• Improved tone. Reports of a Greenland deal ‘framework’ boosts sentiment. US equities rose. USD index a bit firmer. AUD outperforms. NZD edges higher.

• Data flow. The volatile Australian jobs report due today. US PCE deflator out tonight. Tomorrow Q4 NZ CPI is released. BoJ also meets on Friday.

Global Trends

An improvement in risk sentiment overnight after US President Trump dialed down his aggression with regards to Greenland at the Davos World Economic Forum. After earlier stating the US wouldn’t use force to acquire Greenland, President Trump posted that following discussions with the Secretary General of NATO a “framework of a future deal with respect to Greenland” had been formed. And hence the higher tariffs announced against several European nations over the weekend won’t go ahead on 1 February. This latest episode is another example of the TACO environment (i.e. Trump Always Chickens Out) which generated repeated bursts of market volatility over the past year.

In response US equities have risen, though the ~1.2% gain in the S&P500 only puts the index in slight positive territory for the week. Elsewhere, US bond yields slipped back with the benchmark 10yr rate modestly lower and the curve a bit flatter. US 10yr yields are currently around the bottom of their overnight 4.25-4.30% range. Sticking with bonds, attention also remains on Japan with the recent volatility in JGBs raising a few eyebrows. Concerns about the prospect of more unfunded fiscal spending by the Japanese government has seen long end Japanese bond yields jump up, however there was a little reprieve yesterday. Indeed, even after tumbling ~14bps the Japanese 30yr yield remains over ~20bps above where it ended last week. Trends in Japan’s bond market is another potential source of market volatility that needs watching.

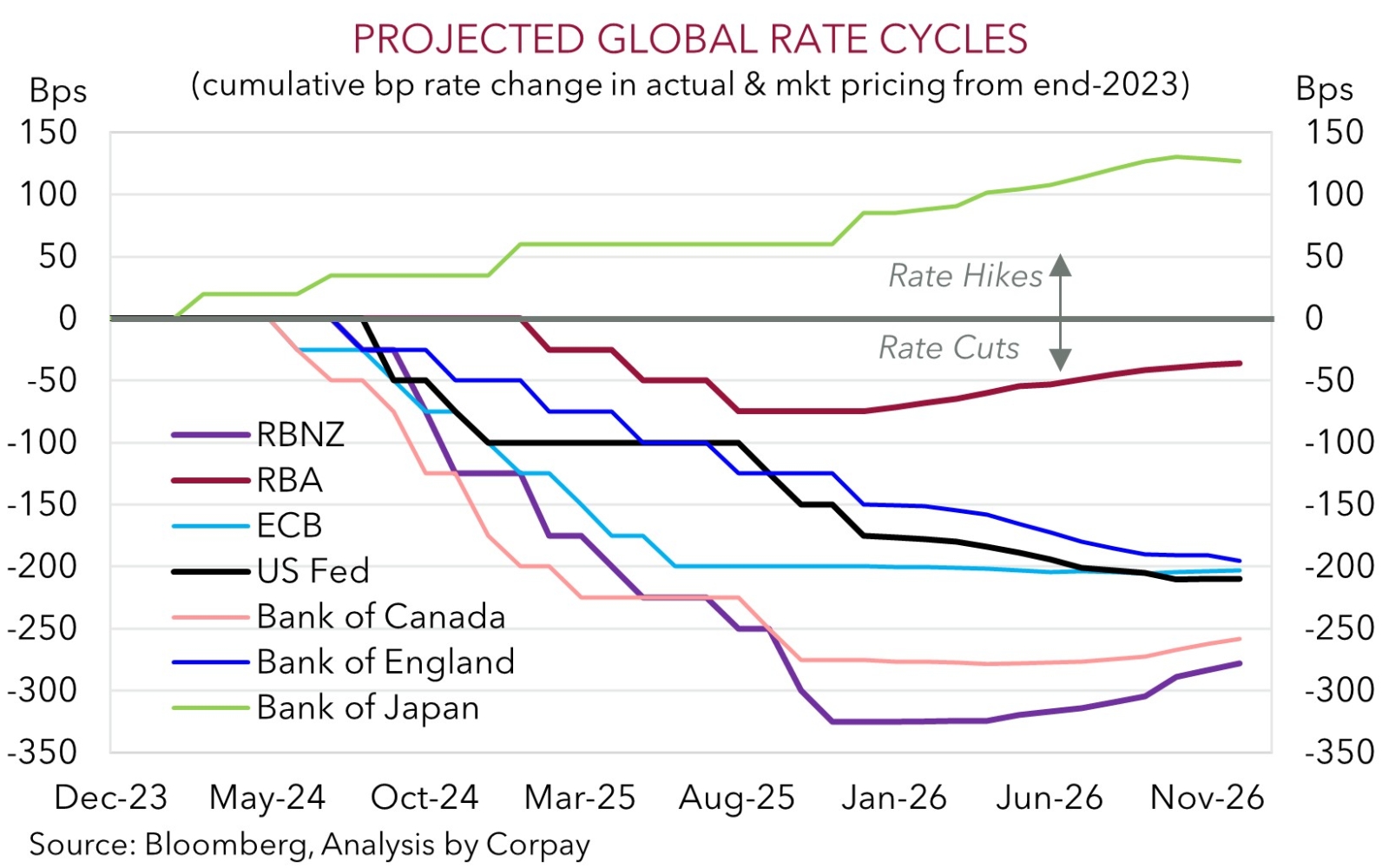

In FX, the USD index has ticked up a fraction on the back of the reduced US risk premium with EUR dipping under ~$1.17 and USD/JPY nudging up towards ~158.40. GBP also lost some ground (now ~$1.3426). UK core CPI inflation held steady at 3.2%pa. Mechanical base effects look set to drag UK CPI lower in early 2026. This is supporting the case for more Bank of England rate cuts with the market pricing in another reduction by June. Closer to home, the more upbeat tone in risk markets helped the NZD edge higher (now ~$0.5845), while the AUD, which outperformed overnight, is within striking distance of its ~15-month peak (now ~$0.6762).

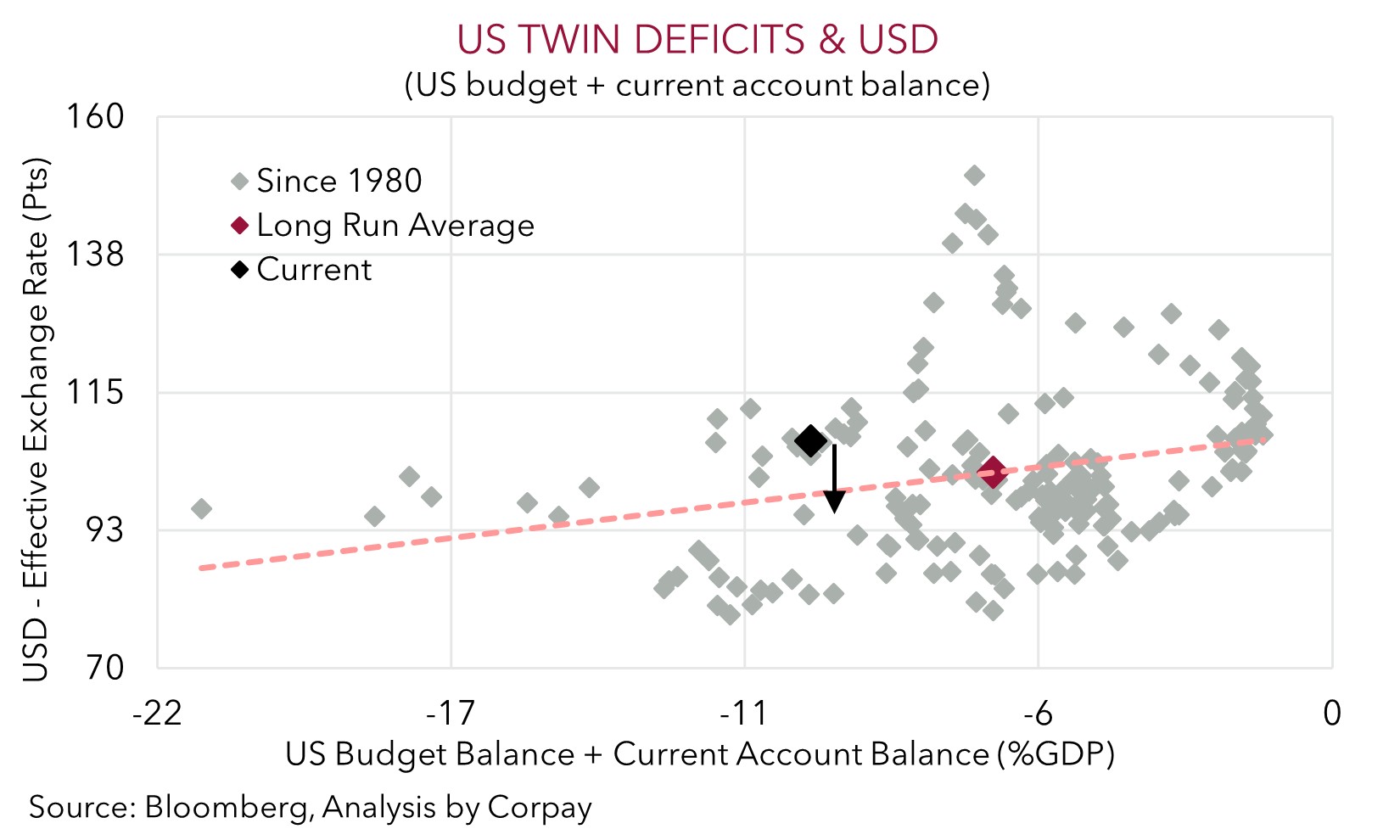

The global macro calendar picks up over the rest of the week. Tonight, weekly US initial jobless claims are due (12:30am AEDT), as are the October/November PCE deflator prints (2am AEDT). Signs of firmer US spending and/or sticky core inflation pressures may, in our opinion, give the USD some renewed support. However, we don’t think turnarounds in the USD should be overly large/long lasting. The overvalued USD is facing longer-term structural headwinds such as the US’ sizeable ‘twin deficits’ (see chart below).

Trans-Tasman Zone

The improvement in risk appetite and reduction in US-related risk premium following overnight developments/comments related to Greenland has supported the NZD and AUD (see above). At ~$0.5845 the NZD is around the top of the wide range it has occupied since late-September. NZ Q4 CPI is due tomorrow (Fri 8:45am AEDT). Based on leading indicators NZ inflation may come in above the RBNZ’s projections. If realised, we think this could bolster the case looking for the RBNZ to (eventually) begin its interest rate hiking cycle (possible later this year), and in turn help the NZD recoup more ground.

The AUD (now ~$0.6762) also strengthened a bit further and is close to its ~15-month highs. Outperformance on the cross-rates gave the AUD a helping hand. The AUD has risen by ~0.2-0.7% against the EUR, JPY, GBP, NZD, CAD, and CNH over the past 24hrs. In level terms, AUD/EUR (now ~0.5787) is at its highest since last May, AUD/GBP (now ~0.5037) is at an ~11-month peak, AUD/CNH (now ~4.7069) is north of its 1-year average, and AUD/JPY (now ~107.11) is approaching its cyclical highs. We continue to think that there are uneven risks for AUD/JPY at current levels given the divergence from underlying drivers such as interest rate differentials and where it is tracking compared to history (since 1995 AUD/JPY has only been above ~107 in ~0.2% of trading days).

Today in Australia focus will be on the monthly jobs report (11:30am AEDT). The labour force stats are notoriously volatile (over the past 6-months monthly jobs have ranged from -21,300 to +42,200). Based on the signal from forward indicators we think that after a weak November hiring rebounded in December. Signs Australia’s job market is on solid footing might reinforce views that the RBA remains on a different path to its peers and/or boost odds a rate hike in early-February. The market now views a 3 February rate rise as a ~27% chance. The more important Q4 CPI inflation data is due next week (28 January). Over the medium-term we continue to see the AUD grinding up into the high-$0.60s with more favourable yield spreads between Australia and others such as the US a factor, as is a weaker USD, and prospect of more stimulus out of China.