• US Fed. Another US rate cut announced. But guidance wasn’t as ‘hawkish’ as feared. Positive for sentiment. USD weaker. AUD close to year-to-date peak.

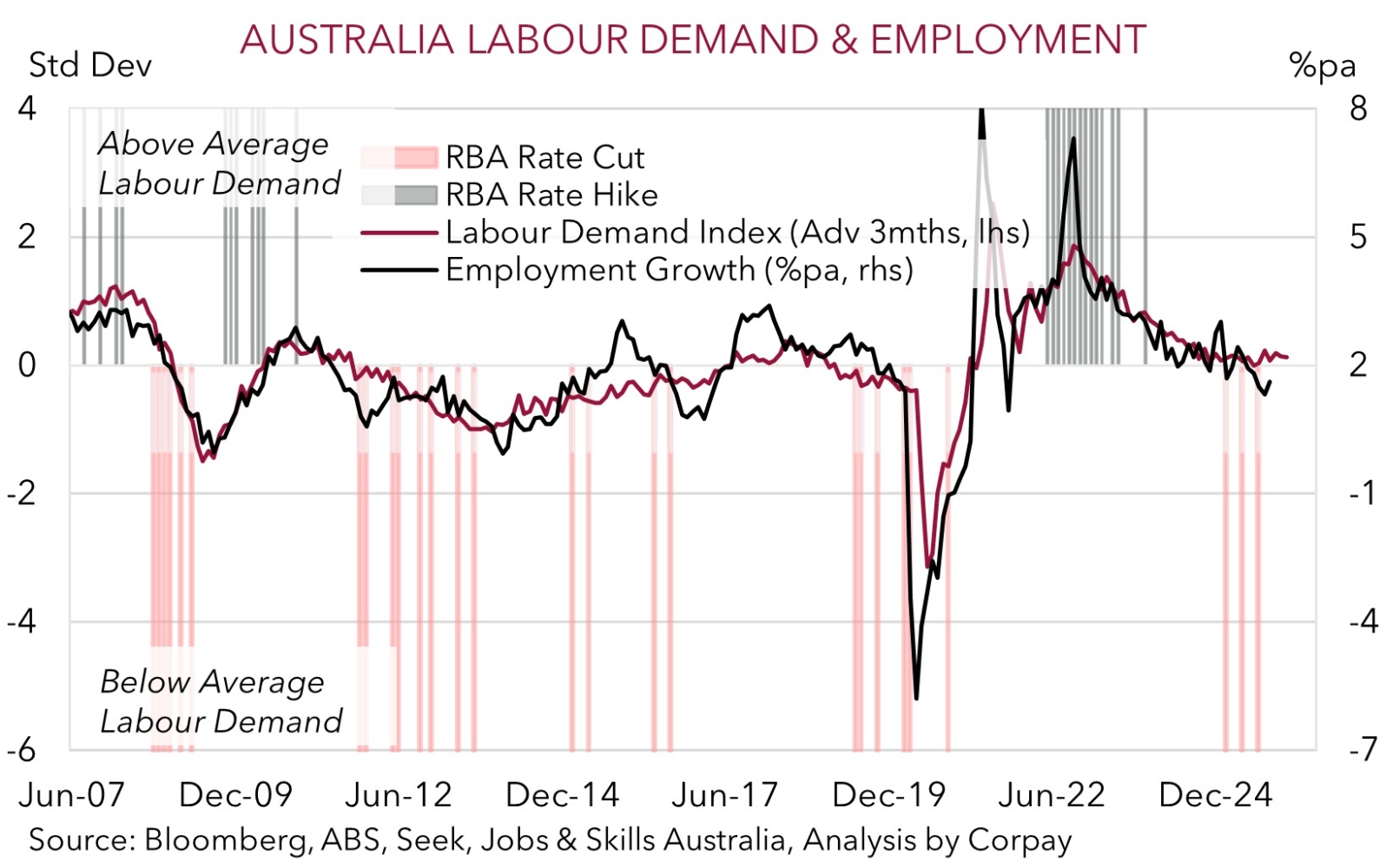

• AU jobs. Australian employment data due today. Monthly figures are volatile. Another solid report would reinforce views RBA may hike rates in early-2026.

Global Trends

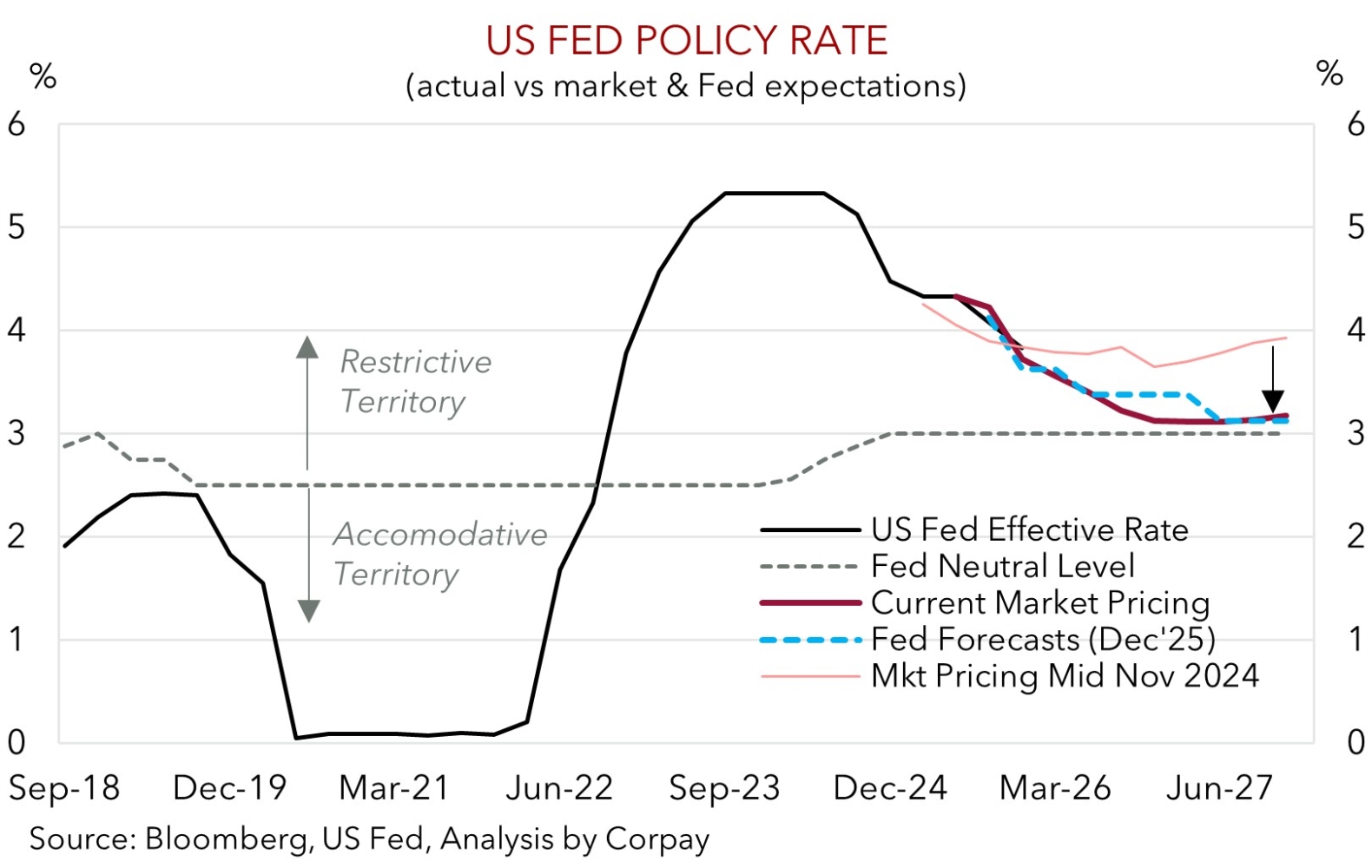

The US Fed meeting was the market focal point overnight. As expected, the US Fed delivered another 25bp rate cut, lowering the policy target range to 3.50-3.75%. This was ~90% factored in ahead of the event. Notably, the Fed’s updated guidance and economic projections were little different from last time out with members still divided on how things might unfold. Indeed, the voting committee was split about the latest rate cut with President Trump’s appointee (Miran) again calling for a larger 50bp reduction, while 2 others of the 12-person group pushed for no change. Views about the macro and interest rate outlook were only tweaked at the margin. US inflation is assumed to hold up near-term before gradually cooling towards 2%pa over the forecast horizon, while downside risks to the jobs market remain front of mind for many Fed policymakers. Because of these tensions, although Chair Powell noted a rate hike isn’t “anyone’s base case next move”, only a modest amount of easing is predicted from here with the ‘dot plot’ showing 1 rate cut in 2026 and another in 2027. This was on par with the Fed’s previous projections.

Outcomes compared to expectations matter for markets, and with the Fed not being as ‘hawkish’ as many had feared they may be risk sentiment has been supported. US equities ended the session higher with the S&P500 (+0.7%) just shy of record levels. After their recent upturn US bond yields also gave back ground with the 2yr rate shedding ~7bps (now ~3.54%). And the USD weakened. EUR (the major USD alternative) has risen towards ~$1.17, GBP is firmer (now ~$1.3383), and the interest rate sensitive USD/JPY tracked the pull-back in bond yields (now ~155.95). Elsewhere, the NZD (now ~$0.5815) and AUD (now ~$0.6679) extended their respective upswings with the latter within striking distance of its year-to-date peak ahead of today’s Australian jobs data (11:30am AEDT).

We believe the US Fed is data-dependent, and without a further deterioration in US labour market conditions or growth momentum near-term it could ‘pause’ its interest rate cuts in early-2026. This in turn might help the USD level off over the next few weeks. However, we remain of the opinion that the US Fed’s growth/jobs forecasts might prove to be optimistic. As the impact of higher import costs/tariffs continues to bite down on activity and downside risks to employment crystalize we feel the US Fed could end up delivering more interest rate reductions than policymakers/markets now think. Over the medium-term, we expect the step down in US interest rates to exert downward pressure on the USD.

Trans-Tasman Zone

The softer USD on the back of the “not as hawkish as feared US Fed guidance” supported risk sentiment overnight and given the NZD and AUD another boost (see above). At ~$0.5815 the NZD is over 4% above the low point touched after the RBNZ’s late-November meeting where it cut interest rates but gave signals the move could be the last this cycle. The AUD (now ~$0.6679) is closing in on its year-to-date high, though in a sign of how USD-centric the moves over the past 24hrs have been the AUD has been mixed on the cross-rates. While AUD/CNH has risen by ~0.5% (now ~4.7146, a high since early-October), the AUD consolidated versus the EUR, JPY, GBP, and NZD.

In addition to navigating the market fallout of the US Fed meeting today the AUD will also have to contend with the Australian jobs data (11:30am AEDT). The monthly employment figures are volatile. Consensus is looking for employment to increase by ~20,000, but that might still see unemployment nudge up to ~4.4%. This type of outcome would still be a solid result, in our view, particularly as forward looking labour demand indicators point to improved conditions over early-2026.

The ‘hawkish’ rhetoric from the RBA earlier this week combined with the run of positive activity/inflation data has raised the odds of a rate hike being delivered in Q1. Today’s jobs figures, as well as the upcoming inflation data (for November on 7 January, and for December/Q4 on 28 January), and another employment report (22 January) will be lasered in on by the RBA ahead of its next meeting (3 February). For more see Market Musing: RBA & AUD – Stars Aligning.

More headline/data driven AUD volatility is possible over the short-run. But we don’t see AUD pull-backs being too deep or lasting too long. Over the medium-term, we continue to see the AUD grinding up into the high-$0.60s with more favourable yield spreads between Australia and the US a factor. As is the improvement in US/China trade relations and firmer Asian growth. Notably, based on current pricing the RBA-US Fed policy rate spread is projected to swing to ~75bps in the RBA’s favour by late 2026. The last few times this spread was in this region (Q1 2017 and Q4 2006) the AUD was tracking in the low $0.70s.