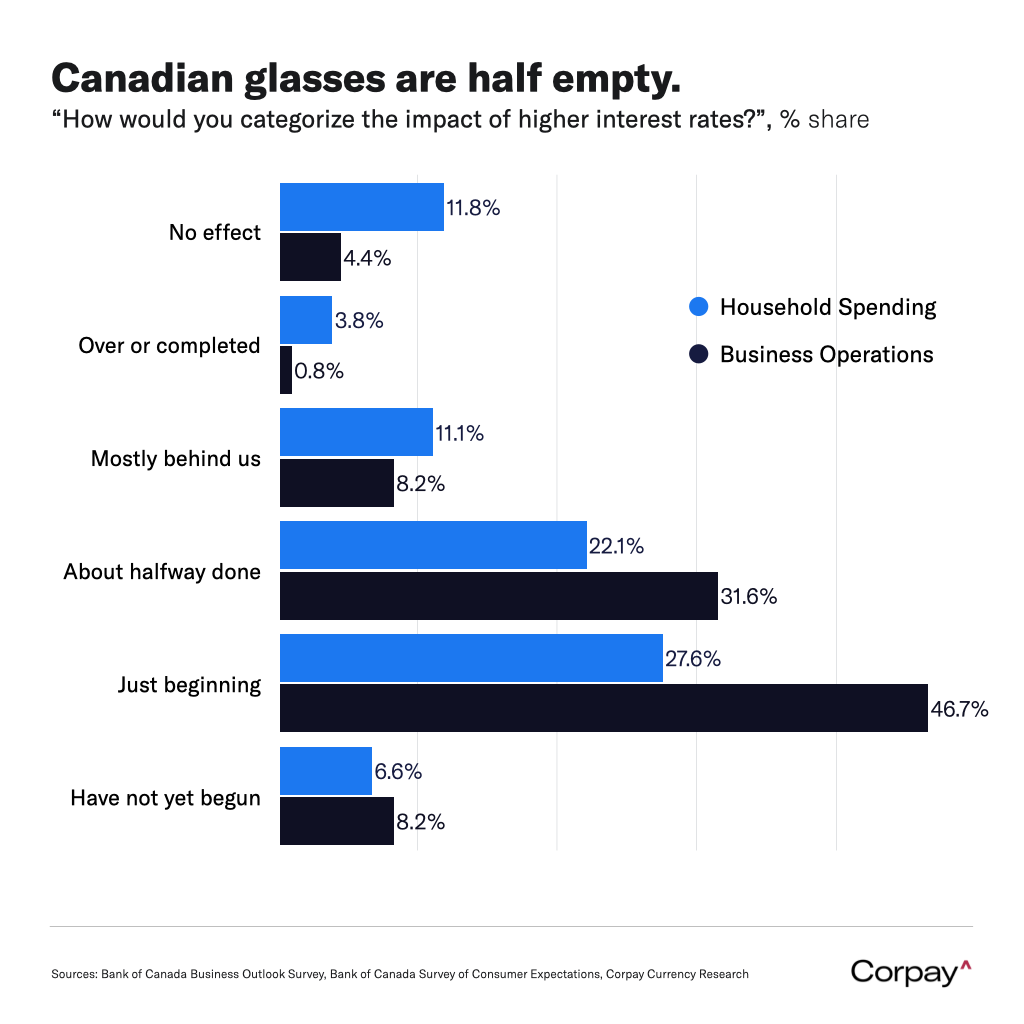

Mashing this morning’s Bank of Canada third-quarter Survey of Consumer Expectations and Business Outlook Survey together, it’s clear that businesses and households and businesses are aware – perhaps more than markets – of the lagged effects of monetary tightening.

Both consumers and businesses are relatively optimistic on employment conditions in the years ahead, but seem resigned to elevated levels of inflation, and most think the adverse impact of central bank monetary tightening has yet to hit the economy.

This runs contrary to consensus forecasts, which are – broadly speaking – set for a “soft landing”, but it wouldn’t be entirely surprising if the wisdom of the crowds proved more accurate. As George Orwell put it, “Some ideas are so stupid that only intellectuals believe them”.