• Consolidation. US equities tread water ahead of tomorrow’s US Fed decision. The USD index ticked up. AUD outperformed due to RBA rhetoric.

• RBA shift. No change in rates yesterday but there were ‘hawkish’ signals. Inflation risks have changed. February meeting looks ‘live’ for a rate hike.

• US Fed. Another rate cut expected. Focus will be on the Fed’s guidance. A ‘cautious’ tone about more near-term rate reductions may see the USD lift.

Global Trends

Modest moves across most asset classes overnight as traders marked time ahead of tomorrow’s US Fed decision (Thurs 6am AEDT) and Chair Powell’s press conference (Thurs 6:30am AEDT). US equities consolidated with the S&P500 hovering ~1% from its record highs while bond yields ticked up ~2-3bps across the curve with the benchmark 10yr rate (now ~4.18%) close to its 6-month average. In FX, the USD index nudged up a bit with EUR (now ~$1.1626) and GBP (now ~$1.3299) slipping back a fraction and the interest rate sensitive USD/JPY rising (now ~156.94, ~0.6% from its multi-month peak). Elsewhere, NZD tread water (now ~$0.5780) while the AUD edged higher (now ~$0.6640) and outperformed on the cross-rates after the RBA’s ‘hawkish’ comments at yesterday’s meeting.

Data wise the US JOLTS job openings report (which provides a gauge of labour demand, jobs turnover, and wage pressure) was a mixed bag. On the positive side job openings increased in September/October, however other important details about churn and hiring were sluggish with the ‘quits rate’ (an indicator of confidence about the employment market and future wages) falling to a new low of 1.8% and layoffs increasing. In Japan, BoJ Governor Ueda remarked in an interview that “we are closer to 2% inflation on a sustained basis” and policymakers should continue to adjust the degree of monetary accommodation until rates are “back to the natural level. Wherever it is”. Market odds of the BoJ announcing a 25bp rate hike next week are sitting at ~90%.

In terms of tomorrow’s US Fed meeting although the FOMC appears divided and a split decision looks likely markets and surveyed economists think the core of the committee should vote in favour of another 25bp interest rate cut. This is ~90% discounted by markets. In our view, to appease some of the more ‘hawkish’ members of the voting committee and get a rate reduction over the line the statement and Chair Powell’s press conference may indicate another move in early 2026 remains data dependent and isn’t locked in. Outcomes compare to expectations drive markets. We believe that based on where market pricing is now tracking a ‘cautious’ tone from the US Fed about further interest rate cuts coupled with not that much change to its economic projections could see the USD recapture some lost ground in the near-term.

Trans-Tasman Zone

The subdued volatility ahead of tomorrow’s US Fed decision (Thurs 6am AEDT) has seen the NZD consolidate around levels last traded in late-October (now ~$0.5780). This is ~3.5% above the low touched post the RBNZ’s late-November meeting where it cut rates but gave hints the move might be the last this cycle. When speaking today new RBNZ Governor Breman noted “there is no preset course” for policy and that it is important to look at the incoming data. Given the rapid and large-scale interest rate cuts delivered by the RBNZ and signs the NZ economy is starting to respond positively we think no more reductions are likely and the next move could (eventually) be a hike.

AUD has ticked higher (now ~$0.6640, less than 1% from its 1-year high) and posted gains of ~0.1-0.9% against EUR, JPY, GBP, NZD, CAD, and CNH the past 24hrs. AUD/EUR (now ~0.5710) is at a ~6-month high, AUD/NZD (now ~1.1487) is within striking distance of its cyclical peak, AUD/GBP (now ~0.4993) is at the upper end of its multi-month range, and AUD/JPY (now ~104.20) is up around levels last traded in July 2024. The ‘hawkish’ tone from the RBA at yesterday’s meeting has been AUD supportive.

As expected, the RBA kept rates steady at 3.6%. However, the door to a hike as soon as February has been opened, in our view. According to the RBA, the data “suggest some signs of a more broadly based pick-up in inflation”, and that risks to the outlook have shifted to the “upside”. Indeed, in the words of Governor Bullock it looks like “additional rate cuts aren’t needed” and the question is whether an “extended pause or rate hikes” are on the horizon. The upcoming Australian inflation reports (for November on 7 January, and for December/Q4 on 28 January), as well as labour market trends (11 December and 22 January) will be lasered in on by the RBA ahead of its next meeting (3 February). For more see Market Musing: RBA & AUD – Stars Aligning.

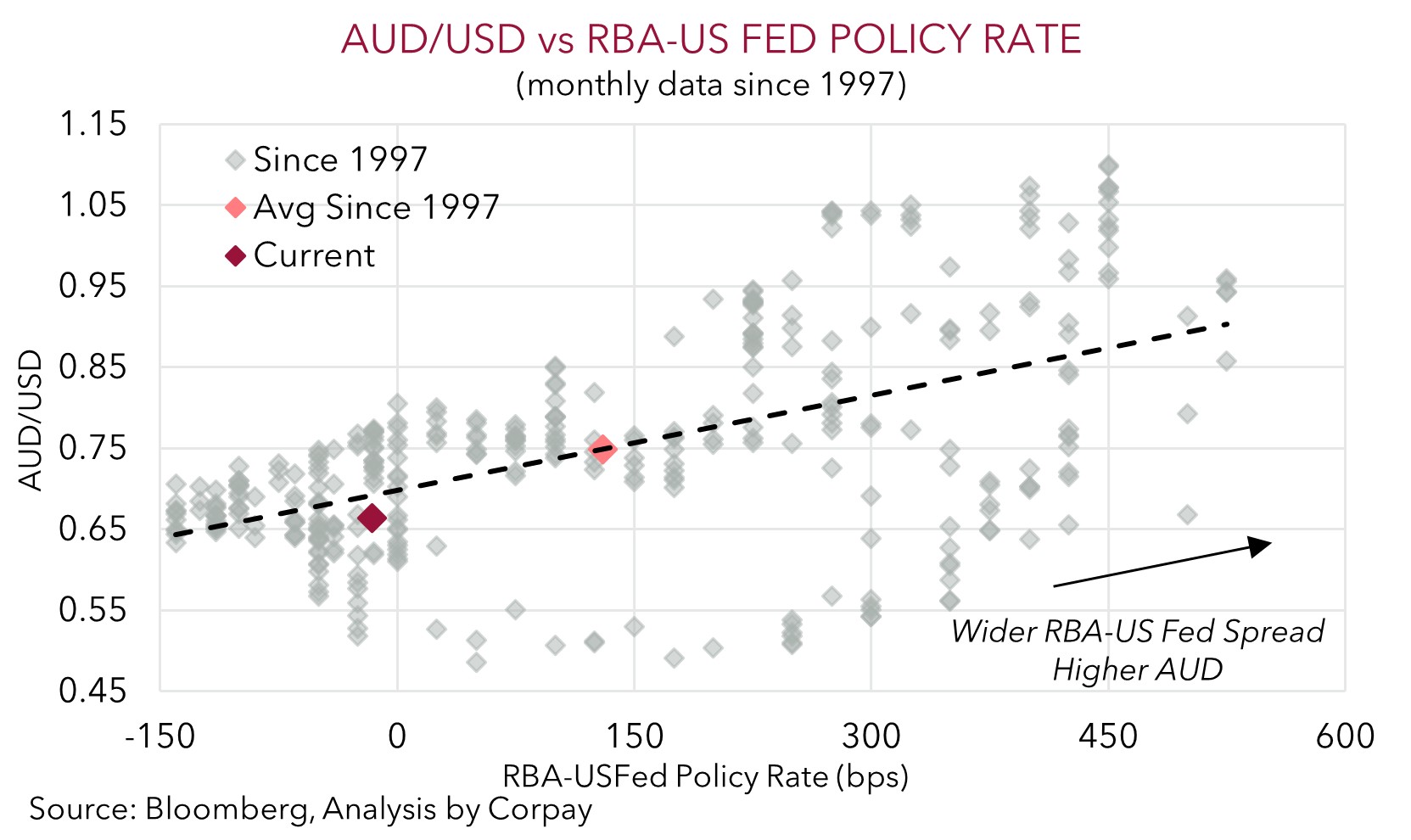

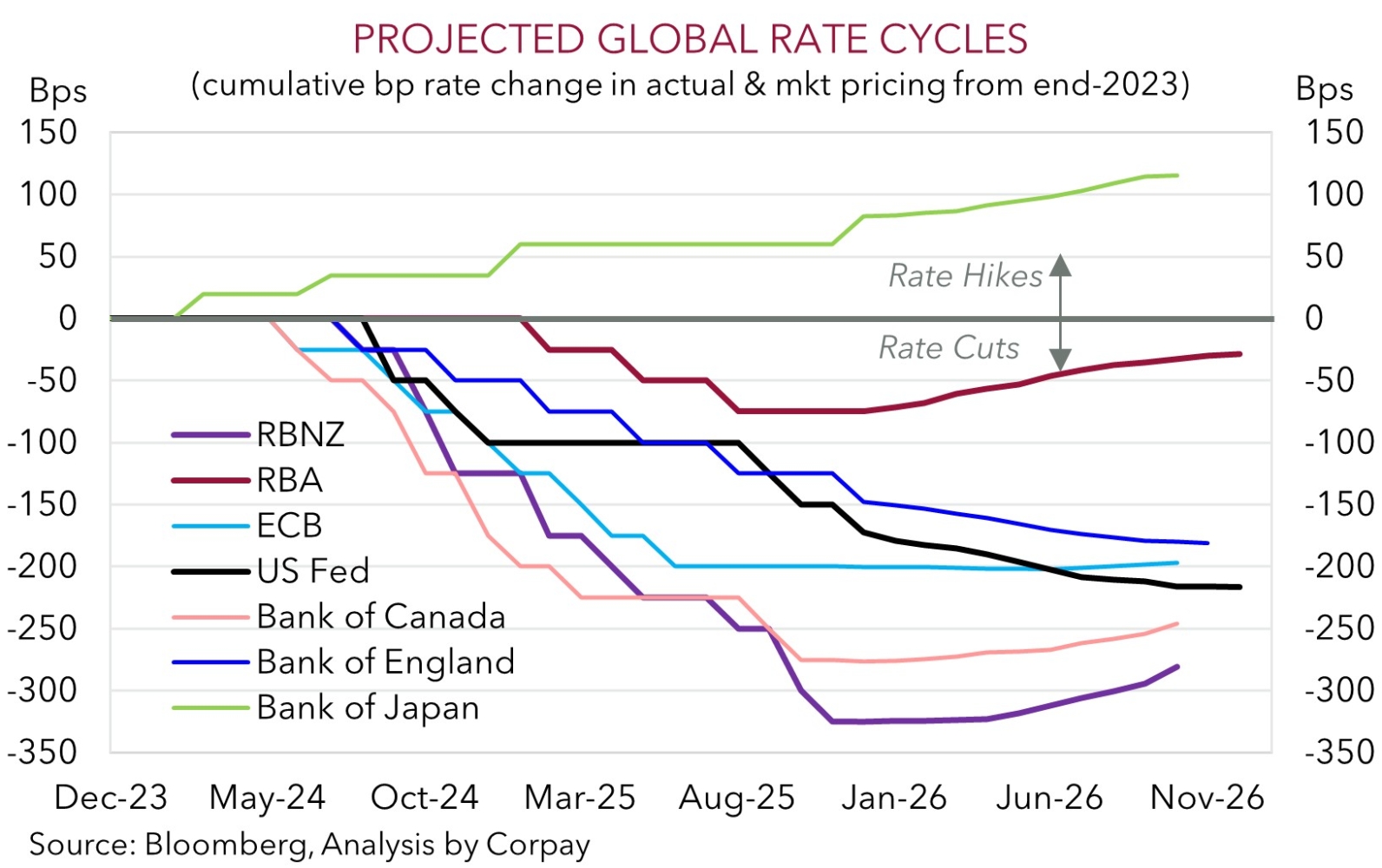

Event driven AUD volatility is possible the next few days with the US Fed (Thursday 6am AEDT) and Australian jobs data (Thursday AEDT) on the radar. As mentioned we think the USD could recover lost ground if the US Fed cuts rates but sounds ‘cautious’ about the need to deliver another reduction in early-2026. This may see a bit of heat come out of the AUD in the short-term. But we don’t see AUD pull-backs being too deep or lasting too long. Over the medium-term, we continue to see the AUD grinding up into the high-$0.60s with more favourable yield spreads between Australia and the US a factor. Based on current pricing the RBA-US Fed policy rate spread is projected to swing to ~75bps in the RBA’s favour by late 2026. The last few times this spread was in this region (Q1 2017 and Q4 2006) the AUD was hovering in the low $0.70s.