Investors are bargain-hunting across the financial markets this morning, scooping up discounted assets after a multi-week selloff. Futures on North American equity markets are pointing to gains after the open, Treasury yields are inching higher, and economically-sensitive currencies are outperforming their safe-haven brethren amid a broader improvement in risk appetite.

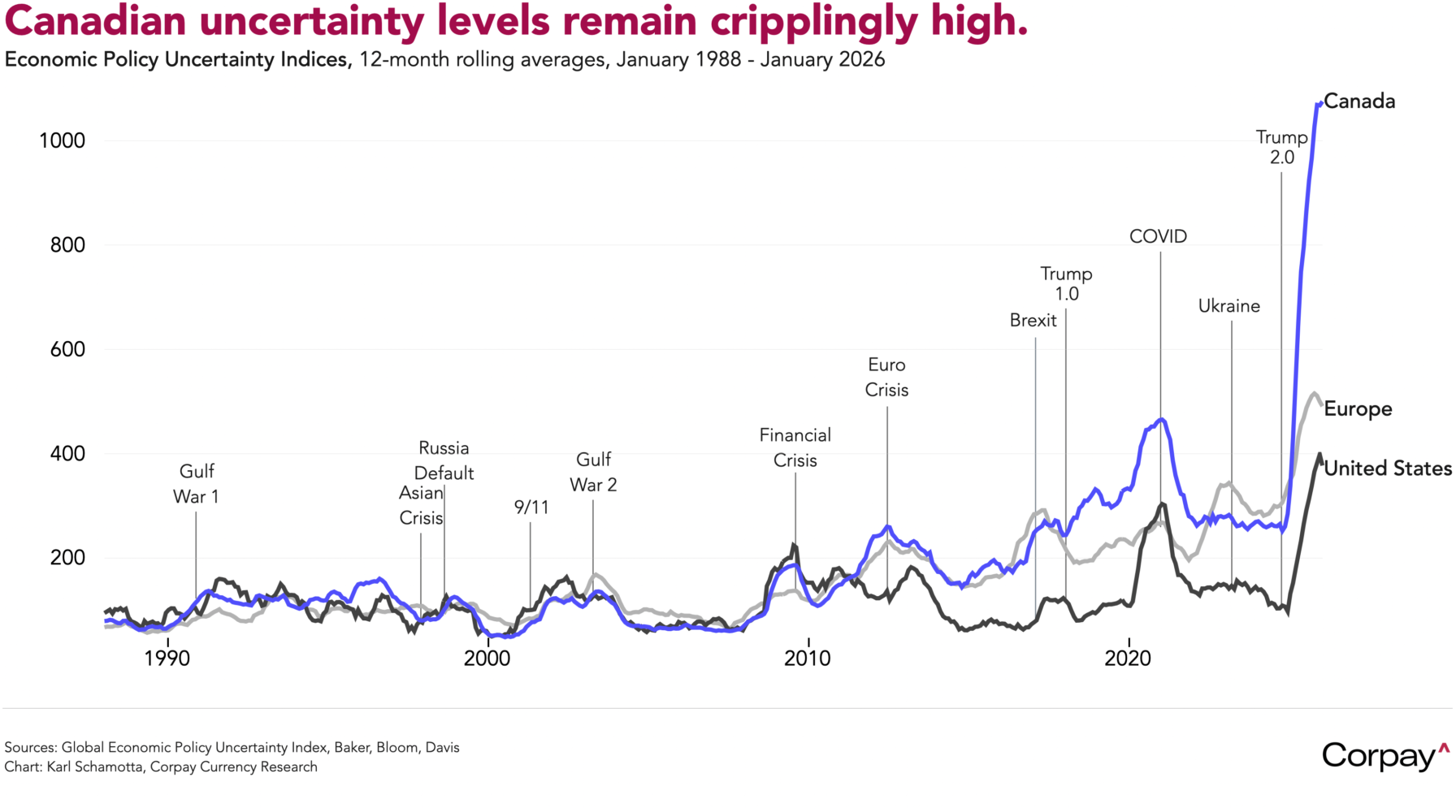

The Canadian dollar remains narrowly rangebound after yesterday’s inflation figures failed to alter expectations for the Bank of Canada to keep rates on hold for the rest of the year. After delivering an aggressive 200 basis points in easing over the last two years, the Bank has landed near what Governor Tiff Macklem calls “about the right level,” and overnight index swaps are pointing to no movement in policy settings in 2026. The logic reflects offsetting forces: idiosyncratic factors are keeping inflation near target even as trade policy changes and an ongoing housing-market downturn weigh on activity, making tightening hard to justify. Sentiment has improved modestly, but uncertainty levels in Canada remain far above global peers, supporting an extended pause.

The British pound is little changed after inflation eased as expected last month, giving the Bank of England room to cut rates in March if needed. According to an update published this morning, headline consumer prices rose 3.0 percent in the year to January, down from 3.4 percent on lower fuel prices. Core inflation edged down to 3.1 percent from 3.2, while services inflation slipped to 4.4 percent from 4.5 percent. Price pressures are expected to moderate further in coming months as base effects and policy changes flatten annual comparisons, allowing officials to focus more narrowly on the signs of labour market softness exhibited in yesterday’s report. Overnight index swaps are now putting near-85-percent odds on a cut at next month’s meeting.

The euro is also shrugging its shoulders on reports that Christine Lagarde will step down as European Central Bank president before her term expires in October 2027. According to the Financial Times, Lagarde hopes to give French president Emmanuel Macron an opportunity to work with German chancellor Friedrich Merz on the selection process before he leaves office next year. The market implications are uncertain, given the wide range of views among potential candidates and the low likelihood of an abrupt policy shift. Names cited include Bank for International Settlements chief Pablo Hernández de Cos, former Dutch central bank head Klaas Knot, Bundesbank president Joachim Nagel and current executive board member Isabel Schnabel. In any case, the next president will lead an institution that is more consensus-driven than the Federal Reserve and less individualistic than the Bank of England.

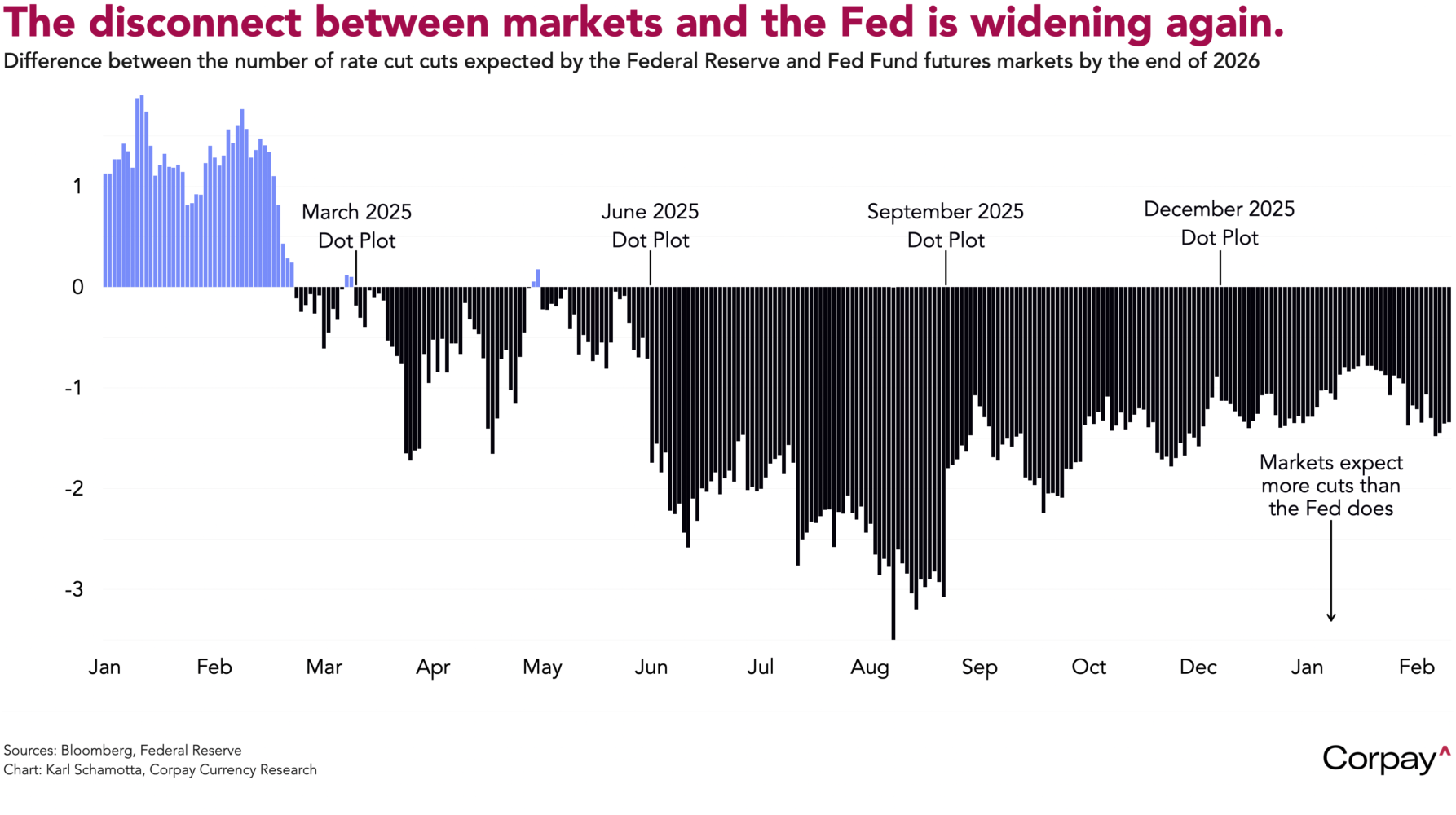

Markets will scrutinise this afternoon’s Fed minutes for signs of a shift in views among policymakers, given that there are now almost two and half rate cuts priced into futures curves by year end—considerably more than the single move shown in the December “dot plot” summary of economic projections.

Evidence of an easing bias could be difficult to find. Although Governors Waller and Miran dissented in favour of lowering rates at the January meeting, the committee revised its statement to say activity was “expanding at a solid pace” and unemployment was showing “some signs of stabilisation”—suggesting that most officials were growing less concerned about downside risks and more comfortable with an extended pause. Chair Powell said “if you look at the incoming data since the last meeting [there’s a] clear improvement in the outlook for growth . . . everything comes in suggesting that this year starts off on a solid footing for rates”.

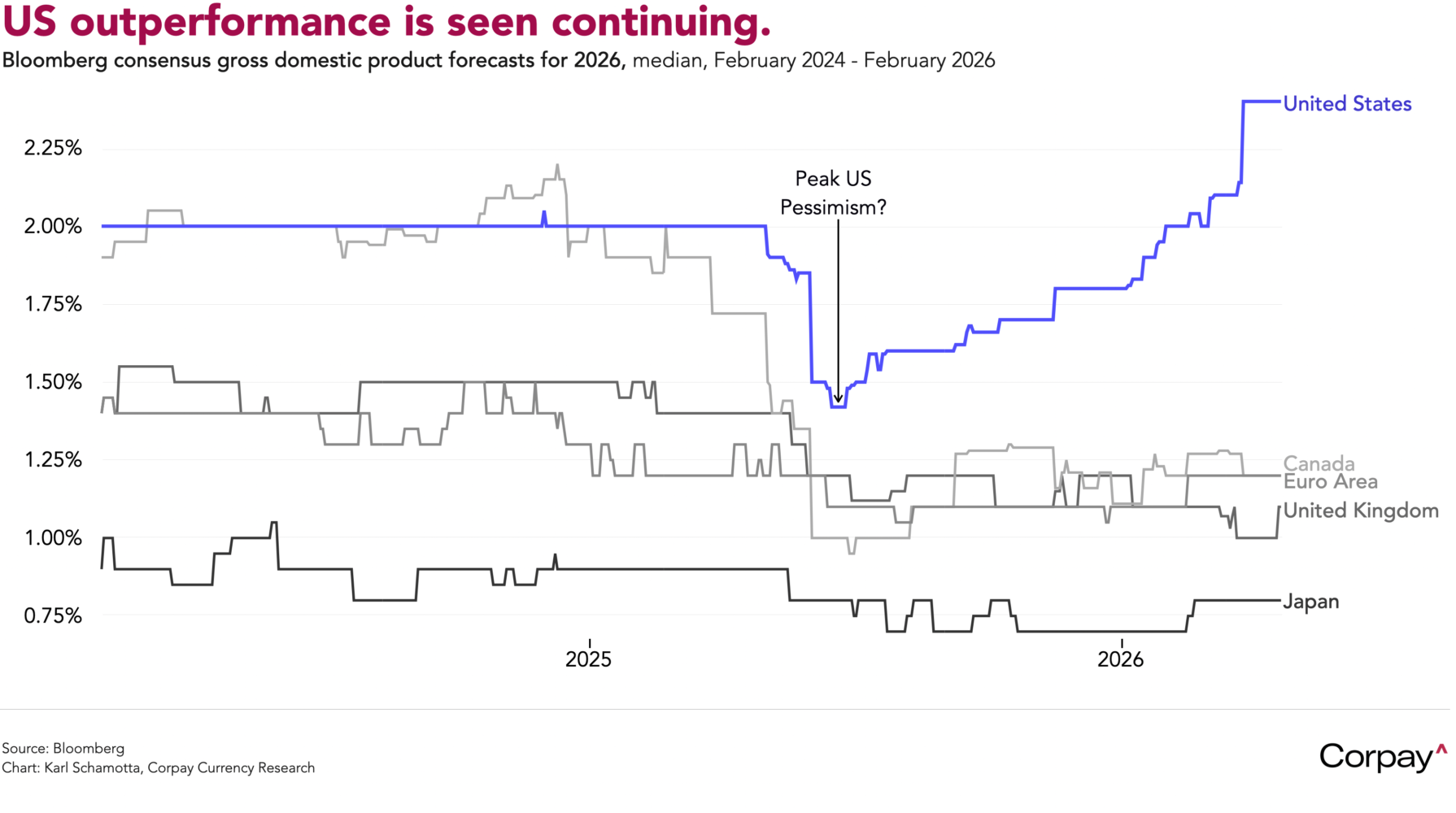

Against this backdrop, we’re struggling to see the case for a dollar-bearish narrowing in cross-currency rate differentials. While US exceptionalism may fade over time, the near-term backdrop remains favourable: inflation is easing, labour markets are holding up and growth is still strong. Tailwinds could build as tax refunds arrive, uncertainty recedes and business investment firms. Consensus is gradually shifting toward another year of US outperformance, and a comparable improvement elsewhere is harder to identify. At some point, that should support a hawkish repricing in the dollar.