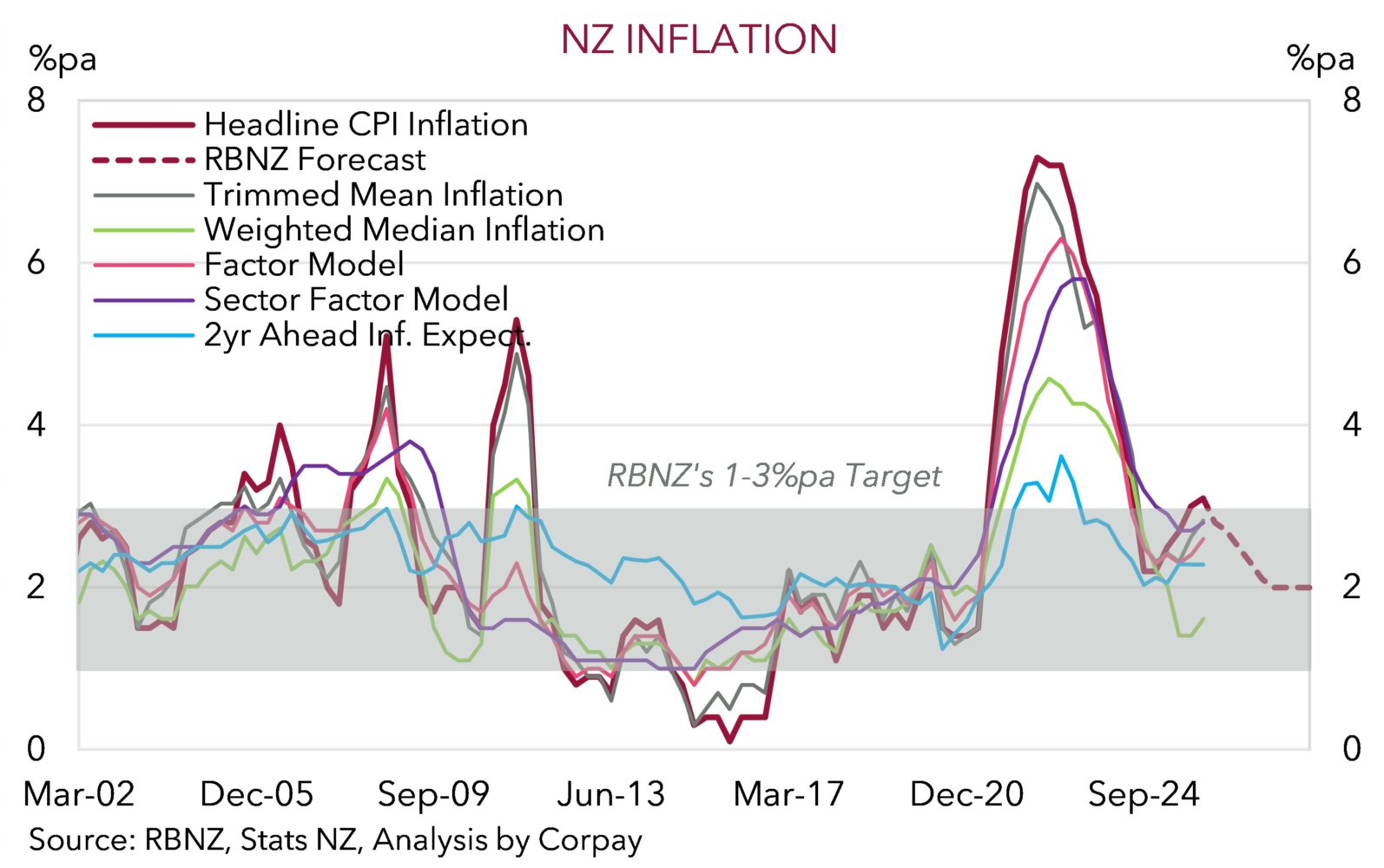

The RBNZ provided a balanced assessment of how things are unfolding with less policy ‘accommodation’ and interest rate increases now projected from Q4 2026/Q1 2027. According to the RBNZ, the “NZ economy is at an early stage in its recovery” with the lower level of interest rates flowing through and supporting activity across sectors like manufacturing, construction, and retail. NZ GDP growth is forecast to accelerate to an above ‘potential’ pace over the next few quarters (chart 1). On top of that, as seen in some of the recent data and business surveys, while unemployment is elevated the NZ labour market “is stabilising”. And with excess slack set to lessen but remain in place in the NZ economy over 2026, inflation should ease (chart 2).

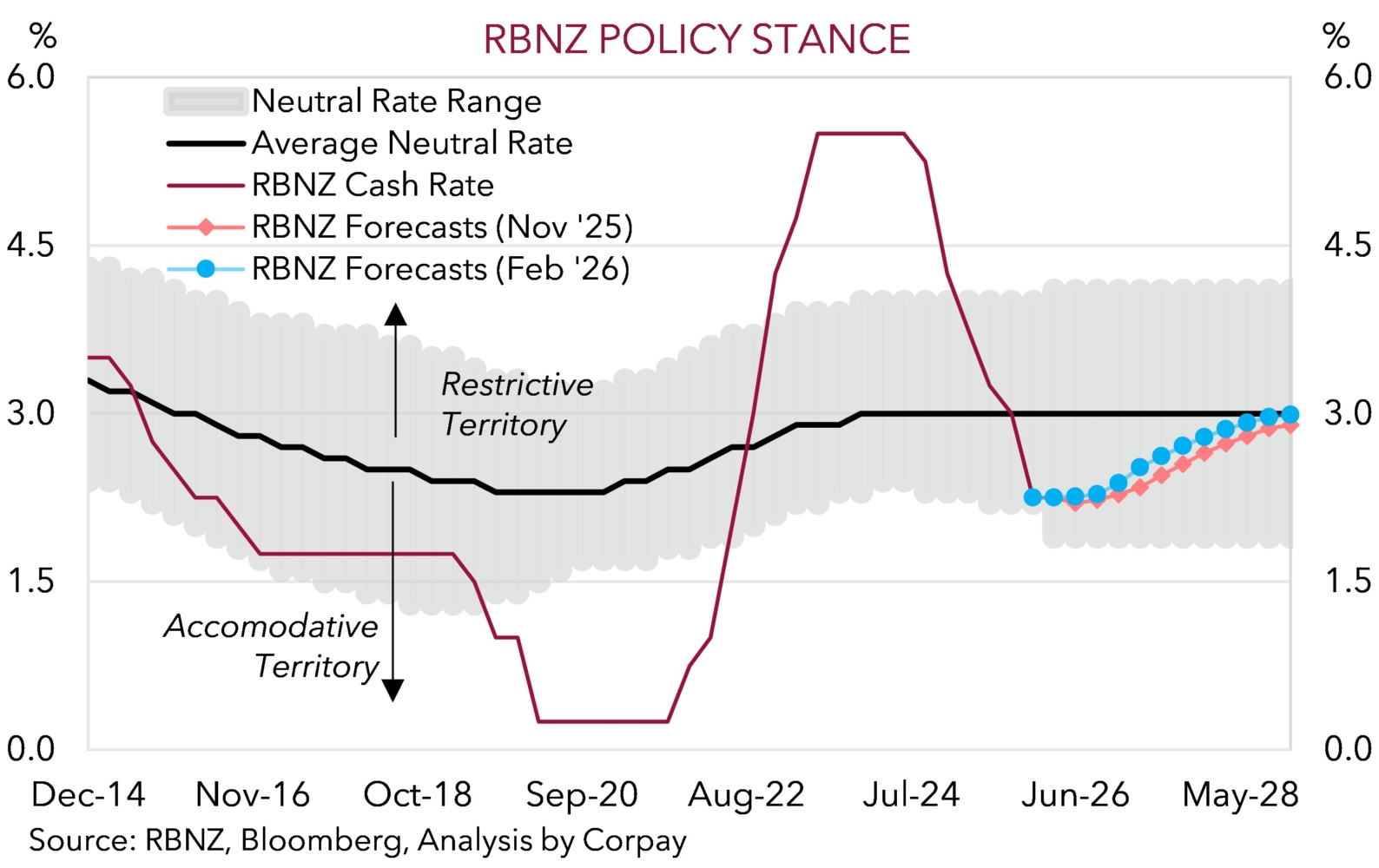

This is how economic cycles typically operate. As the emerging ‘green shoots’ broaden out and solidify the RBNZ notes they should begin to take their foot off the gas with monetary policy settings set to “gradually normalise” down the track. This point was illustrated in the RBNZ’s updated projections with the interest rate track showing a slightly quicker return to ‘neutral’ (i.e. rates near ~3% by late-2028) (chart 3). The outlook for the next move by the RBNZ to be a rate hike, albeit later this year given the spare capacity that needs to be absorbed across the NZ economy, is inline with our thinking.

In markets outcomes compared to expectations are what matter. On the back of a run of positive NZ growth and jobs data, as well as firmer price pressures forward looking markets had already shifted to a more ‘hawkish’ view. Failure by the RBNZ to match these lofty expectations has taken a bit of heat out of the NZD against the USD (now ~$0.6000) and AUD (now ~1.1780, or NZD/AUD ~0.8489). After a strong start to the year, we think the NZD is biased to drift back further in the near-term, particularly if the incoming US data shows the economy is on sturdy ground which in turn helps the beaten down USD to bounce back.

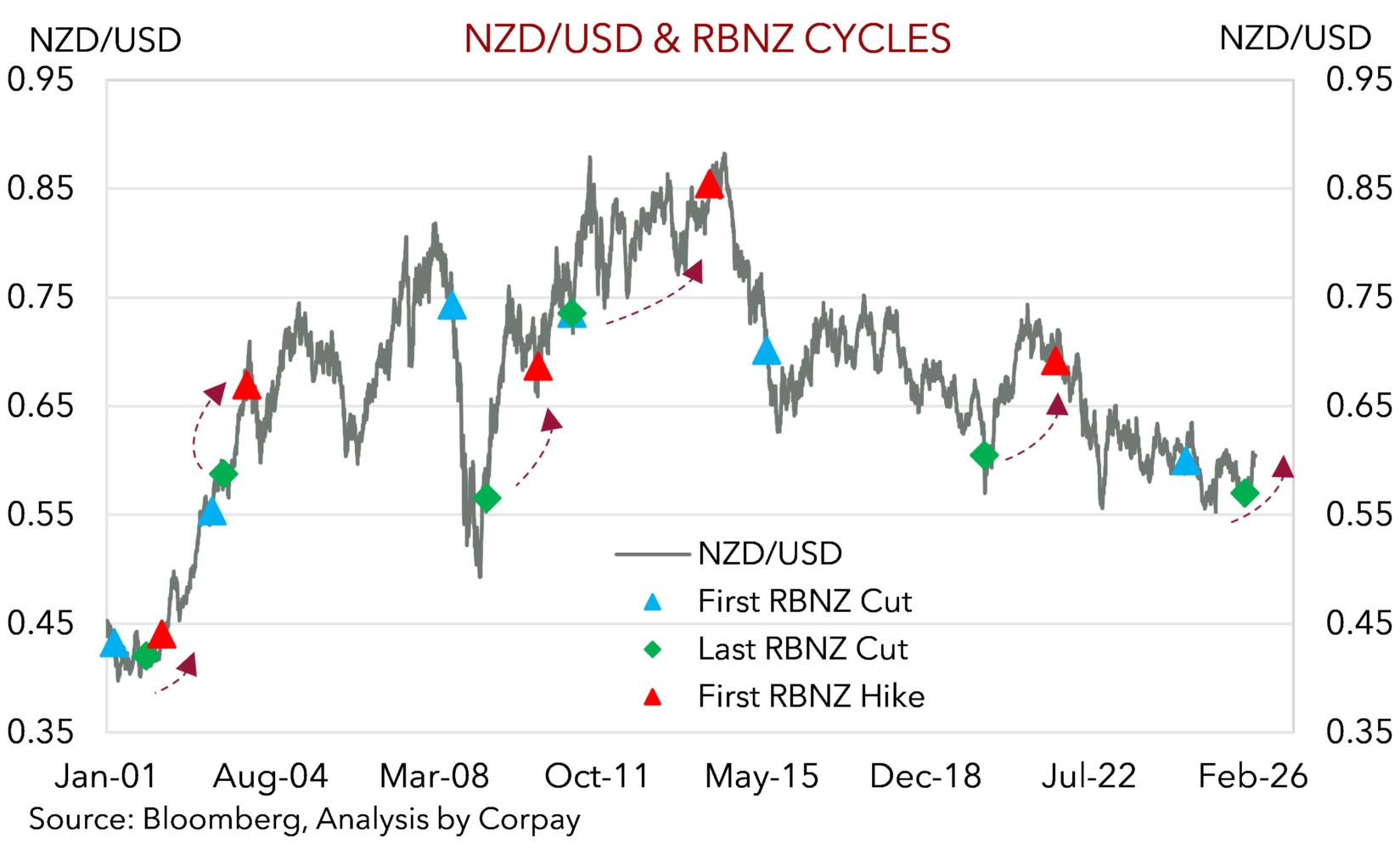

However, as the impact of US trade tariffs continues to materialise across the US economy, the US Fed delivers additional interest rate cuts, the NZ economy improves, and RBNZ interest rate rises come closer into view, the NZD should edge higher, in our view. We continue to forecast the NZD to grind up towards ~$0.62 later this year. As outlined previously, the NZD has tended to strengthen between the last RBNZ rate cut and the first rate increase in the next cycle (chart 4).

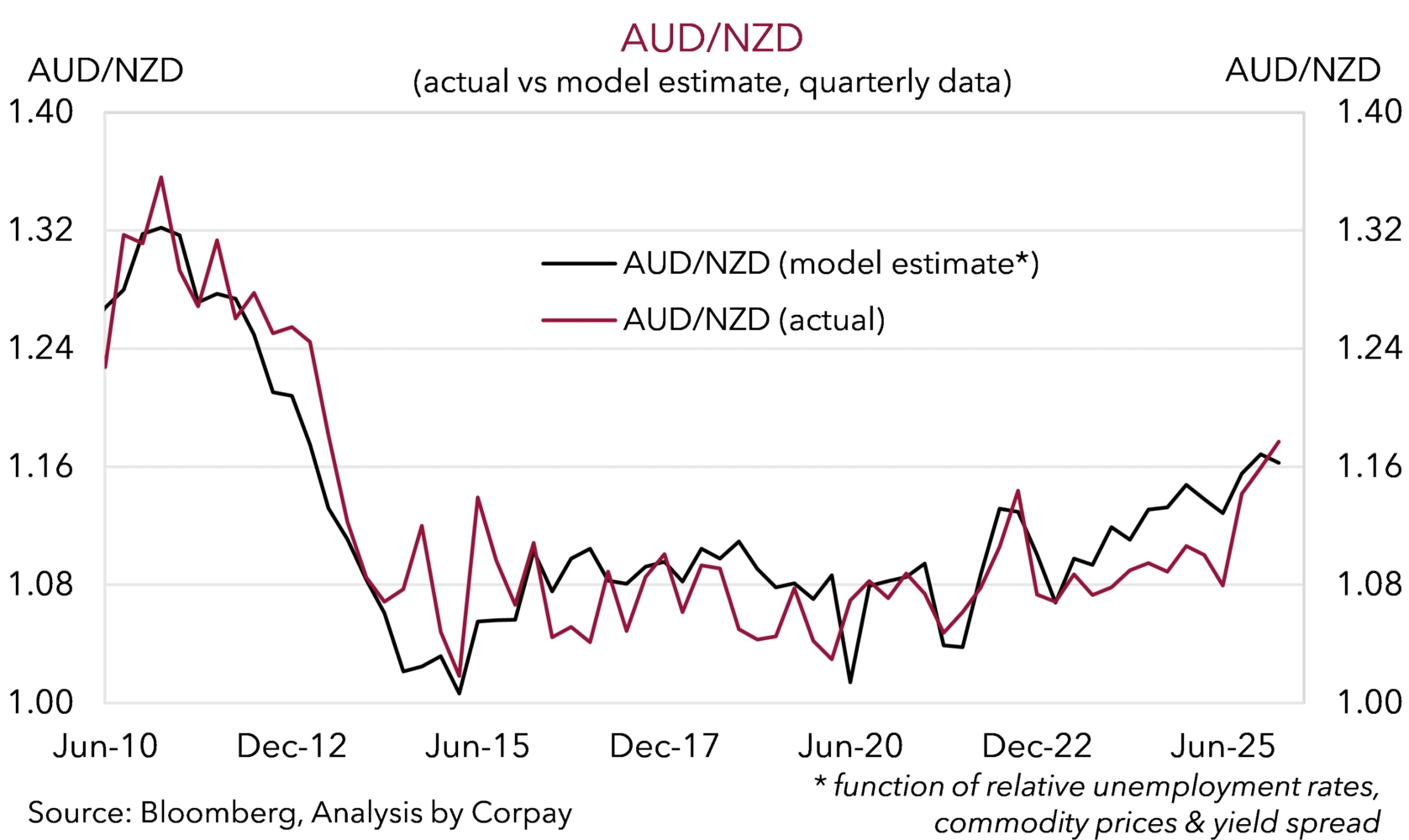

Furthermore, while looking solely at yield and interest rate spreads suggests AUD/NZD may extend its upswing (or NZD/AUD falls further), this isn’t the complete story. Indeed, AUD/NZD is tracking a little above where our broader model, which incorporates relative commodity prices and macroeconomic impulses, says it should be (we currently see ‘fair value’ near ~1.1630 or ~0.86 for NZD/AUD) (chart 5). As economic cycles converge and the Australian economy/jobs market loses steam due to RBA rate hikes we see AUD/NZD easing down towards ~1.13 by Q3 2026 (NZD/AUD forecast to rise to ~0.8850) (chart 6).