Good morning. Foreign exchange markets are again facing treacherous conditions as a blizzard of macroeconomic and geopolitical risks hits the headlines. After a weekend filled with shocks—including an actual snowstorm—the dollar is succumbing to broad-based selling pressure as policy uncertainty spikes, equity futures are pointing to renewed losses at the open, and precious metals are going parabolic as investors pile into alternative currencies and asset classes.

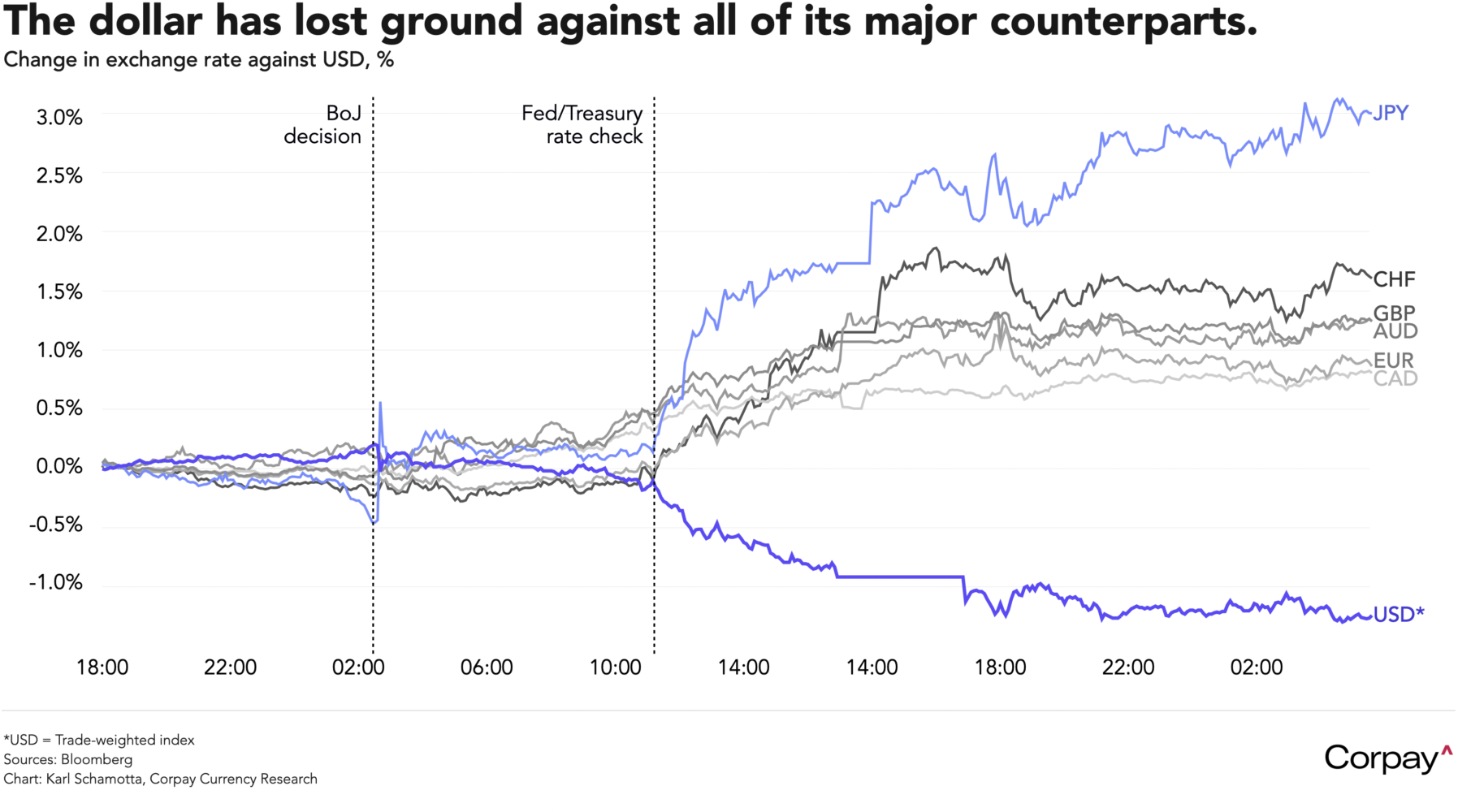

Trading desks are on intervention watch after the New York Federal Reserve reportedly conducted “rate checks” for the Treasury on Friday, fuelling speculation of coordinated action between Tokyo and Washington. We’re seeing no evidence of official foreign exchange purchases having taken place, but the news triggered a sharp, roughly 3 percent jump in the yen as traders covered short positions and braced for further volatility.

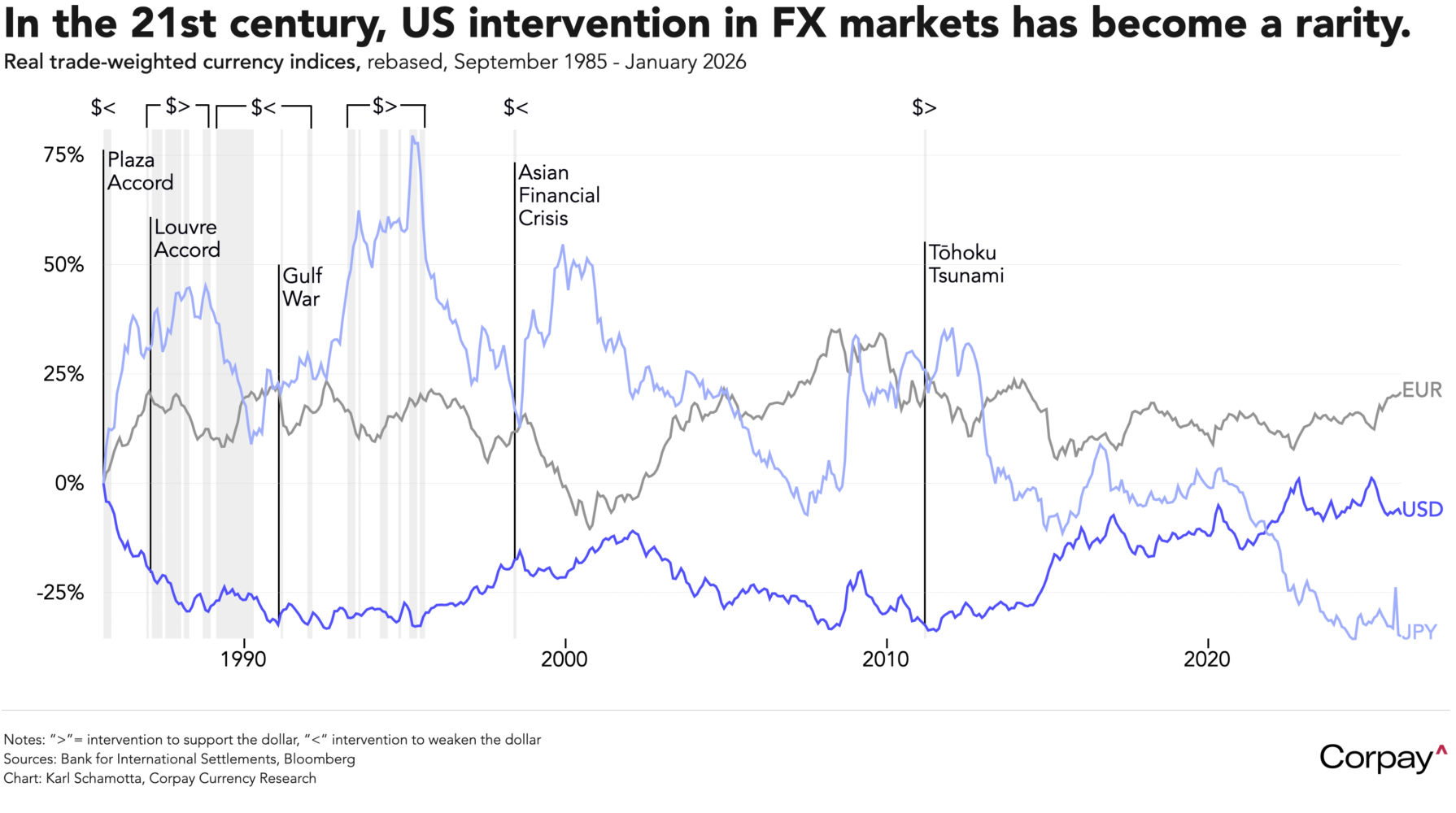

For currency market veterans, the reported involvement of the US Treasury is the more intriguing element. While coordinated action has occurred in recent decades—most notably after the 2011 Tōhoku tsunami and Fukushima disaster—it has typically come at Japan’s request and after a period of sharp currency moves. Although Japan’s finance minister, Satsuki Katayama, said weeks ago that she and US Treasury secretary Scott Bessent were uneasy about the yen’s “one-sided depreciation”, realised volatility remains subdued and exchange rates have not shown the kind of disorderly behaviour that usually prompts intervention.

We see two possible explanations. The more likely is that Bessent believes yen weakness amplified last week’s sell-off in Japanese government bonds, indirectly lifting US borrowing costs and warranting a response. A less likely, but more consequential, possibility is a Plaza Accord-style agreement to push the yen higher in a sustained way, aimed at curbing inflation in Japan and narrowing cross-Pacific trade imbalances. The former would point to modest adjustments to stabilise bond markets. The latter would mark a profound shift in how advanced economies manage exchange rates, and could usher in a period of extreme volatility as intervention joins tariffs as a routine policy tool.

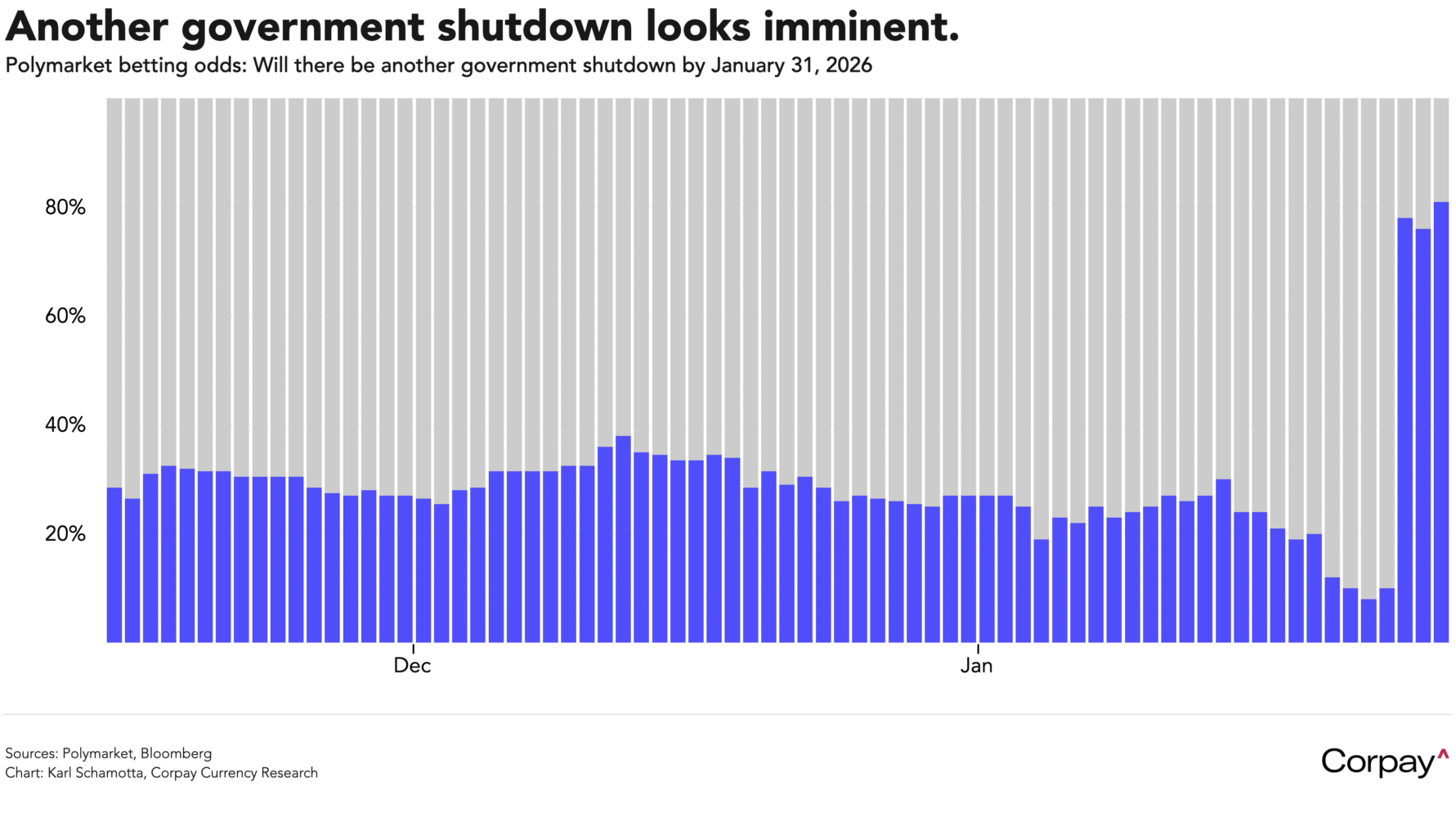

Odds on another government shutdown soared over the weekend when Department of Homeland Security agents shot and killed a US citizen in Minneapolis, prompting Senate Democrats to say they would block this week’s spending package. Senate minority leader Chuck Schumer said on Saturday night his party would vote against legislation that includes money for the Department of Homeland Security, implying that Congress will miss an end-of-the-week deadline to fund the government, potentially leading to another disruption in government payrolls, economic data, and markets.

Beyond a fairly-typical economic data calendar, the week ahead is full of central bank meetings.

The Federal Reserve is expected to leave its policy settings unchanged at Wednesday’s meeting—and for good reason. Growth indicators remain robust, financial conditions are exceptionally loose, labour markets are showing no sign of a long-feared non-linear slowdown, and core inflation is still near the upper end of the target range.

Politics may nonetheless overshadow any fundamental signals. Chair Powell is likely to face questions about threats to the Fed’s independence following the administration’s criminal investigation into him and its attempt to dismiss Governor Lisa Cook. The White House could announce a successor nomination at any moment, with betting markets now favouring BlackRock chief investment officer Rick Rieder, someone who is well-regarded by investors but who remains an unknown quantity in a policy sense. Markets are pricing the next rate cut for July—one month later than in late December—with 47 basis points of easing expected by year end, down from 58, and we see little reason for that to shift materially if Rieder wins this season of ‘The Apprentice’.

The European Central Bank, Bank of England, and Bank of Canada will almost certainly stay sidelined, leaving rates untouched as they await more clarity on economic conditions before making further adjustments. Underlying core inflation pressures are softening in all three regions, and growth headwinds are coming largely from structural shifts in the global economy that monetary policy is ill-suited to address. Investors will, nonetheless, parse updated forecasts and forward guidance language carefully for hints of a positive shift in expectations for the future.

Taken in sum, an extraordinarily dangerous—but also opportunity-laden—week beckons. Trading ranges in currency markets are beginning to break, generating new risks for organisations carrying unhedged exposures, while also presenting entry points for those seeking to place new positions. Talk to your trading teams—or reach out directly—if you would like to discuss strategy.