Good morning, and feel free to hit the snooze button. Financial markets are back to ignoring geopolitical headlines, with most major currency pairs exhibiting rangebound behaviour, Treasury yields flatlining, and equity futures setting up for an incremental retreat at the open. Investors are ignoring the latest threats against Greenland from the White House*, and are downplaying signs of growing friction between China and Japan—at least outside regional indices. Measures of implied volatility in foreign exchange markets are holding near cycle lows.

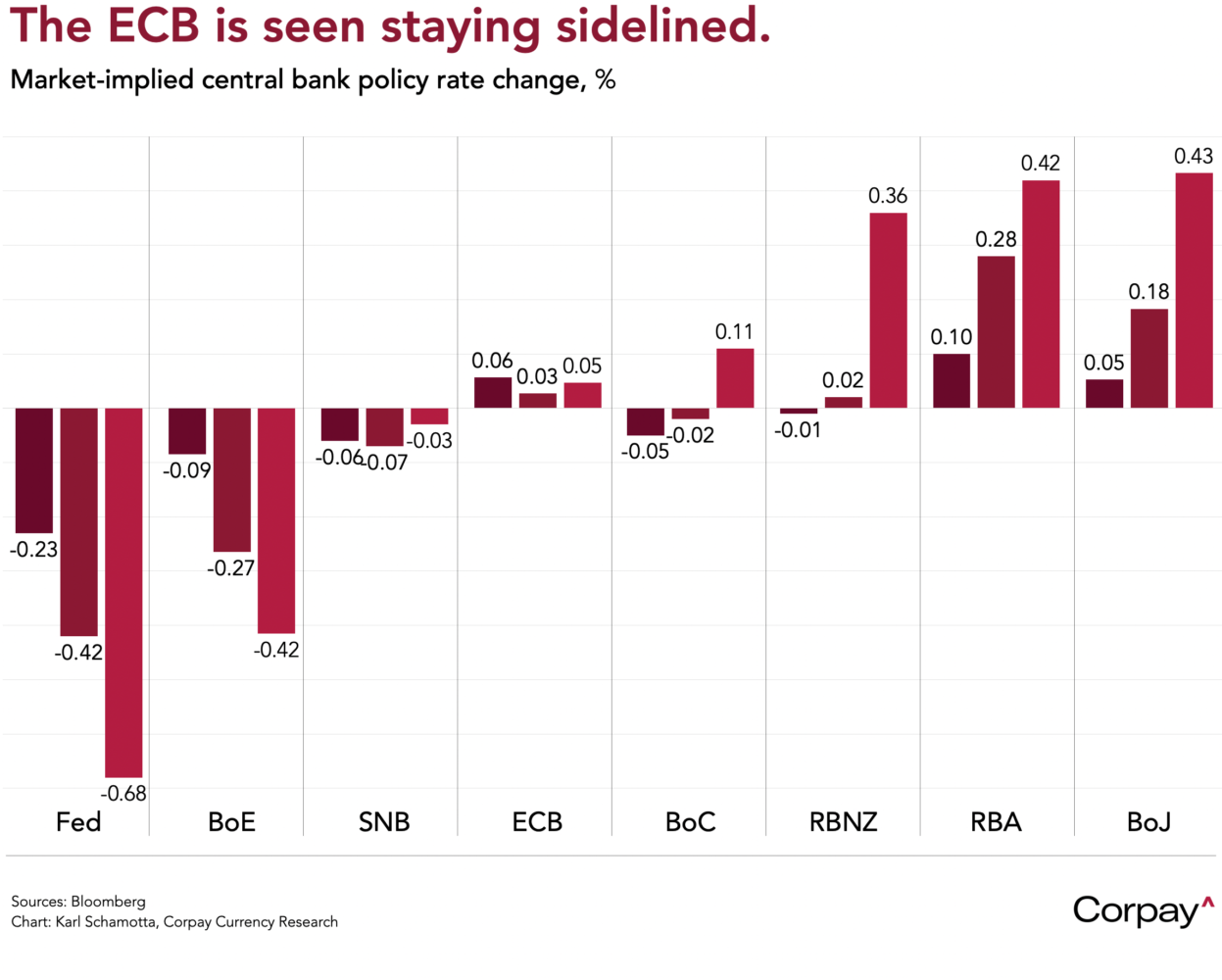

The euro is trading on a slightly weaker footing after a bloc-wide inflation report showed price growth easing toward target last month, ratifying the European Central Bank’s steady-as-she-goes approach to monetary policy. Headline consumer prices climbed just 2 percent in the year to December—down from 2.1 percent in the prior month—with year-over-year base effects flattering the print, but a gauge of underlying services costs also dropped, pointing to a broad-based disinflationary impulse. Market-implied expectations for a rate hike in the euro area have been pared back since the start of the year, contributing to a renewed widening in cross-Atlantic yield differentials.

Data should play a bigger role in driving price action today. Taken in sum, this morning’s ADP’s private jobs update, durable goods orders, the Institute for Supply Management’s services purchasing manager index, and the Job Openings and Labor Turnover report will shed light on how economic conditions are evolving ahead of Friday’s critical payrolls report. With the Federal Reserve now firmly focused on downside risks in labour markets, traders may treat any hint of weakness as a cue to sell the dollar, delaying our anticipated recovery and offering buyers a tactical trading opportunity.

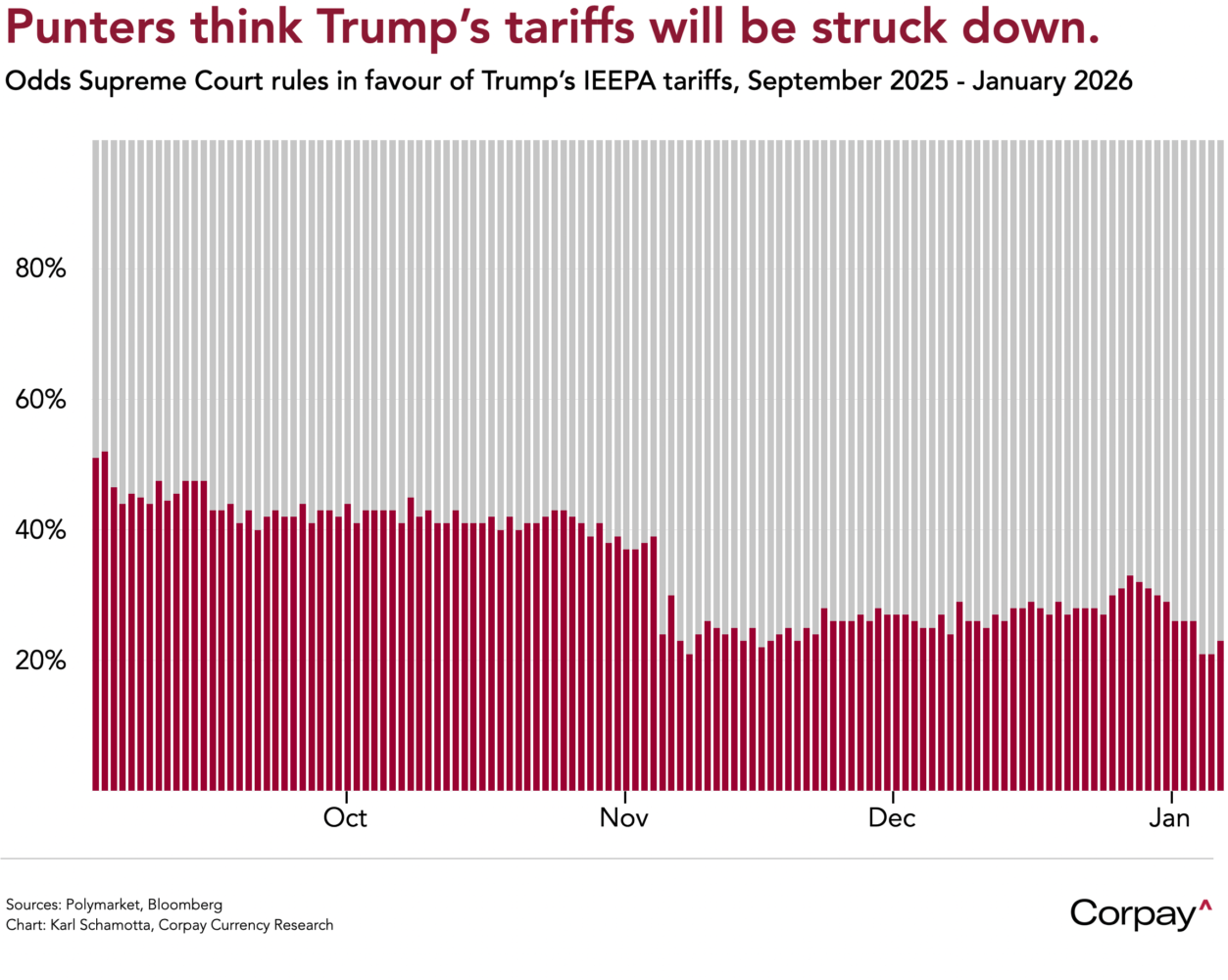

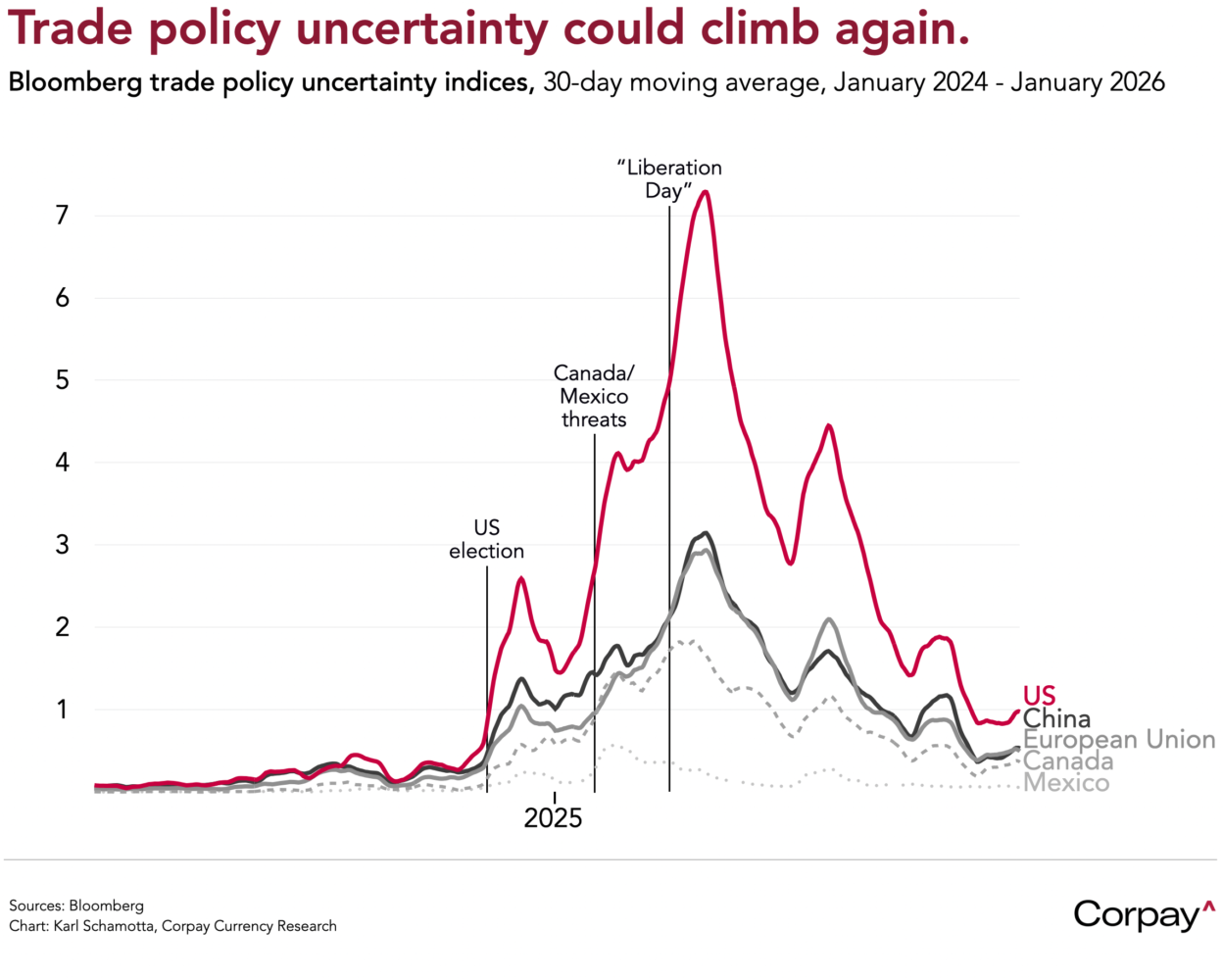

The US Supreme Court could issue a ruling on Donald Trump’s tariff regime as early as Friday morning. A scheduling update published yesterday noted that decisions in recent cases could be released at 10:00 a.m. on Friday, without specifying which. After a series of defeats in lower courts and seemingly-hostile oral arguments, prediction markets are placing roughly 70 percent odds on the justices striking down the president’s use of the International Emergency Economic Powers Act to impose his “fentanyl” and “reciprocal” tariffs last year.

In theory, any market response could be muted, given that the administration is expected to quickly reissue many levies under other statutes. In practice, the decision risks raising volatility: most alternative laws operate within narrower constraints and face legal challenges of their own, and businesses would be left chasing refunds while engaging in another round of tariff front-running. And the impact is also likely to vary across countries, offering short-term relief for importers from countries like Brazil, India, and China, but doing little to ease the (much lower) burden on Canadian and Mexican products that currently cross the border under USMCA exemptions. Currency markets could react to any headlines that emerge.

*Just a suggestion, but perhaps someone could remove the Risk boardgame from the Oval Office. Greenland isn’t as big as it looks on paper, and one needn’t move armies across it to invade North America.