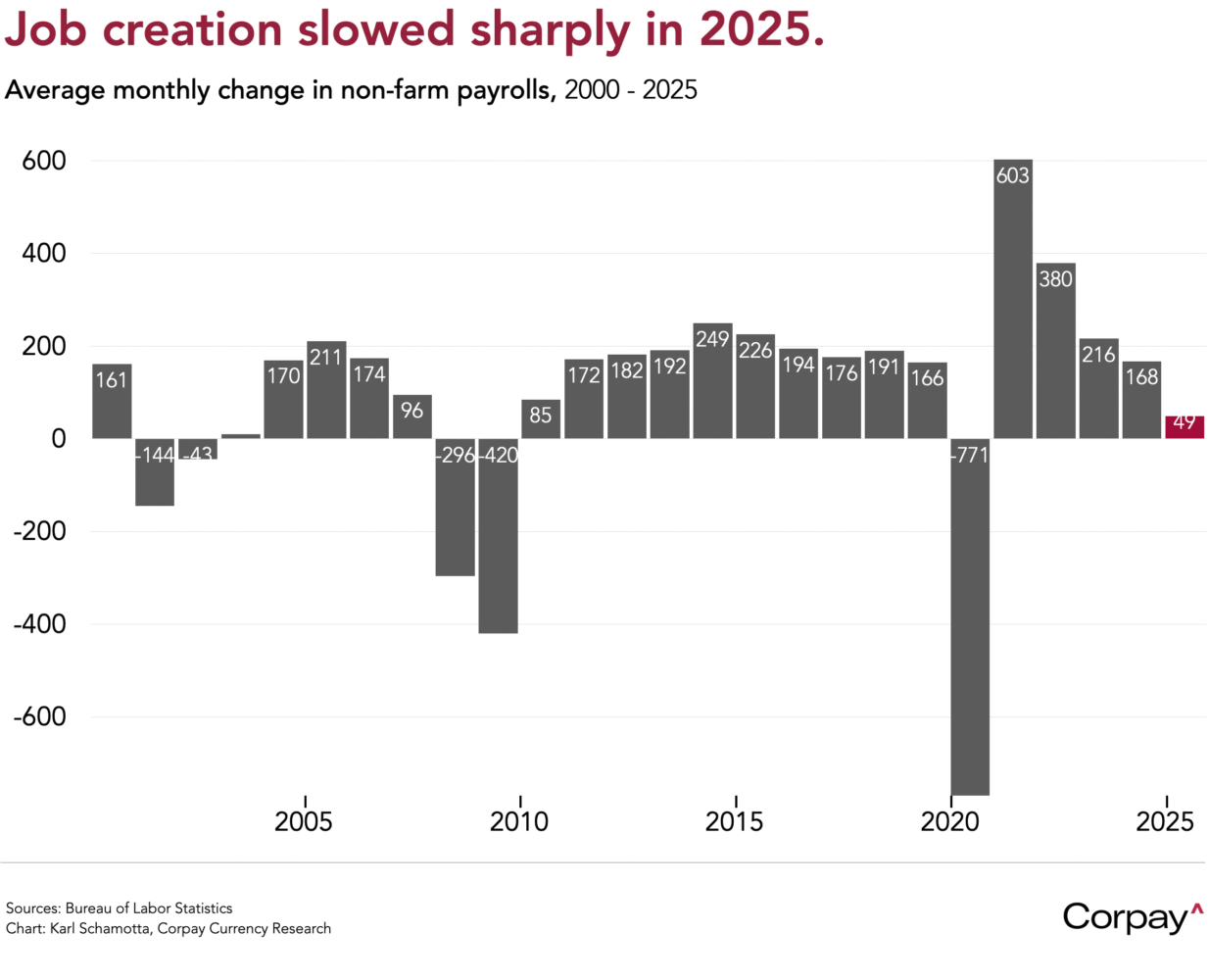

The US economy generated fewer jobs than anticipated, but the unemployment rate declined last month, giving the Federal Reserve room to slow the pace of monetary easing over the course of 2026. According to the Bureau of Labor Statistics, 50,000 jobs were added in December, undershooting a consensus forecast set around the 70,000 mark, and the previous two months were revised down by 76,000 positions. On a full-year basis, the economy added an average 48,600 jobs per month, marking the worst performance outside the early-aughts dot-com collapse or a recession in the last 25 years.

The unemployment rate—arguably the most important variable in determining the central bank’s policy trajectory—unexpectedly fell to 4.4 percent from 4.5 percent previously. Economists have ratcheted “breakeven” levels of job creation lower as structural shifts in the labour force tied to immigration and demographics weaken longstanding links between labour supply and demand, and many expect this divergence to persist over the coming years, reducing the need for blockbuster headline payrolls prints. Average hourly earnings climbed 0.3 percent month-over-month, accelerating from the 0.2-percent pace set in the prior month, and were up 3.8 percent year-over-year, pointing to continued strength in household consumption.

The dollar is ticking higher and Treasury yields are up slightly across the front end of the curve as investors price a slightly slower pace of easing from the Fed, and raise expectations for other economic data series in the coming months. Other major currencies—including the yen, euro, and British pound—are coming under selling pressure amid an ongoing reappraisal of global growth differentials.

Here in Canada, the economy again generated a positive number of jobs last month, continuing a four-month winning streak for a labour market that many—including myself—had discounted last year. According to an update just published by Statistics Canada, 8,200 new positions were added in December as 50,200 full-time roles were added and 42,000 part-time jobs were shed across a broad cross-section of industrial sectors. The unemployment rate jumped 0.3 points to 6.8 percent—topping the expected 6.7 percent—but the change was mostly driven by an 81,000-person expansion in the labour force, and was not mirrored in other measures of underlying demand like hourly earnings.

The Canadian dollar is trading on a slightly firmer basis, but gains look limited as markets fail to endorse the prospect of a rate hike from the Bank of Canada later this year. After a brief burst of (arguably) premature speculation last month, swap markets have moved back toward expecting a hike in 2027—not in October 2026—reducing the expected divergence between US and Canadian yield curves, and mitigating the loonie’s upward momentum.

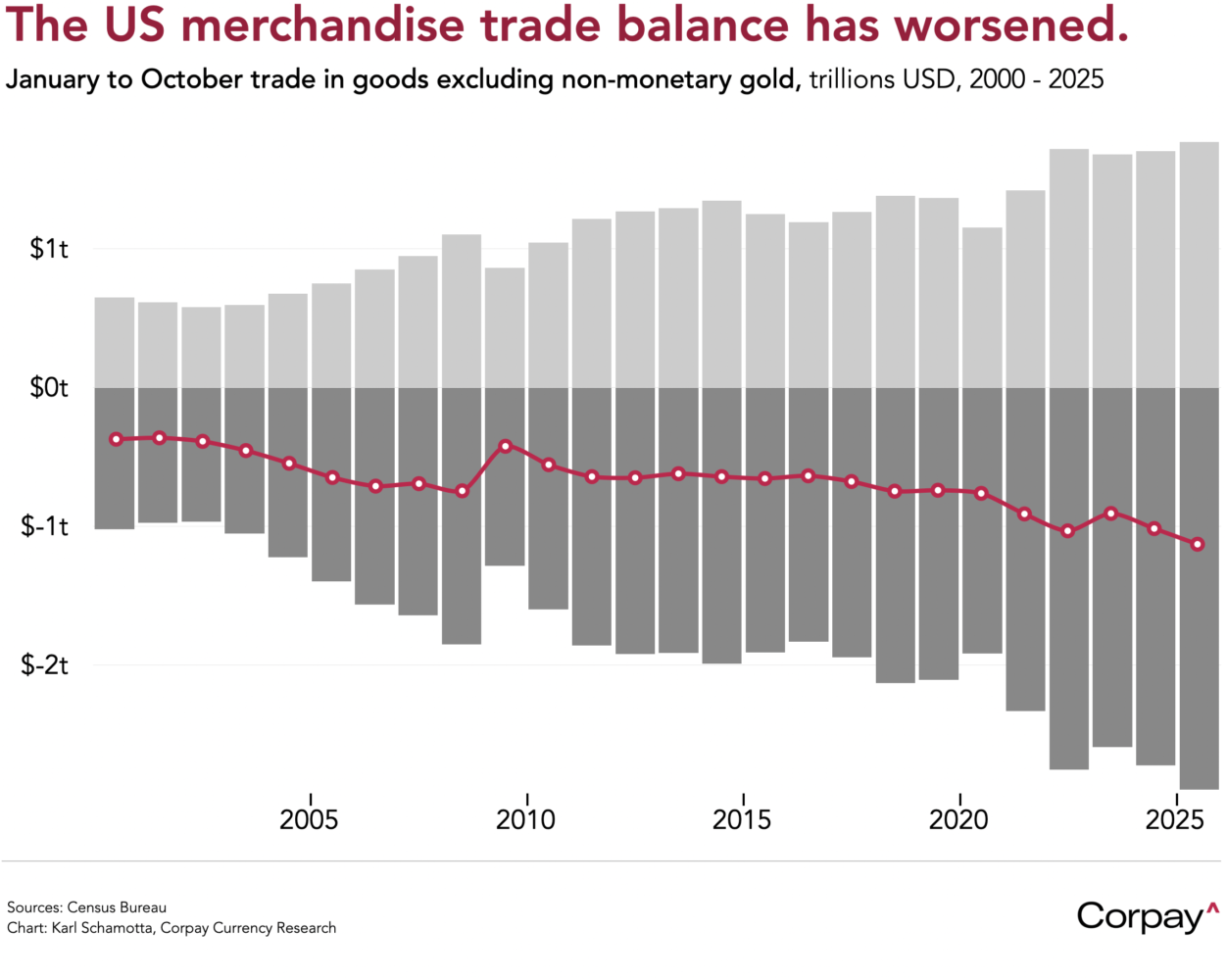

The US trade deficit shrank in October to its lowest level since 2009, seemingly suggesting that the Trump administration’s tariffs are driving a reduction in trade imbalances. Data published yesterday by the Census Bureau showed imports of goods and services falling to $331.4 billion in October, while exports climbed to $302 billion, driving a 40-percent drop in the imbalance from the prior month.

But ‘bullwhip’ effects played havoc with the numbers. With tens of thousands of businesses calibrating and re-calibrating order levels to optimise imports around tariff deadlines, the monthly data have seen a series of violent swings over the last year—moves that have been exacerbated by physical price arbitrage flows in bullion markets. When the first ten months of 2025 are compared with the same period in the prior year and non-monetary gold shipments are excluded, the US goods trade deficit climbed 11.1 percent, underlining continued strength in underlying demand, along with the age-old power of cross-border cost differentials.

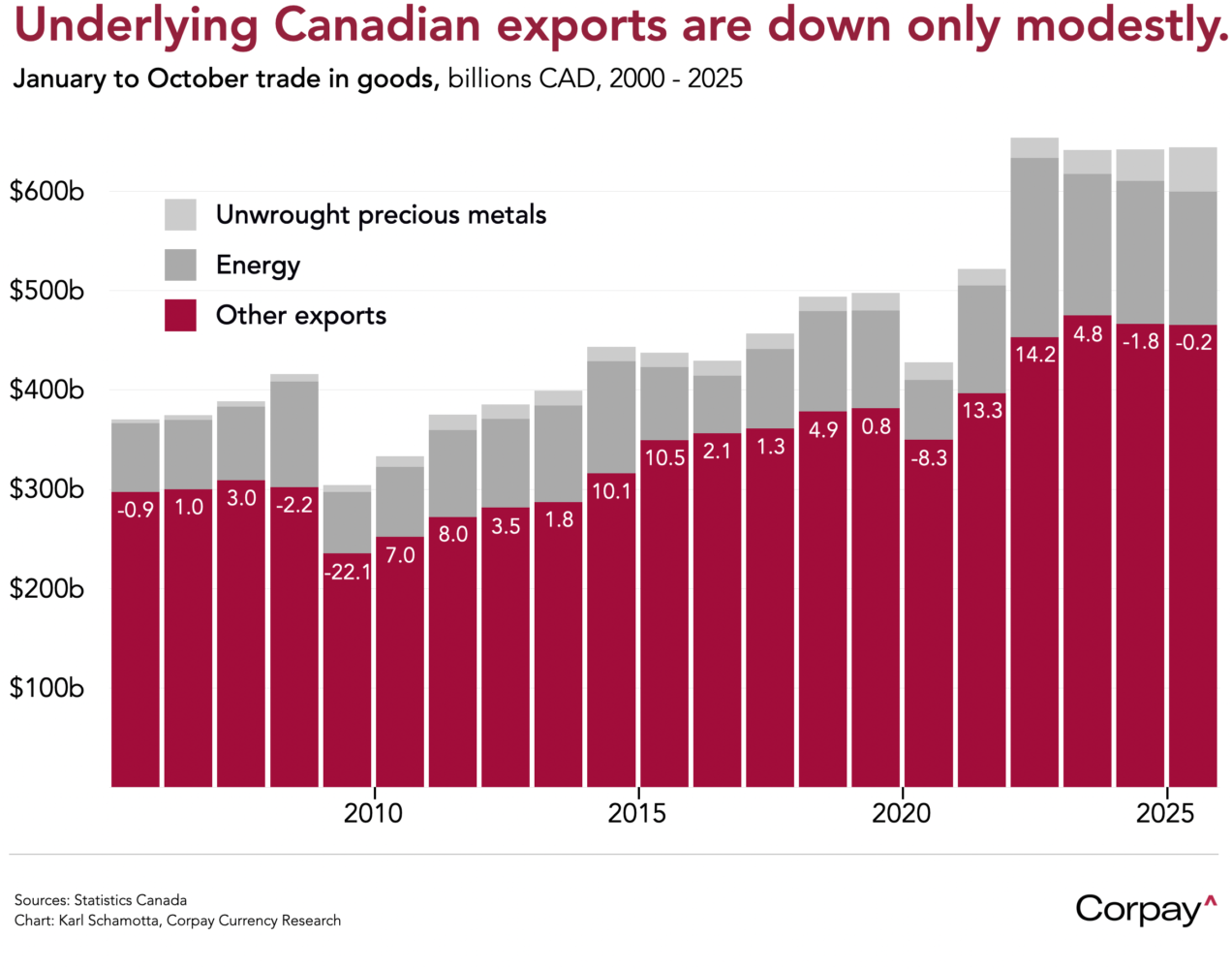

A similar pattern can be seen in Canada’s trade numbers. According to Statistics Canada, the country recorded a $583-million Canadian-dollar merchandise deficit in October, reversing the prior month’s surplus, but changes in gold and energy export volumes contributed heavily to the headline. If the January-to-October period is compared with the same period in 2024, non-energy, non-unwrought-gold exports were down an underwhelming -0.2 percent—hardly consistent with the sense of gloom that has settled on much of the economy.

The Supreme Court is expected to issue decisions in several pending cases this morning, raising the possibility that it could invalidate Donald Trump’s use of the International Emergency Economic Powers Act to impose many of last year’s tariff increases. The court does not reveal which cases it will rule on in advance, so a decision could still be weeks or months away, and the administration has already said it would pursue alternative legal routes to reimpose many levies*. Even so, investors will be watching closely, as businesses could be entitled to billions in refunds and future tariffs may face tighter congressional oversight.