The dollar is weakening and yields are nudging lower after US consumer spending surprisingly flatlined in December, underpinning expectations for more monetary easing in the months ahead. According to figures published by the Census Bureau this morning, total receipts at retail stores, online sellers and restaurants were little changed over the holidays after a 0.6 percent gain in November, and so-called “control group” retail sales—with gasoline, cars, food services, and building materials excluded—fell -0.1 percent, missing forecasts set at 0.4 percent.

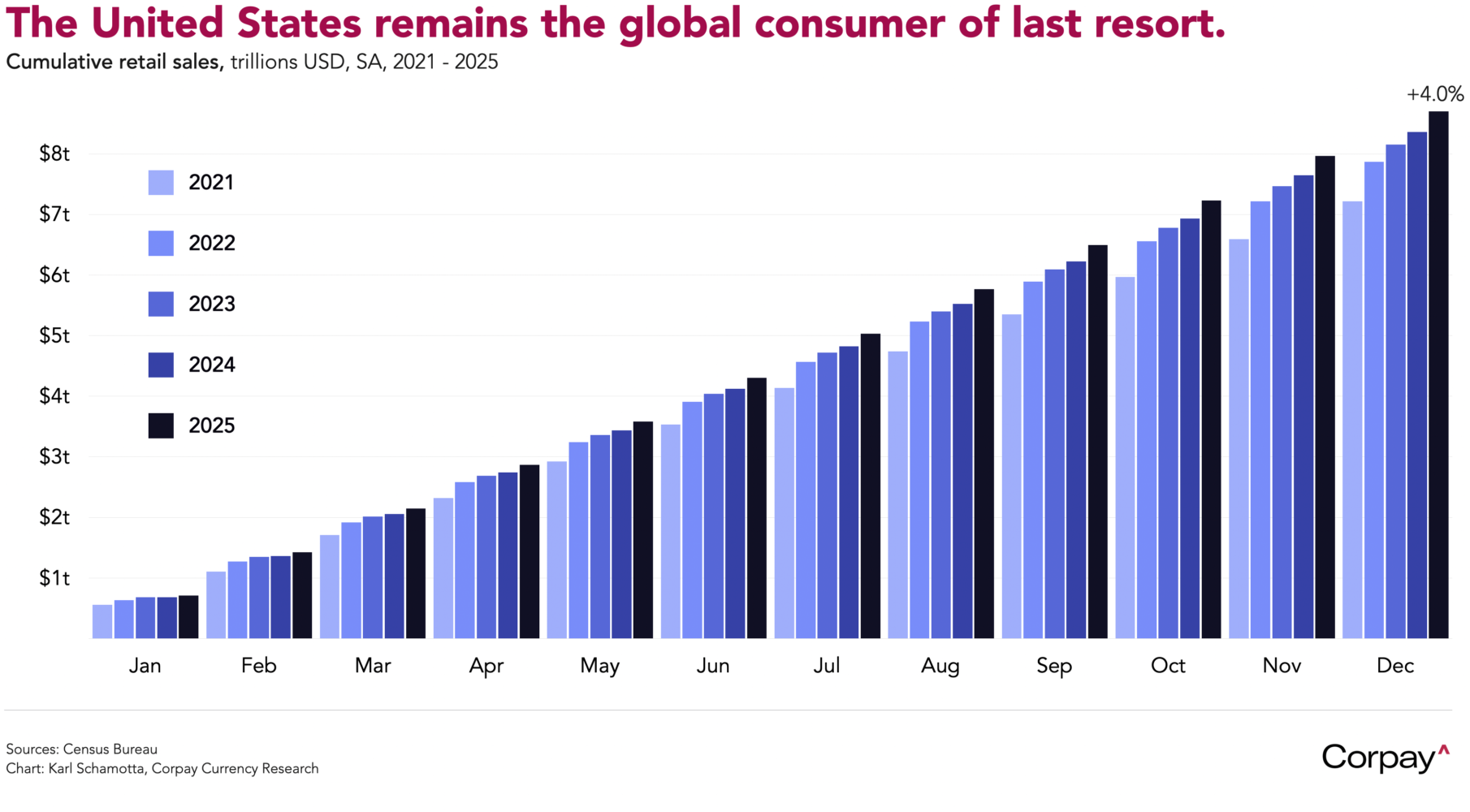

The US remains the global consumer of last resort—overall retail sales were still up 4 percent year-over-year in 2025, and import volumes have gone from strength to strength despite the ongoing noise from the White House—but it is clear that marginal spending growth is increasingly coming out of household savings, suggesting that momentum could slow further after tax refunds are paid out in the coming months.

The dollar came under renewed selling pressure yesterday when Kevin Hassett, chair of the National Economic Council, said investors should “not panic” over lower employment numbers, suggesting that accelerating productivity gains and slower labour force growth could lead to weaker absolute job creation in the months ahead. Consensus forecasts collected by the major data providers are still pointing to a circa-65,000 increase in tomorrow’s non-farm payrolls report, with the unemployment rate unchanged. But concerns over the White House’s early access to data have pushed the Wall Street “whisper number” lower, and investors are betting on a more decisive Federal Reserve easing cycle beyond the April meeting.

President Trump’s social media account returned to form last night, issuing threats against Canada over the construction of a bridge between Ontario and Michigan. In a discursive post on Truth Social, the president said he would not allow the Gordie Howe International Bridge to open “until the United States is fully compensated for everything we have given them, and also, importantly, Canada treats the United States with the Fairness and Respect that we deserve,” saying the US should get “at least one half” of the $6.4 billion Canadian-funded infrastructure project*.

Markets are ignoring this. Other recent provocations—including 100-percent tariffs on Canadian goods, and 50-percent levies on Canadian aircraft—have come to naught, and investors assume someone in the administration will eventually realise that the bridge is already partly owned by the state of Michigan. The Canadian dollar is trading steady after a brief downward blip.

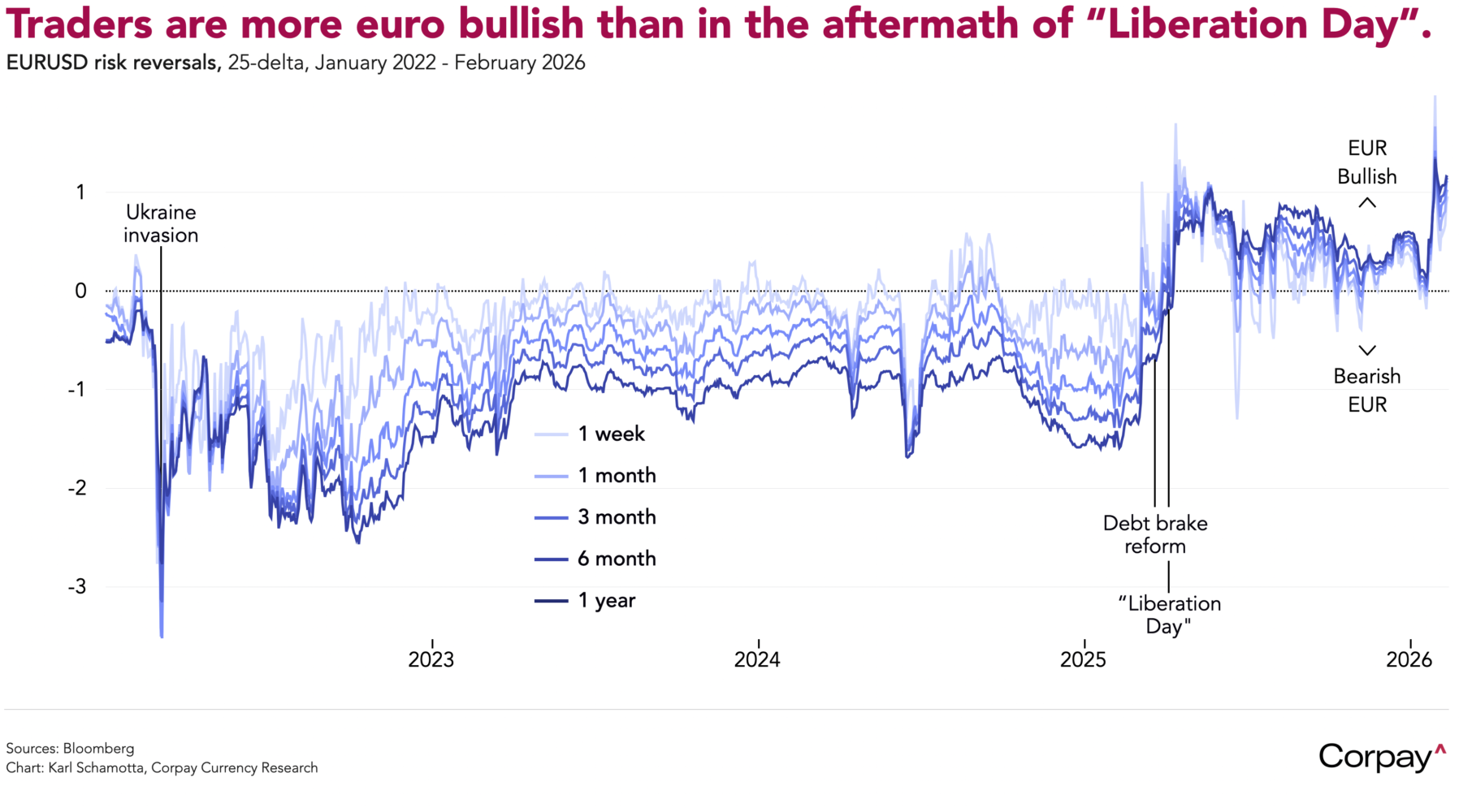

Although the euro is edging higher, it is still lacking the momentum for a sustained break above the psychologically-important 1.20 level. Stronger European fundamentals—more fiscal spending, firmer German industrial data and improved sentiment—have shifted relative growth expectations in the common currency’s favour, while US policy uncertainty and the gradual unwind of long-dollar positions built during years of exceptionalism have weighed on the greenback. Options traders are paying more for euro upside protection than at almost any point in the currency’s history, aside from a brief pandemic spike. But the euro’s role as the market’s “anti-dollar” means the next catalyst is likely to come from Washington rather than Europe. For hedgers, that puts tomorrow’s payrolls report—and President Trump’s social media feed—at the centre of the near-term outlook.

*In what is, undoubtedly, a coincidence, Detroit’s billionaire Maroun family owns a nearby bridge that is expected to lose traffic once the Gordie Howe crossing opens.