Good morning. Risk-sensitive currencies are advancing as shutdown fears recede and investors resume betting on a weaker dollar. According to the New York Times, US president Donald Trump and Senate minority leader Chuck Schumer are nearing a deal that would tighten limits on federal immigration agents and strip funding from the Department of Homeland Security, potentially clearing spending bills before Friday’s midnight deadline and averting another shutdown. The greenback is giving back some of yesterday’s gains, which followed Treasury secretary Scott Bessent’s insistence that a “strong dollar” policy remains in place and that the US was “absolutely not” intervening to support the yen, and investors are rotating into currencies tied to a firmer commodity cycle, including the Canadian and Australian dollars, while trimming exposure to traditional havens such as the Swiss franc, Japanese yen and euro.

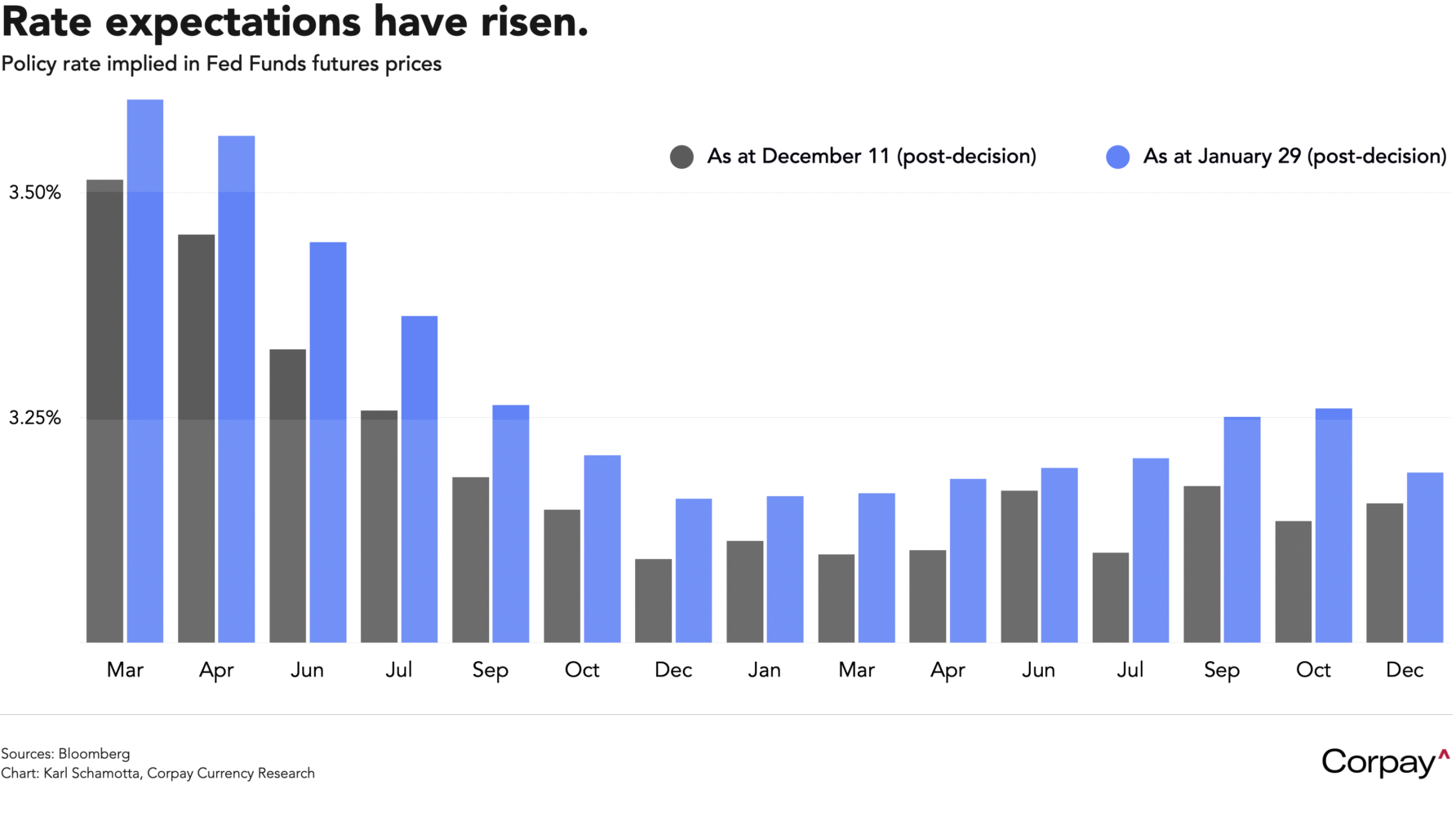

Policymakers at the Federal Reserve paused their easing cycle and indicated they see no pressing reason to move again in the near term, setting the stage for a prolonged pause. In yesterday’s widely-anticipated decision, officials voted by an overwhelming margin to leave rates unchanged, and made a number of adjustments to the statement language to reflect an improving growth backdrop and diminishing downside risks in labour markets. Chair Powell outlined what he called a “clear improvement” in the outlook, noted job markets were delivering “evidence of stabilisation,” and said rates do not appear to be in “significantly restrictive” territory. Market-implied policy expectations moved very little during the decision itself, but remain higher than in December, reflecting a brightening in views on the American economy’s underpinnings and confidence that the Trump administration will ultimately back off in its assault on the Fed’s independence.

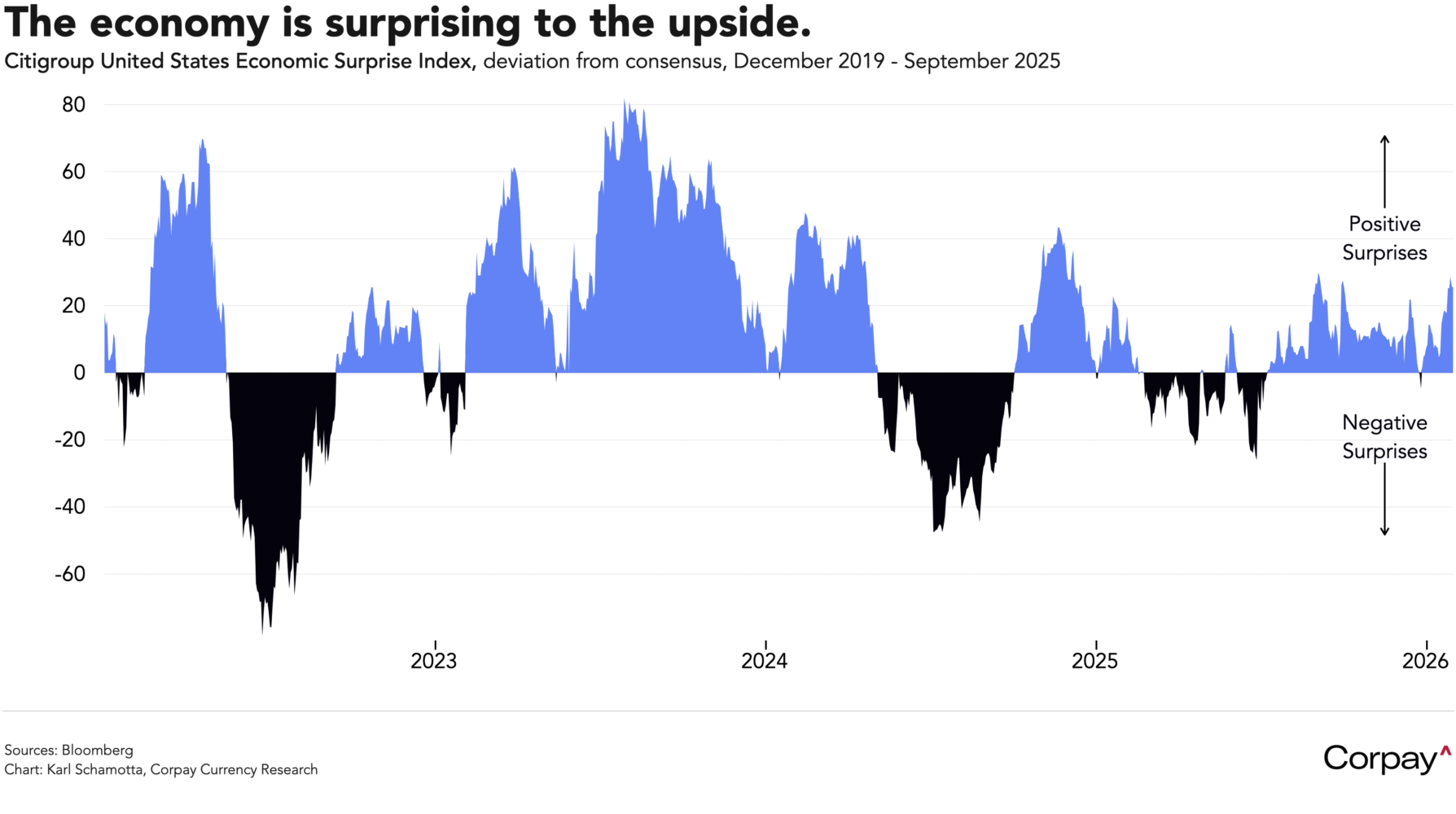

The fundamental backdrop has strengthened by more than economists anticipated. There’s little sign of a slowdown in household spending, business investment, or government spending, and the US economic surprise index, which measures the gap between forecasts and realised data, has climbed sharply over the last month as “hard” measures of activity have outperformed their “soft”, survey-driven peers.

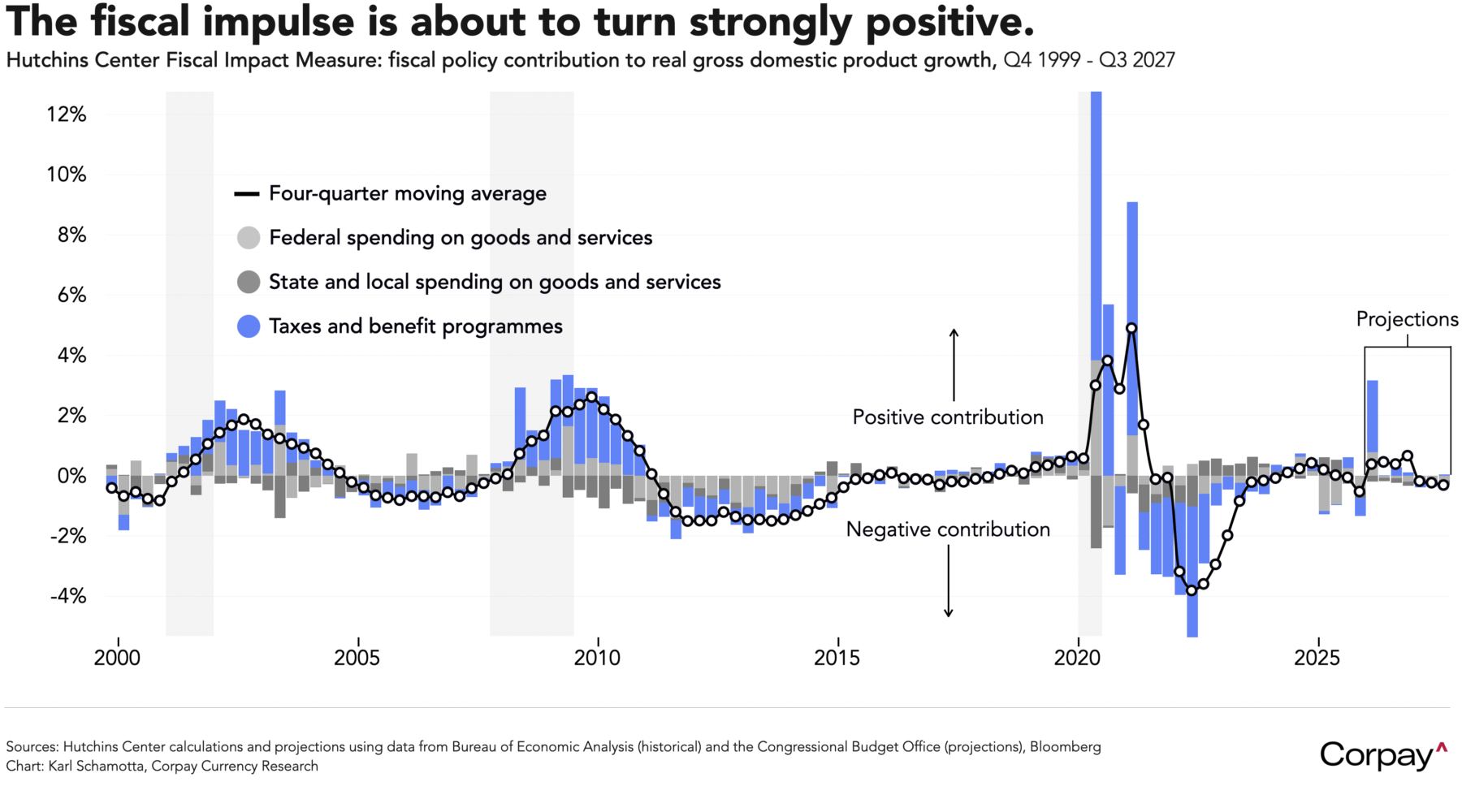

Further gains could be in the offing as a mechanical rebound from the last shutdown plays out and tax refunds resulting from the One Big Beautiful Bill Act are deposited in the coming months. The Hutchins Center Fiscal Impact Measure, which attempts to quantify how government tax and spending policies will affect the economy, is pointing to a growth boost equivalent to 3 percentage points of gross domestic product in the first quarter as spending delays are resolved and tax cuts boost spending among households and businesses. This is on par with the stimulus efforts previously launched during recessions or military conflicts, and comes against a full-employment backdrop, implying—to us, at least—that the risk of an overheat in the US economy is quite real.

The impact on the dollar is difficult to foresee. Under the dynamics that have shaped currency markets since the late 1990s, upward revisions to US growth and policy expectations should favour the dollar. However, with other countries lifting defence spending and sharpening their focus on competitiveness, it is unclear that growth differentials will swing decisively in America’s favour. Global investors have also grown more cautious on US assets, and passive reallocation may cap gains—to wit, much of the dollar’s weakness over the past year was driven by policy uncertainty rather than any change in underlying fundamentals.

But we do think the risk of a topside move in the dollar is now underappreciated, and would urge market participants to be wary of stretched technical positioning in many currencies, including the euro, pound, Canadian dollar, and Mexican peso. Market punditry has also turned overwhelmingly dollar-bearish—something that often serves as a good contrarian signal*. A reversal, if one comes, could be swift and forceful.

*Especially if reinforced by a request from Giselle Bundchen for payment in other currencies or a cover on the Economist magazine.