Global markets are taking the latest surge in geopolitical risk largely in stride after the United States attacked Venezuela and detained President Nicolás Maduro over the weekend. A mild flight to safety is lifting the dollar, the Japanese yen, and Swiss franc against their risk-sensitive rivals, Treasury yields are down slightly, and both of the major crude benchmarks—Brent and West Texas Intermediate—are trading slightly lower. The Mexican peso is off around 0.7 percent after Donald Trump said the US will have to “do something” about drug shipments from the country.

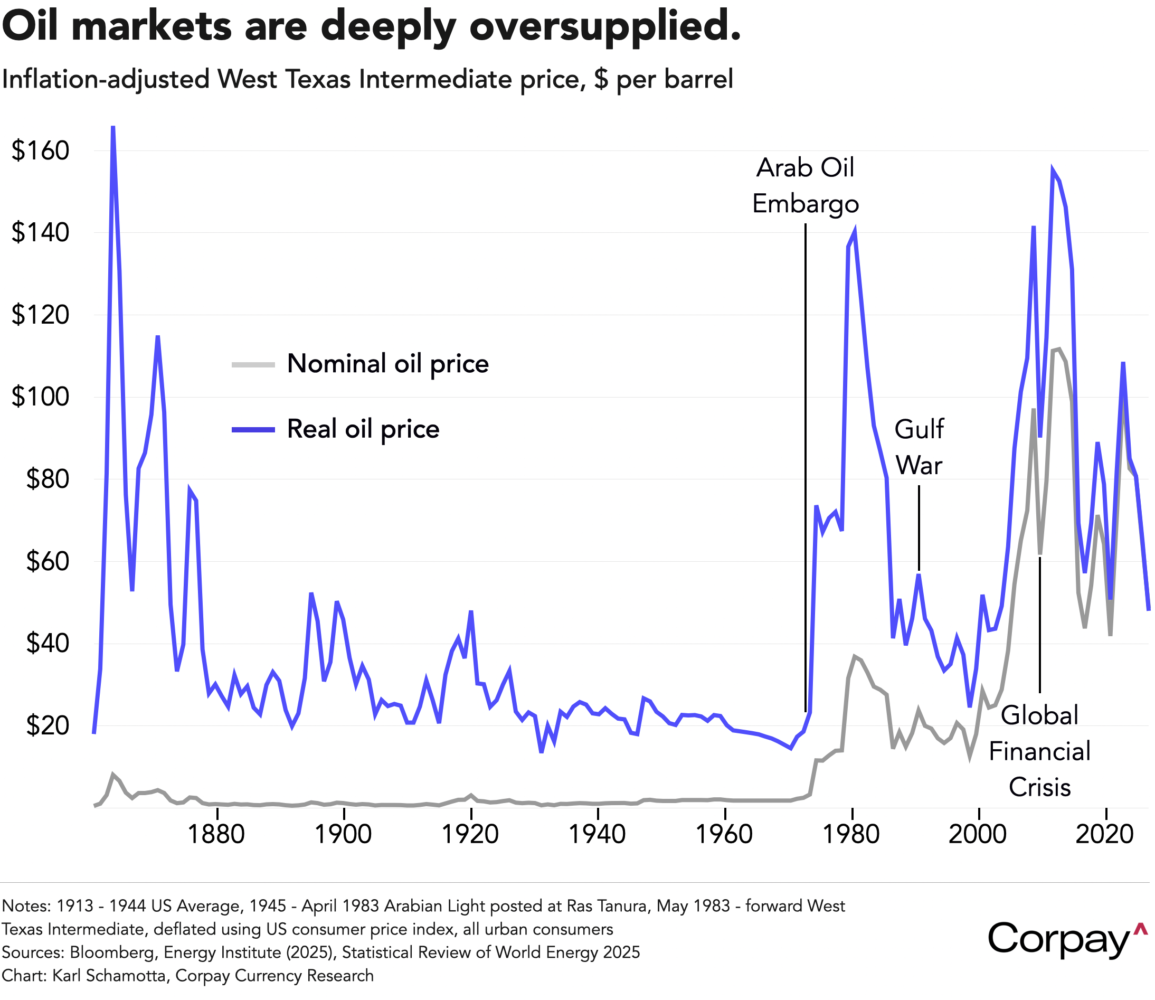

From a mechanical standpoint, the global macro backdrop looks essentially unchanged. After decades of mismanagement, Venezuela’s economy sits on the margins of global goods and capital flows, and bringing its vast oil reserves back online would require billions in long-term investment. Output should rise as the country reopens, but a broader reconfiguration of worldwide distribution networks is hard to justify given elevated political risk and a crude market still in surplus. Real prices are near levels last seen during the 2020 pandemic, the Saudi-led push against shale in 2012, and the early 2000s, before China emerged as a major industrial power.

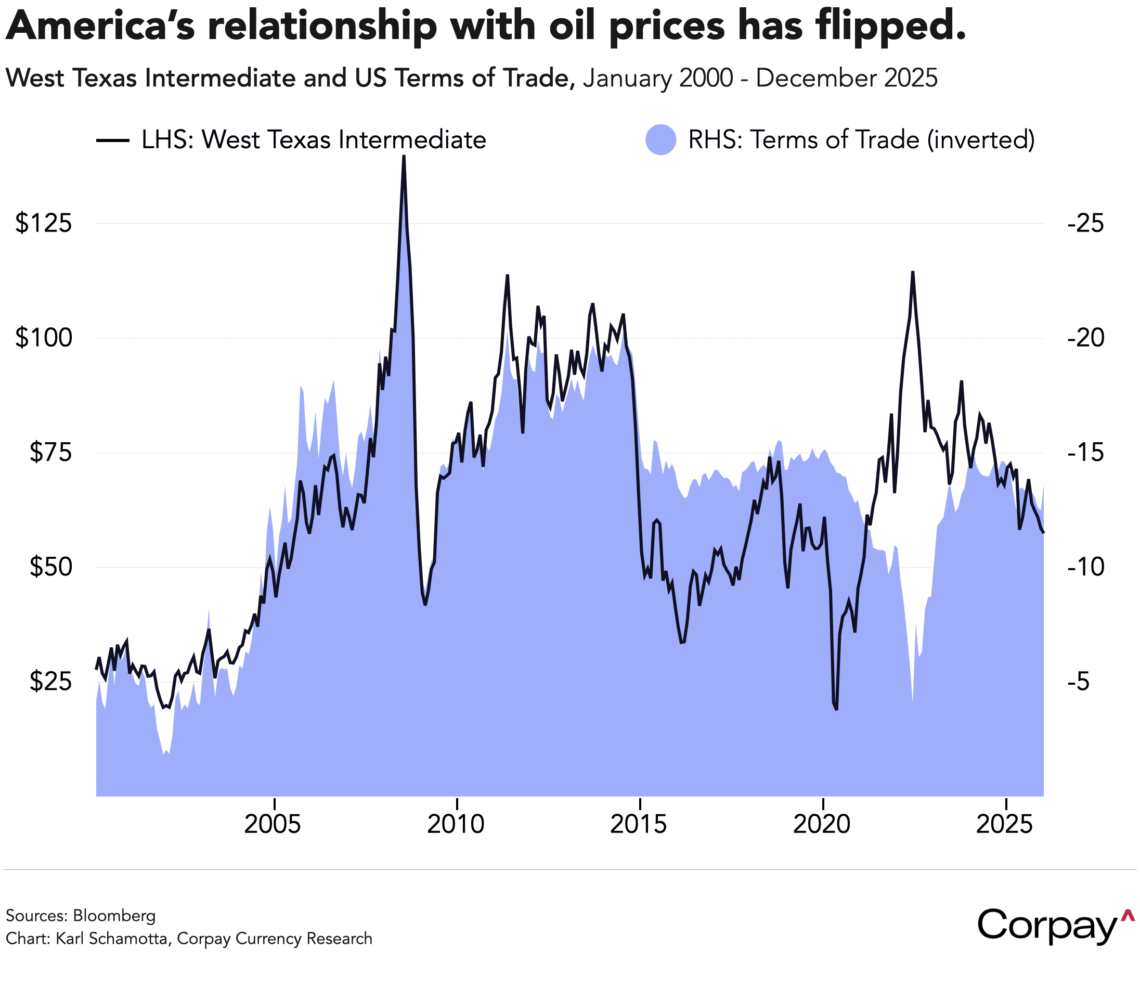

A renewed decline in oil prices would hurt US terms of trade. The country’s emergence as a shale-energy superpower in the 2010s has meant that its trade balance improves when crude prices climb, and deteriorates when they fall—a reversal from decades past, when the opposite held true. We therefore expect the weekend’s events to ultimately have a fairly neutral effect on the greenback, even if other countries choose to diversify reserve holdings in fear of future attacks.

On a more prosaic level, the trading year is set to begin with a relatively-light data calendar: December inflation data from France and Germany are due tomorrow, followed by Italy and the wider euro area on Wednesday. While a modest rise in core prices is expected, few see this altering the European Central Bank’s view that policy is “in a good place”, and markets largely expect rates to remain on hold through the year. Here in North America, the Institute for Supply Management’s manufacturing and services surveys—due today and Wednesday—followed by Thursday’s weekly jobless claims, should offer some insight into US conditions around the critical holiday period, though the usual seasonal caveats apply.

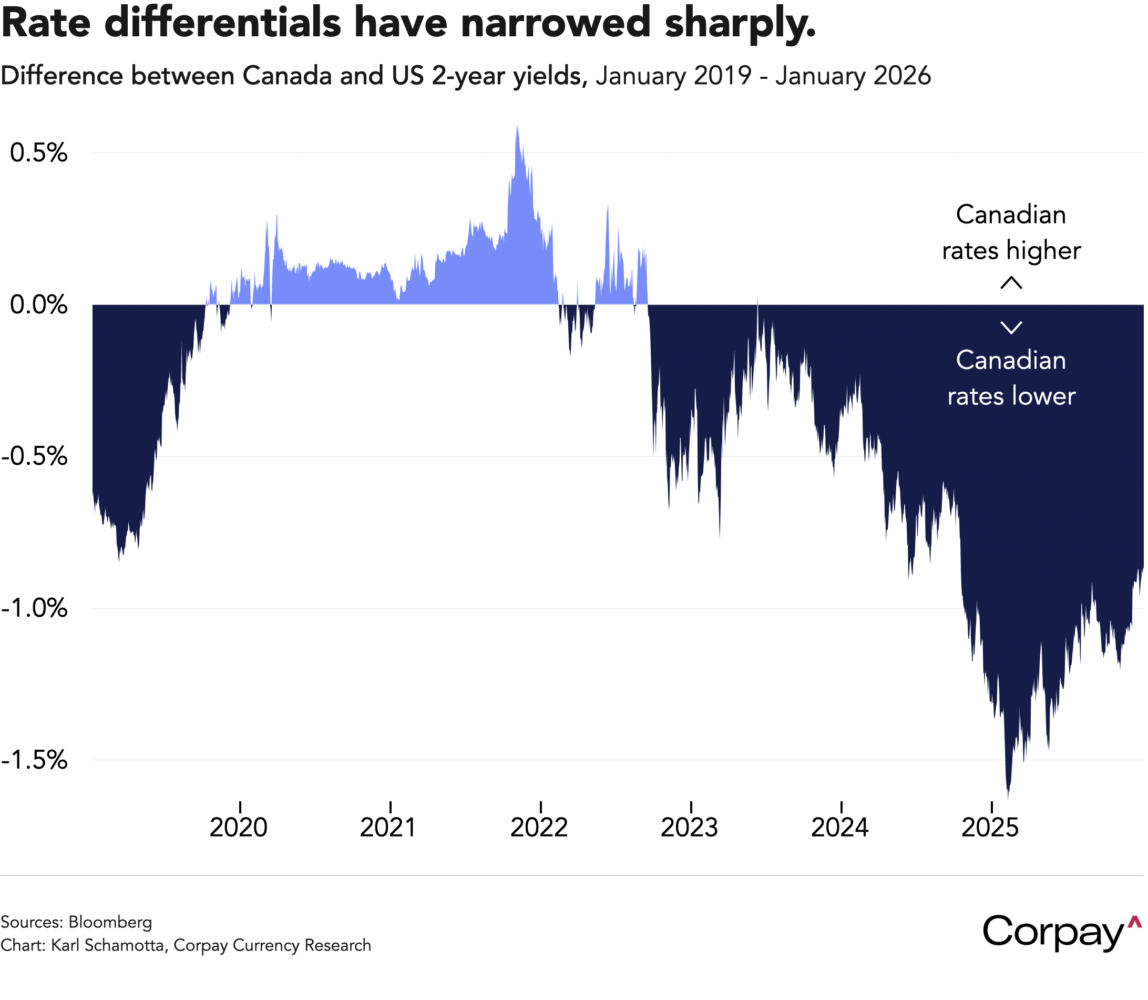

Friday’s US and Canadian employment reports are likely to have a greater impact on markets. December’s US non-farm payrolls report is expected to show just 25,000 jobs added in the month—a print that would put the labour market on track for its worst annual performance outside a recession in at least two decades—while Canada is seen creating roughly 30,000 roles in a fourth consecutive month of gains. Such an outcome could reinforce expectations for further easing from the Federal Reserve while ratifying the Bank of Canada’s move to the sidelines, and might help narrow still-wide cross-border rate differentials, putting the greenback under renewed selling pressure.

Surprises are possible however, and bearish positioning on the dollar looks vulnerable to a short squeeze. Although the US economy may be in the early stages of a policy-induced slowdown, there are reasons to suspect that a hawkish repricing in rate expectations could play out over the coming months. Consensus appears overly dovish on the labour market and Federal Reserve policy, given the absence of fiscal restraint, continued resilience in consumer spending, buoyant asset prices and historically-loose financial conditions. Currency markets have a long record of confounding early-year expectations, and there is little reason to think 2026 will be an exception.

Happy New Year, and may all your troubles last as long as consensus foreign exchange forecasts.