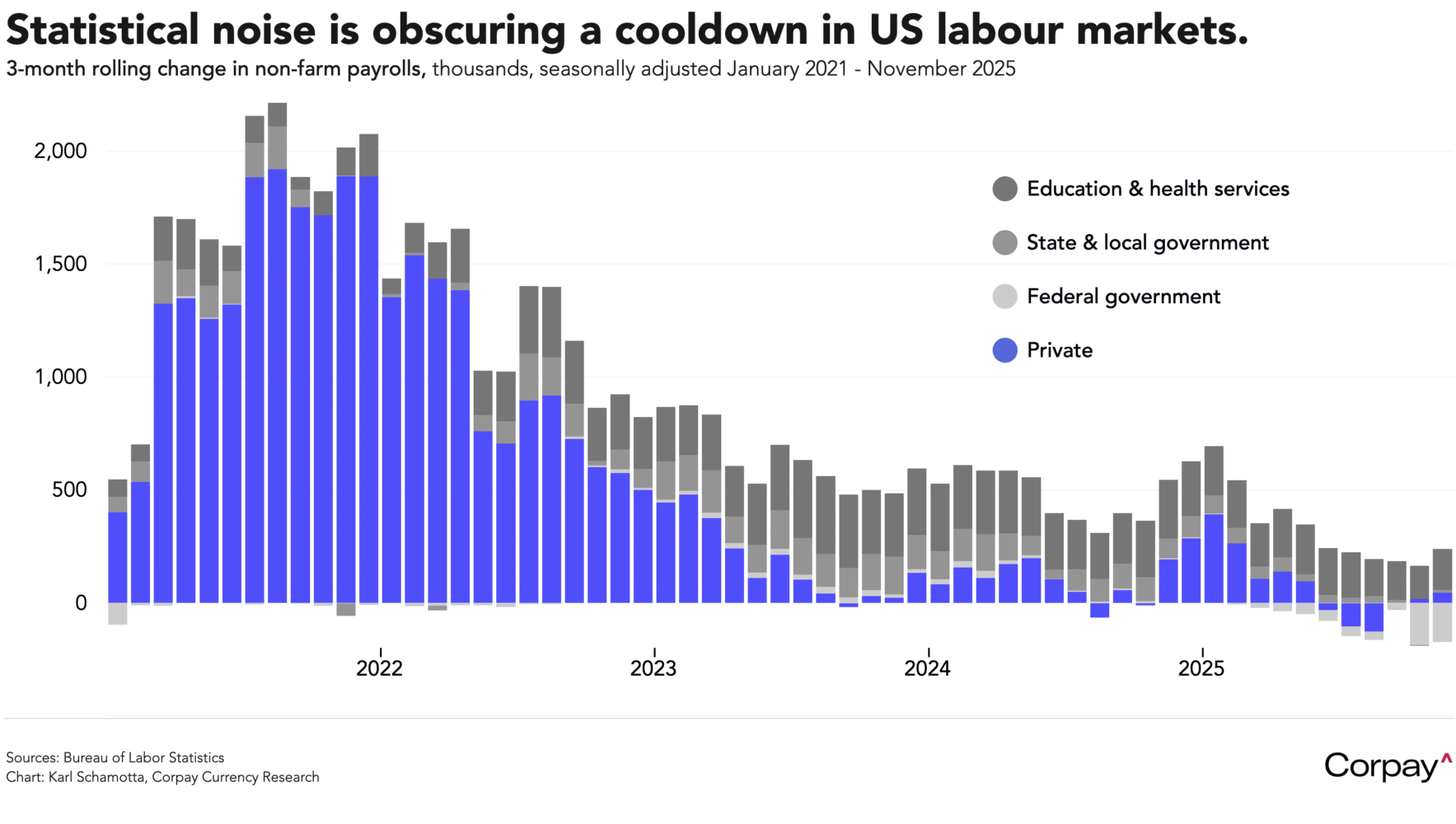

US labour markets continued to cool in October and November, slightly raising market bets on a stepped-up easing campaign from the Federal Reserve next year. According to delayed data just released by the Bureau of Labor Statistics, a total -41,000 jobs were lost over the last two months—representing an undershoot relative to consensus forecasts—while the previous two months were revised lower by a total 33,000 positions, bringing the three-month average pace of job creation to 22,000, down from 62,000 ahead of the update.

As expected, the federal government shed the largest number of workers, cutting payrolls by a total -172,000 positions between September and November, but hiring remained weak in the private sector, with construction and healthcare activity providing a minimal boost to headline gains.

The unemployment rate ticked up to 4.6 percent from 4.4 percent in September, but is widely considered a flawed measure at this juncture, given major uncertainties regarding workforce participation, age demographics, and immigration trends. Average hourly earnings climbed 3.5 percent year-over-year in November, down from the 3.8 percent previously recorded.

Separately, underlying US retail spending grew more than expected in October, suggesting that consumers remain optimistic even as job markets worsen and policy uncertainty remains spectacularly high. According to figures just published by the Census Bureau, so-called “control group” retail sales—with gasoline, cars, food services, and building materials excluded—rose 0.8 percent in October, beating forecasts set at 0.4 percent. Total receipts at retail stores, online sellers and restaurants were essentially unchanged on a month-over-month basis, following a revised 0.1-percent gain in the prior month.

The dollar is extending its losses from a two-month low and Treasury yields are down across the front of the curve as traders price in a slightly more aggressive course of rate cuts in 2026.

We’re not sure this will prove durable. Given that the data come after Chair Powell spent much of last week’s post-decision press conference focusing on labour market risks, it is fair to think that Fed officials will take evidence of a downturn seriously, but it could take many months yet before a signal can be extracted from the noise unleashed by public sector layoffs, an unprecedented surge in policy uncertainty, and the government shutdown. As long as evidence of a big rise in layoffs remains absent, policymakers are likely to remain on the gradual easing trajectory outlined in the December Summary of Economic Projections.

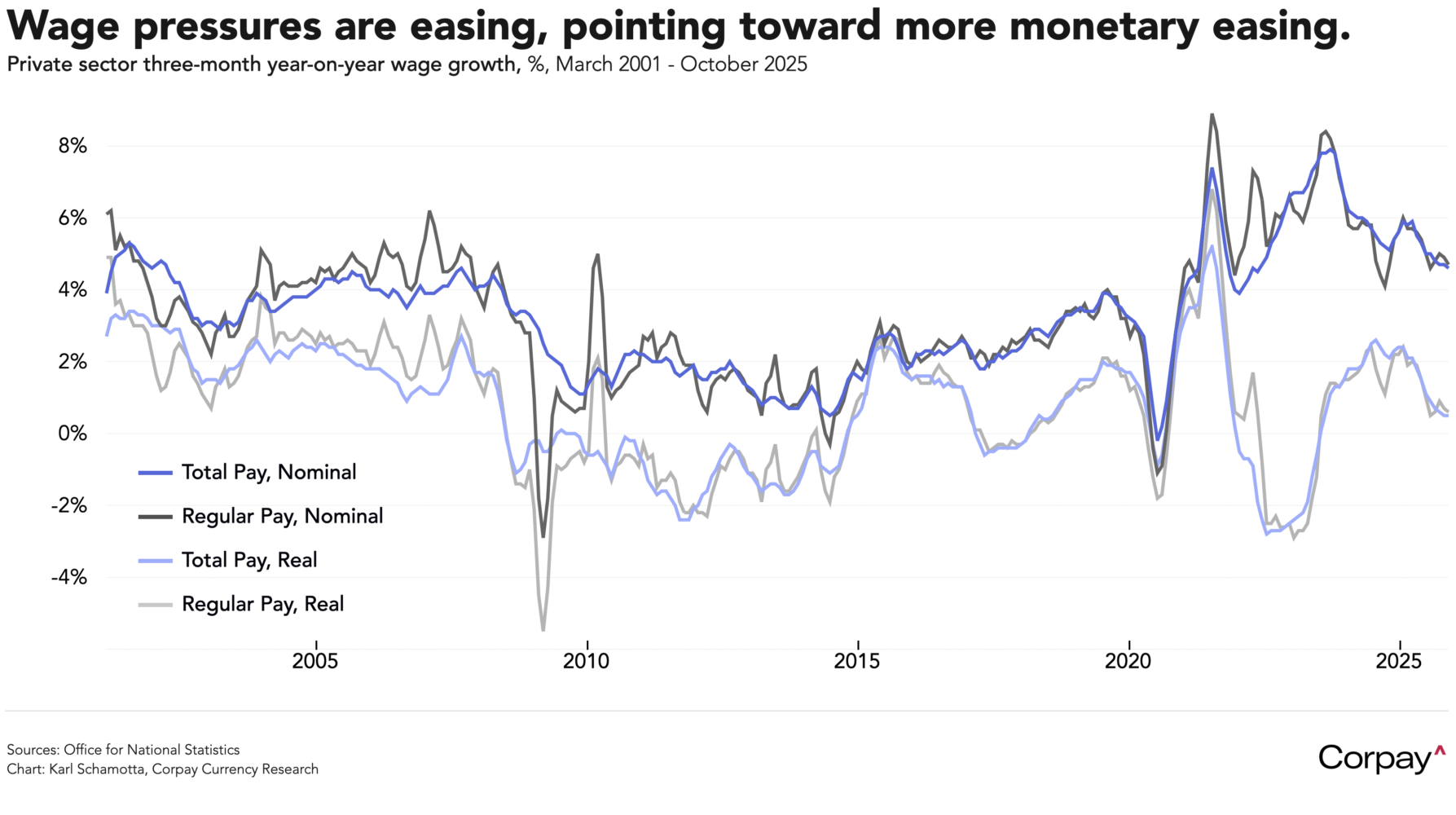

The picture is more clear-cut in the United Kingdom. Odds on a rate cut at Thursday’s Bank of England meeting firmed slightly this morning when the Office for National Statistics said the number of workers on payrolls fell by 38,000 in November, and that regular pay growth in the private sector—the Bank’s preferred measure of underlying wage pressures—fell to 3.9 percent year-over-year in the three months ended in October from 4.2 percent in the prior month. With Governor Bailey now highly likely to vote with his dovish colleagues in favour of easing policy further, odds on a move are holding above 90 percent, and the pound is struggling to match the gains enjoyed by its counterparts.

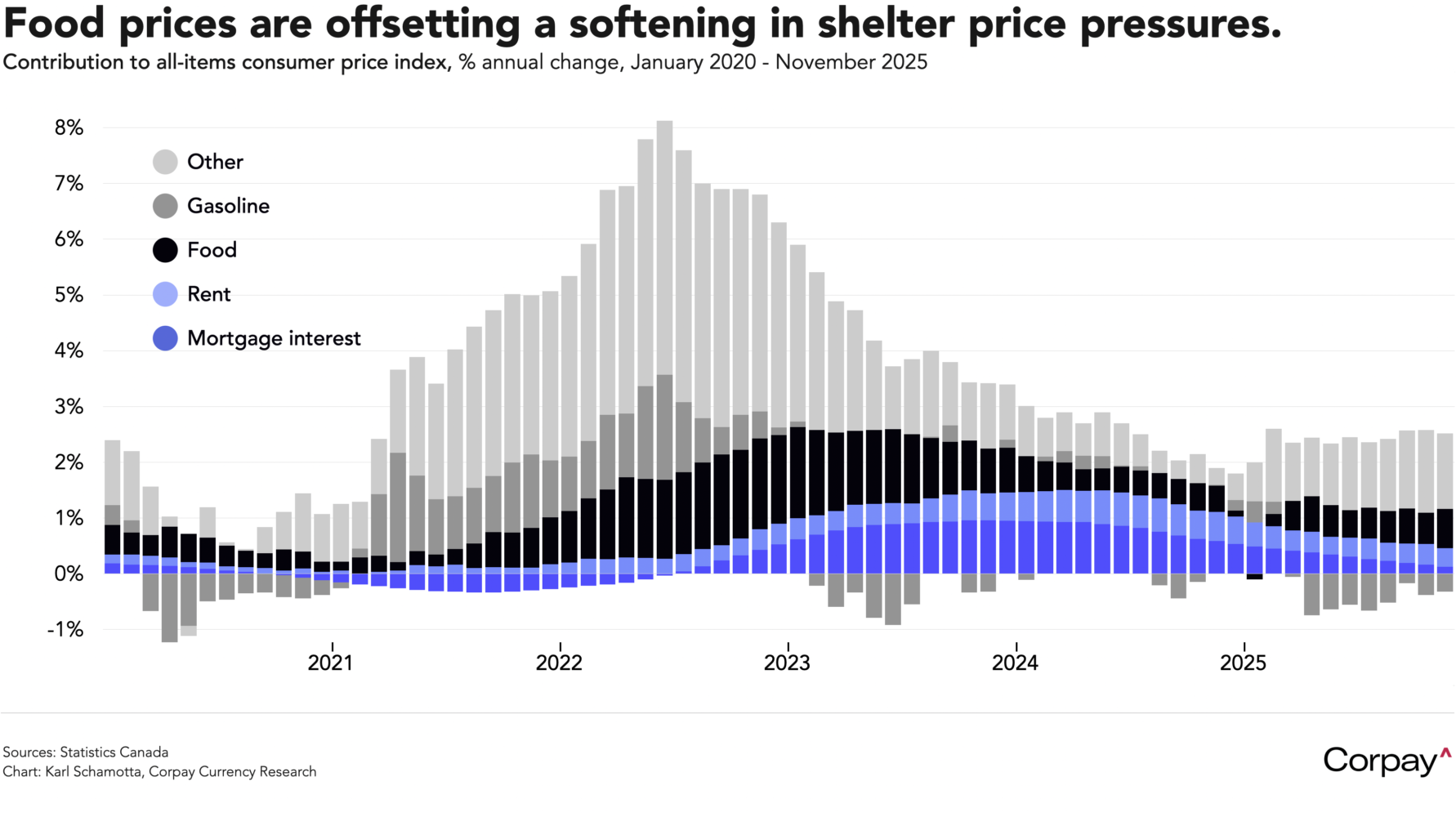

The Canadian dollar is adding to its gains after data published yesterday showed consumer prices remaining broadly stable last month, keeping the Bank of Canada sidelined for now. According to Statistics Canada, underlying core inflation subsided to 2.8 percent in the year to November—down from 3 percent in the prior month—while the headline measure stayed at 2.2 percent for a second month. Food prices—up an astonishing 4.7 percent— offset a continued softening in shelter-related categories, but are typically considered outside a central bank’s remit, given that they are heavily driven by supply-side dynamics. Market-implied expectations for a hike by next October are holding firm.