Good morning. Price action is slowing across the financial markets as geopolitical noise levels come down, and consolidative trading patterns are emerging across most major currency pairs as investor focus pivots back toward economic fundamentals. The dollar is holding steady but remains on the defensive against an improving global growth backdrop, renewed talk of diversification away from US assets, and rising concern over fiscal trajectories. High-beta currencies such as the Australian dollar and Mexican peso have lost some momentum but are holding year-to-date gains, while demand for traditional havens is softening. Equity futures point to further gains, and Treasury yields are edging lower.

Japanese trading desks saw some excitement overnight when the yen jumped almost 200 points in a matter of minutes before reversing direction and edging lower. The move appears to have been sparked by rumours of official intervention shortly after Bank of Japan governor Kazuo Ueda ended his post-decision press conference, but the lack of follow-through points to trigger-happy trading rather than policy action. Sensitivity tends to rise whenever the dollar–yen exchange rate nears 160, even though past interventions have typically followed bouts of elevated volatility, not arbitrary “line in the sand” thresholds.

The Canadian dollar is pushing higher even after President Donald Trump withdrew an invitation for Mark Carney to join his proposed “Board of Peace”, deepening tensions between the two leaders. The move followed Carney’s Davos speech, in which he warned that major powers were weaponising economic integration and argued that middle powers must act together “because if you are not at the table, you are on the menu”. Trump responded on social media by writing “Dear Prime Minister Carney: Please let this Letter serve to represent that the Board of Peace is withdrawing its invitation to you regarding Canada’s joining, what will be, the most prestigious Board of Leaders ever assembled, at any time”.

No major advanced democracy has agreed to join the group, which is said to carry a price tag of more than $1 billion, will be chaired by Trump for life, and features a logo resembling that of the United Nations—except rendered in gold and centred on North America.

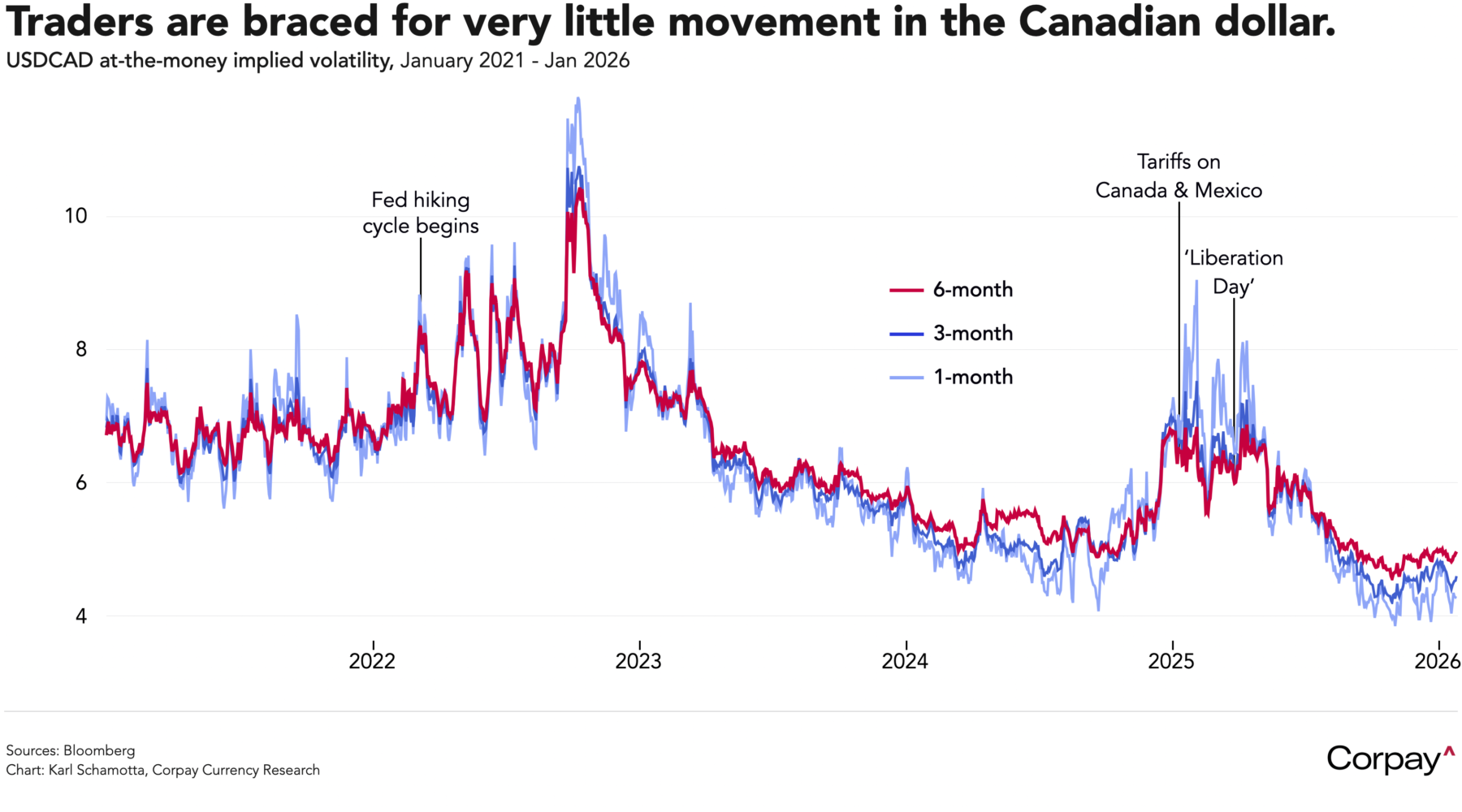

A sustained rift between Carney and Trump could still carry market consequences. Personal antagonism risks turning the upcoming USMCA renegotiation from a largely technocratic exercise into a more adversarial process marked by public brinkmanship and tariff threats, pushing policy uncertainty sharply higher and triggering more turbulence in currency markets. Against that backdrop, today’s nearly-five-year low in implied Canadian dollar volatility—a measure of expected movement—looks complacent, given that downside risks are likely to rise as the deadline approaches.

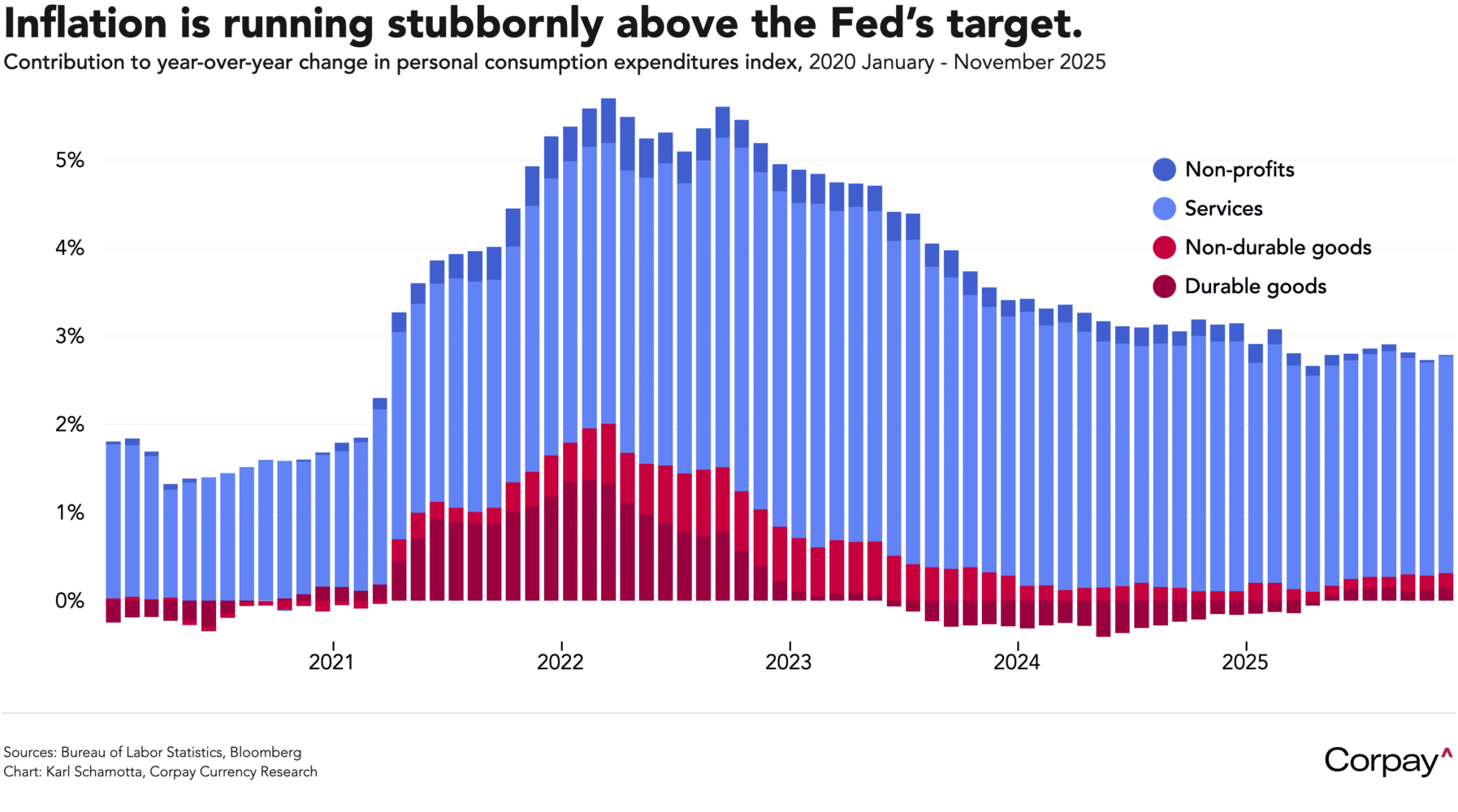

Data out yesterday showed the Fed’s preferred inflation gauge remaining elevated between September and November, reinforcing the central bank’s decision to signal a slower pace of easing. A shutdown-delayed release from the Bureau of Economic Analysis showed the core personal consumption expenditures index rising 2.8 percent from the prior year in November—matching the pace recorded in September—as price pressures stayed firm across goods and services categories.

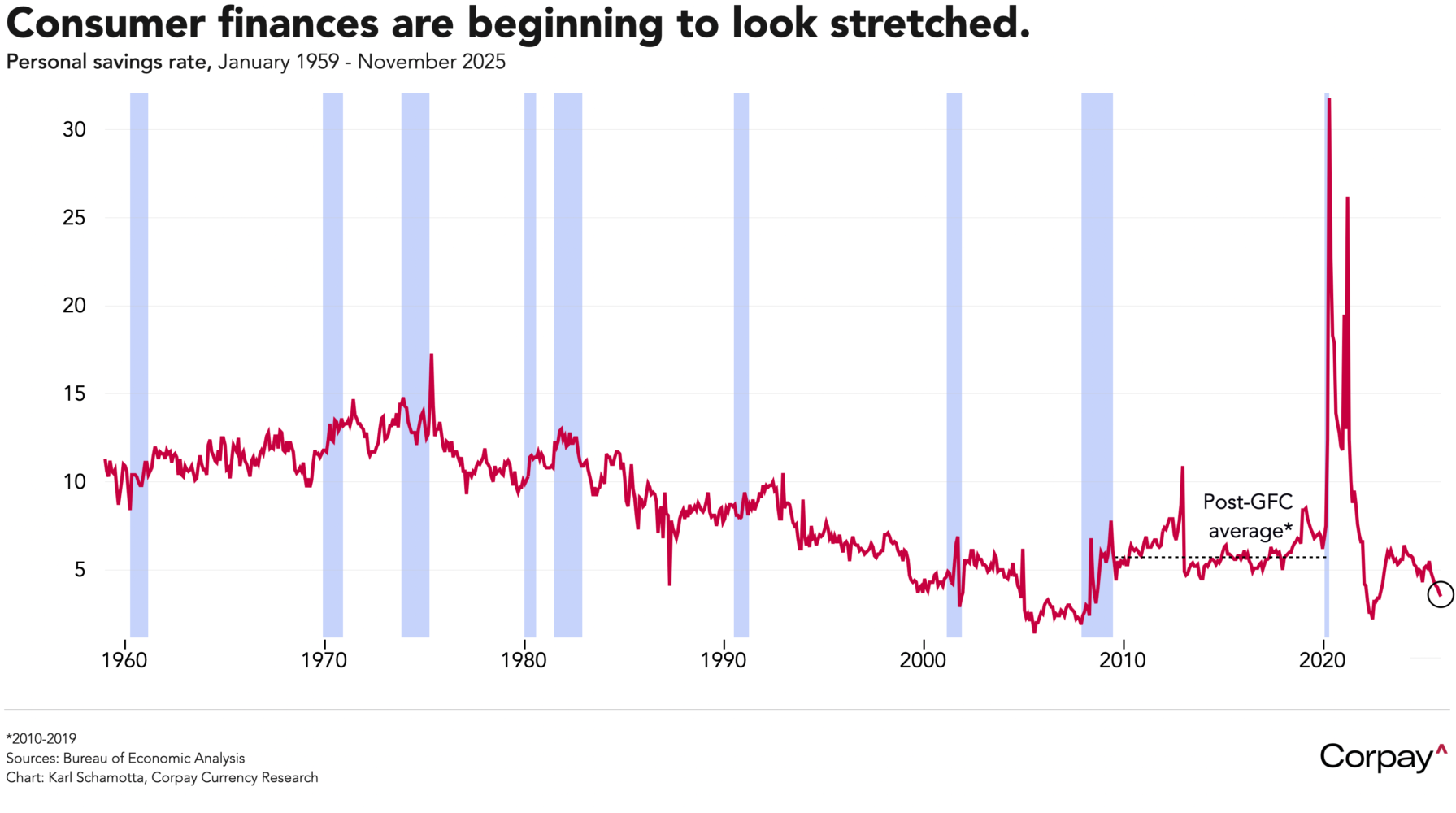

Household balance sheets deteriorated in some respects. Nominal personal income rose just 0.1 per cent in October and 0.3 per cent in November, while spending increased 0.5 per cent in both months. As a result, the savings rate fell to 3.5 per cent in November from 4.0 per cent in September—well below pre-pandemic norms and a sign that many consumers are relying more heavily on credit.

At least three major event risks lie ahead over the next week, as the Trump administration prepares to name Jerome Powell’s successor and both the Federal Reserve and the Bank of Canada deliver policy decisions. A surprise pick such as Kevin Hassett or Stephen Miran could steepen yield curves, lift inflation expectations and weigh on the dollar. If instead, as markets assume, former Fed governor Kevin Warsh or BlackRock’s Rick Rieder emerges on top, the response is likely to be more measured, given their experience and the expectation that policy easing would continue at a gradual pace.

On both sides of the 49th parallel, rates are expected to remain unchanged as policymakers await clearer signals on the economy. Guidance from Tiff Macklem and Jerome Powell is likely to be limited and framed as data-dependent, though the Fed could still surprise by upgrading its view of growth and labour market conditions. While the dollar has surrendered its early-January gains, a hawkish repricing of US growth and policy expectations could yet emerge in my opinion—something that could lay the groundwork for modest appreciation.