After several sessions of violent, whiplash price action in precious metals, cryptocurrencies and high-beta technology stocks, investors are hesitantly stepping back in this morning, driving a mean-reversion process across asset classes. The US dollar—which enjoyed a brief, and increasingly-unusual bout of safe-haven support earlier in the week—is retreating against most of its major peers, while Treasury yields are drifting lower and equity futures are pointing to a partial clawback of yesterday’s losses.

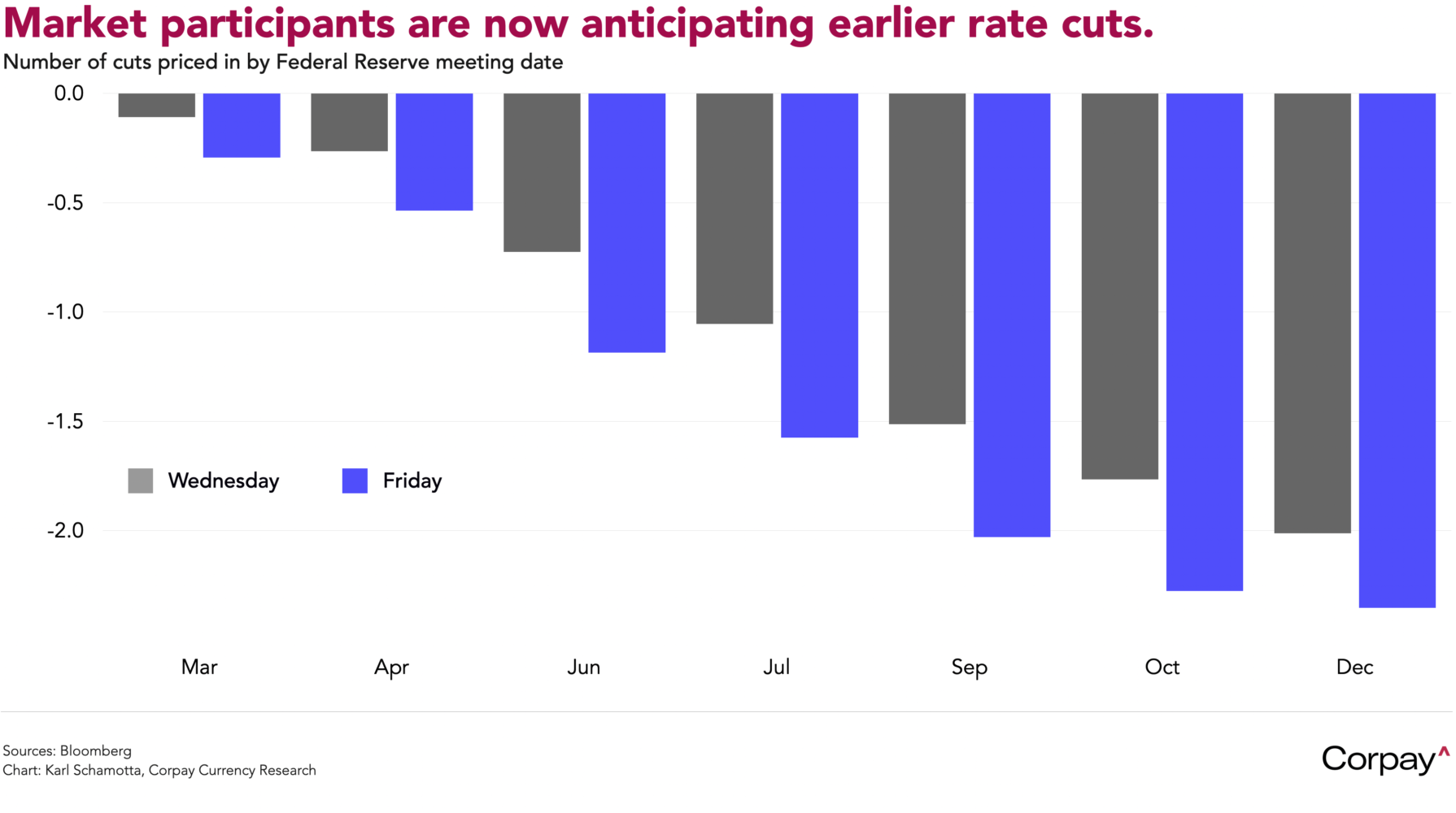

The pattern of returns over the last week suggests that the recent market turbulence reflects narrative exhaustion rather than a decisive shift in macro fundamentals. Although thousands of headlines have singled out President Trump’s nomination of reformed über-hawk Kevin Warsh to head the Federal Reserve as the proximate trigger for the selloff, monetary policy expectations have not meaningfully changed: short-end rate bets have eased somewhat, while long-end yields have held within recent ranges and inflation breakevens are little moved, pointing to a repositioning of risk rather than a fresh macro regime. In just the last two days, traders have brought forward their expectations for the first rate cut to June, from July previously, and now have a total of two quarter-point reductions fully priced in by December.

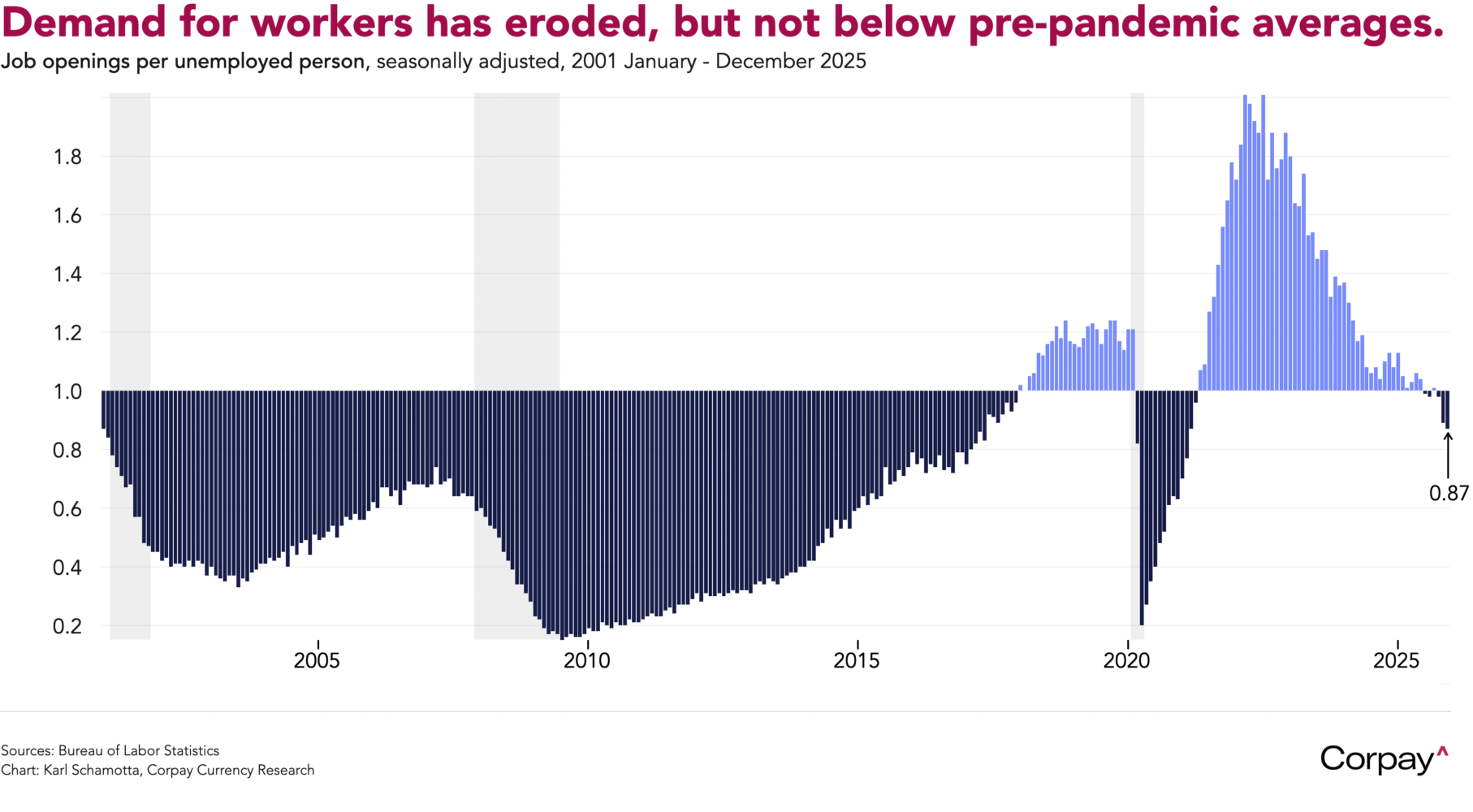

This comes after a raft of data releases yesterday painted a negative picture of labour market dynamics. Initial jobless claims rose to a two-month high, the private-sector Challenger survey recorded more than 108,000 planned layoffs in January, the highest for that month since 2009, and the Bureau of Labor Statistics said the ratio of job openings to unemployed workers slipped below one, to 0.87 in December—a reading that, outside the pandemic period, has not been seen since 2017. The government’s numbers are not, however showing a sharp increase in layoffs, and the quits rate actually rose in the month, suggesting that worker confidence is holding up relatively well.

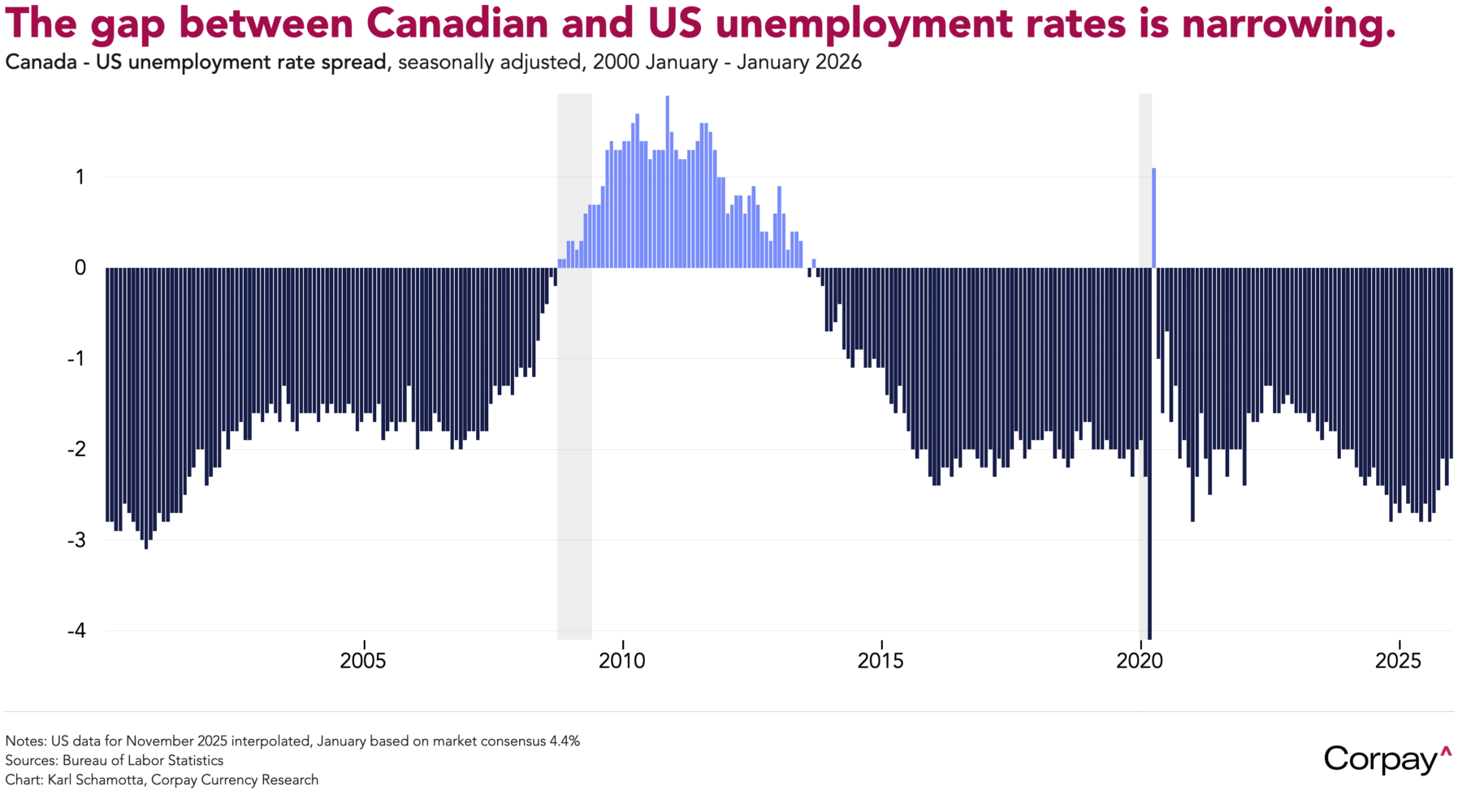

In Canada, the loonie is holding altitude even after the latest labour market release from Statistics Canada snapped a long and suspiciously-strong winning streak, pointing to weakness in the underlying economy. According to the report, 24,800 jobs were lost last month as the manufacturing sector in Ontario was particularly hard hit by US tariffs. At the same time, the unemployment rate—a key driver of policy expectations and the dollar–Canada exchange rate—fell to 6.5 percent, reflecting a drop in labour force participation as immigration restrictions and demographic shifts reduced the number of Canadians seeking work. Economists polled by the major data providers expected the economy would add roughly 7,000 jobs, with the unemployment rate holding steady at 6.8 percent as slower job creation intersected with a shrinking pool of available workers. Bank of Canada Governor Tiff Macklem, speaking yesterday, warned that the country’s labour-market performance could be “uneven” in 2026, though he suggested that stability on the trade front should support a broader rebound in hiring as the year progresses.

The Mexican peso is advancing as a broader improvement in risk appetite lends support, but a more durable catalyst lies south of the Río Bravo. The Banco de México held its benchmark rate at seven percent yesterday, as had been universally expected, pausing an easing cycle that had delivered eleven consecutive cuts over the preceding two years, but also adjusted its projections in a hawkish direction, pointing to a more gradual pace of easing ahead. Policymakers now think inflation will reach target in the second quarter of 2027, a full three quarters later than the timeline published at the previous meeting, and think growth could hold up better than previously anticipated. This should be good news for the peso, which draws support from still-generous carry differentials against the dollar and yen.

The euro is underperforming its non-dollar counterparts following a series of cautious comments from European Central Bank officials after yesterday’s uneventful rate decision. Policymakers left rates unchanged for a fifth consecutive meeting, with President Christine Lagarde repeating that both policy and inflation are in a “good place”. But in interviews this morning, several Governing Council members highlighted downside risks to inflation and the possibility that further appreciation in the euro could eventually force the central bank’s hand, echoing last week’s remarks from France’s François Villeroy de Galhau. Further cuts are still considered extremely unlikely—traders have just 6 basis points in easing priced in by year end—but evidence of a modestly-dovish bias among policymakers is limiting the common currency’s upside potential.

The pound is recovering a portion of yesterday’s losses but remains firmly on the defensive, as political turmoil overshadows what was, by any measure, a surprisingly dovish message from the Bank of England. The Monetary Policy Committee voted 5-4 to leave the Bank Rate at 3.75 percent—far closer than the 7-2 split markets had expected—with Governor Andrew Bailey casting the deciding vote to stay put even as he noted that “there should be scope for some further reduction in the Bank Rate this year”. This more dovish-than-anticipated split sent short-end rates and sterling sharply lower as traders brought forward expectations for the next cut.

Yet it is Westminster, not Threadneedle Street, that is inflicting real damage. Prime Minister Keir Starmer is engulfed in the deepest crisis of his premiership following revelations about former ambassador Peter Mandelson’s relationship with the late financier Jeffrey Epstein. Starmer admitted to Parliament that the vetting process had flagged Mandelson’s Epstein ties before the appointment was made, and that the former ambassador had “lied repeatedly” about the depth of the relationship. He has since apologised to Epstein’s victims and agreed to release all documentation surrounding the decision. The likelihood of a leadership challenge has soared, and betting markets are now putting the probability of Starmer leaving office in 2026 at roughly 70 percent. Traders view the Prime Minister and Chancellor Rachel Reeves as relatively market-friendly figures within Labour, and credit the pair with stabilising gilt yields since taking office. Their potential departure is widening the pound’s political risk discount at a moment when the economic backdrop alone would argue for a weaker currency.

The yen is trading softer and Japanese government bond yields are holding steady as markets position ahead of Sunday’s snap election, which polls suggest will deliver a commanding majority for Prime Minister Sanae Takaichi’s ruling coalition. A Nikkei survey published last night projected the bloc would secure more than 300 of the 465 lower-house seats, a result that would hand Takaichi a strong mandate for her expansive fiscal programme—dubbed “Sanaenomics”—including a possible cut in the consumption tax on food and a significant stimulus package. The prospect of more fiscal largesse is complicating the Bank of Japan’s tightening path, triggering turbulence in long-dated government bond markets, and generating renewed selling pressure on the yen, forcing it inexorably toward the 160 threshold that is often seen as a “line in the sand” for intervention-happy authorities. A decisive Takaichi victory could generate spillover effects across global bond markets ahead of the Monday open, forcing yields higher across the developed economies.

The intensity will not let up next week as the US delivers retail sales numbers, a consumer-price index update, and the delayed non-farm payrolls report. The UK will publish gross domestic figures, Canada will release its latest inflation data, and investors will continue to grapple with the questions everyone is asking: why have markets tumbled, and will it continue?

Have a great weekend, and feel free to send any answers my way : )