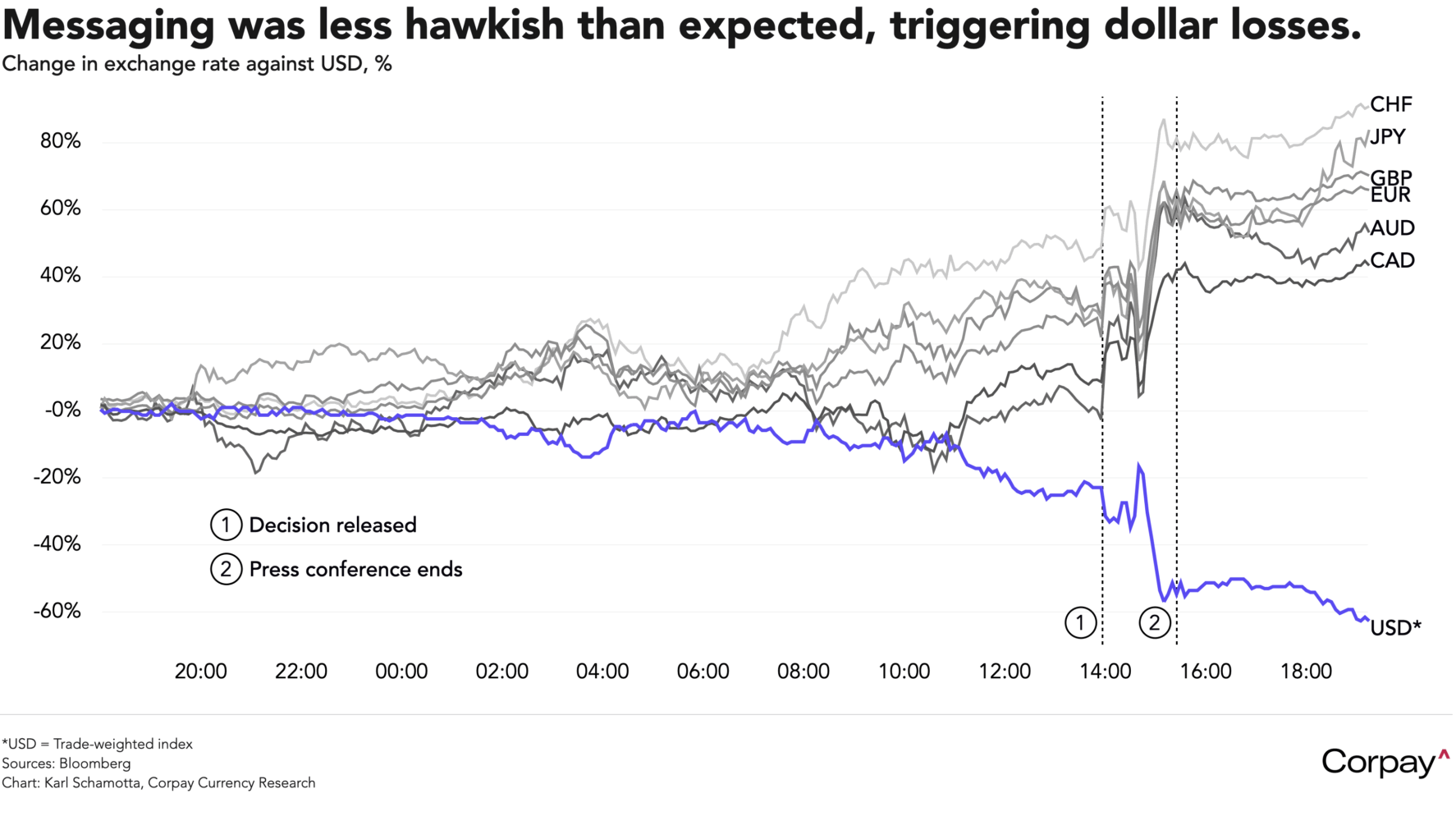

The dollar is back on the defensive this morning as markets absorb yesterday’s unexpectedly-neutral Federal Reserve rate cut as well as a stumble in the overheated US tech complex ahead of next week’s cluster of event risks. Treasury yields are slightly lower across the curve, and traders are assigning a marginally higher probability to additional easing in 2026 after yesterday’s decision landed with a less hawkish tone than many had anticipated. Equity futures are pointing to early losses after Oracle delivered underwhelming cloud-computing results even as it pledged to ramp up capital spending—reinforcing investor concerns about the durability of the artificial-intelligence investment cycle.

The world’s most powerful central bank delivered a third consecutive cut, and avoided delivering the sort of hawkish messaging that might have justified market positioning going in. The statement acknowledged a continued softening in labour-market conditions and a gradual cooling in non-tariff price pressures, and was amended to say that policymakers would assess the incoming economic data, evolving outlook and the balance of risks “in considering the extent and timing of additional adjustments”—language designed to keep the door open to further cuts if needed. Only three dissents were recorded, with two officials favouring a hold, and one lobbying for a bigger cut. This was somewhat more dovish than markets had anticipated and saw the dollar sell off relative to its rivals.

There was very little consensus on the year ahead. Although the updated “dot plot” Summary of Economic Projections featured a sharp upward revision to growth forecasts for next year, a steady rise in unemployment, and a slightly softer inflation profile, with the median dot implying one additional cut—the same as in September—it was clear that committee members hold very different views on how the central bank should respond. Seven of nineteen policymakers expect to leave rates changed in 2026, eight favour two cuts, and one—presumably Stephen Miran—sees another four moves.

Jerome Powell surprised markets by delivering a relatively-dovish performance in the post-decision press conference. The chair said the policy rate is “now within a broad range of estimates of neutral, and we are well positioned to wait to see how the economy evolves”—seemingly setting the stage for a prolonged pause—but then spent a considerable amount of time emphasizing weakness in the labour market, even suggesting that job creation may have been negative this year. “Why do we move today?,” he asked, “Unemployment is now up three-tenths from June through September, with payroll jobs averaging 40,000 per month since April. We think there’s an overstatement in these numbers by about 60,000, so that would be negative 20,000 per month. And also, just to point at one other thing, surveys of households and businesses both show declining supply and demand for workers”.

Earlier in the day, the Bank of Canada left its policy settings unchanged—as had been universally expected—and reiterated that rates are at “about the right level” to support growth and keep price pressures contained. Governor Macklem downplayed recent surprises in growth and job data, indicating that the Bank’s outlook for 2026 hadn’t changed materially in recent months, and that extensive slack in the economy would keep inflation rates near target for now—a combination that suggested policymakers remain reluctant to ratify market expectations for at least one rate hike next year. The Canadian dollar moved down incrementally during the announcement and press conference (see animated chart here), but rallied back later as the Fed’s dovish messaging lifted all boats against the greenback, and further added to its gains when Statistics Canada said the country recorded a trade surplus in September, providing more evidence of resilience in overall exports.

Next week’s data calendar looks extraordinarily perilous, and could see market positioning pivot once again. The October and November non-farm payrolls updates, followed by the November consumer price index release will attract significant investor interest, looming over Canada’s inflation and jobs reports in driving action in the dollar-Canada pair. Central banks will be extremely active, with the European Central Bank’s forecast updates potentially adding momentum to a recent upgrade in rate expectations, and a closely-fought Bank of England decision seeing the pound move dramatically on revised projections for 2026. The Bank of Japan is expected to deliver a long-awaited rate hike, putting pressure on global carry trades, and the Banco de México could shift onto a more hawkish footing even as it lowers rates, responding to recent strength in inflation by pulling back on easing hints in its forward guidance.

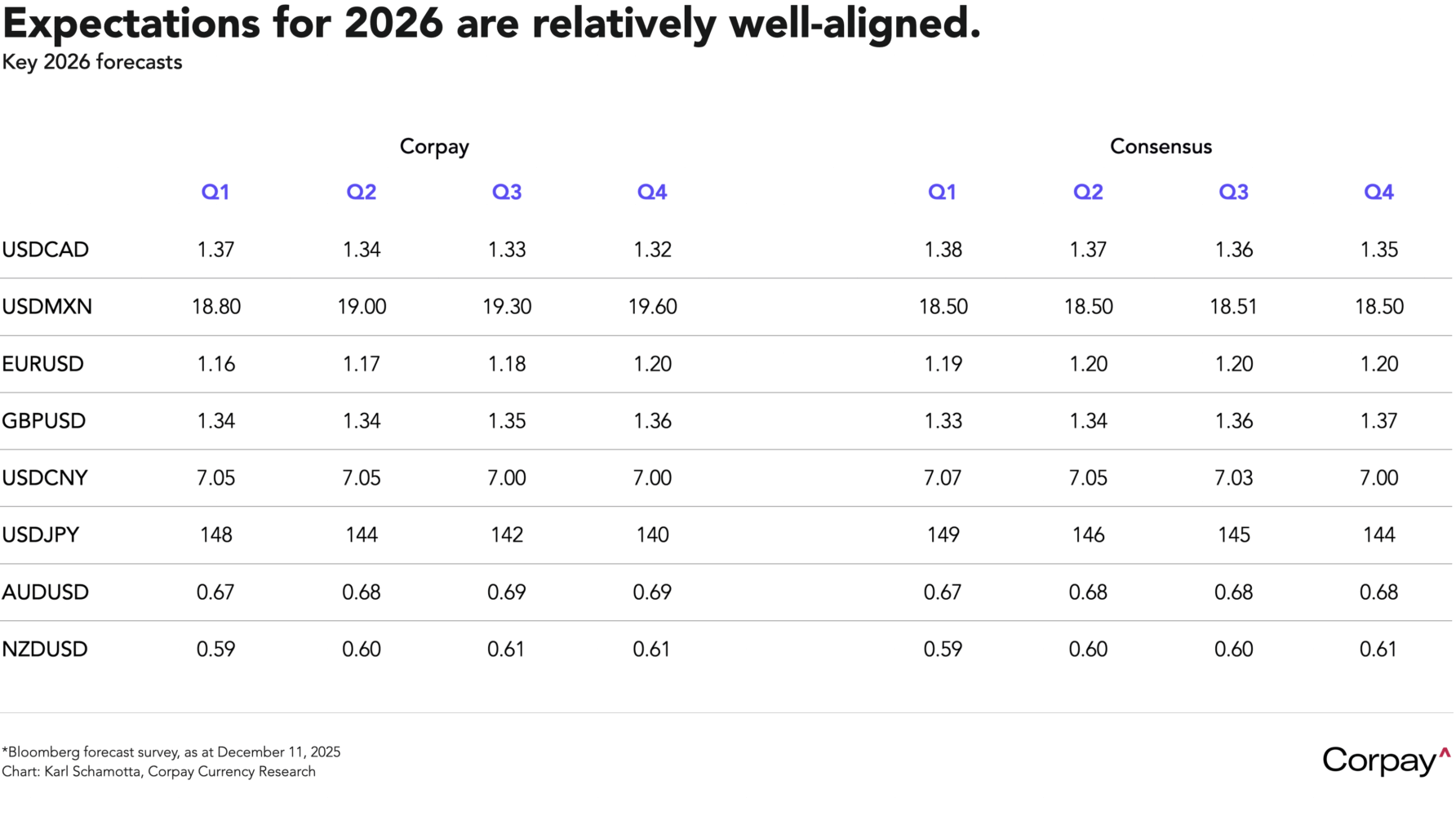

However, with the month’s principal event risk now behind us, we have updated our forecasts to reflect a hawkish recalibration in US growth expectations during the first quarter of 2026, followed by a measured cooling over the balance of the year. With tariff uncertainty receding, tax cuts lifting household incomes, and AI-related spillovers bolstering growth across the economy, we see consensus forecasts for a more-or-less continuous decline in the greenback getting wrong-footed initially, but are aligned with the majority of forecasters in seeing a gradual decline by next December as the drag from this year’s policy changes grows more burdensome. Germany, long mired in stagnation, is forecast to gain momentum from meaningful fiscal stimulus after hitting an initial “trough of disappointment”, helping the euro area expand at a modest pace and allowing the European Central Bank to hold policy steady while the Fed eases—conditions that should support the single currency. China is seen extending its gradual structural slowdown as authorities adhere to their supply-side policy framework. And emerging markets, buoyed by subdued volatility and a favourable global liquidity environment, are expected to remain broadly resilient. The Canadian dollar should grind higher against a more placid backdrop, even as it experiences sharp reversals whenever trade-related headlines hit.

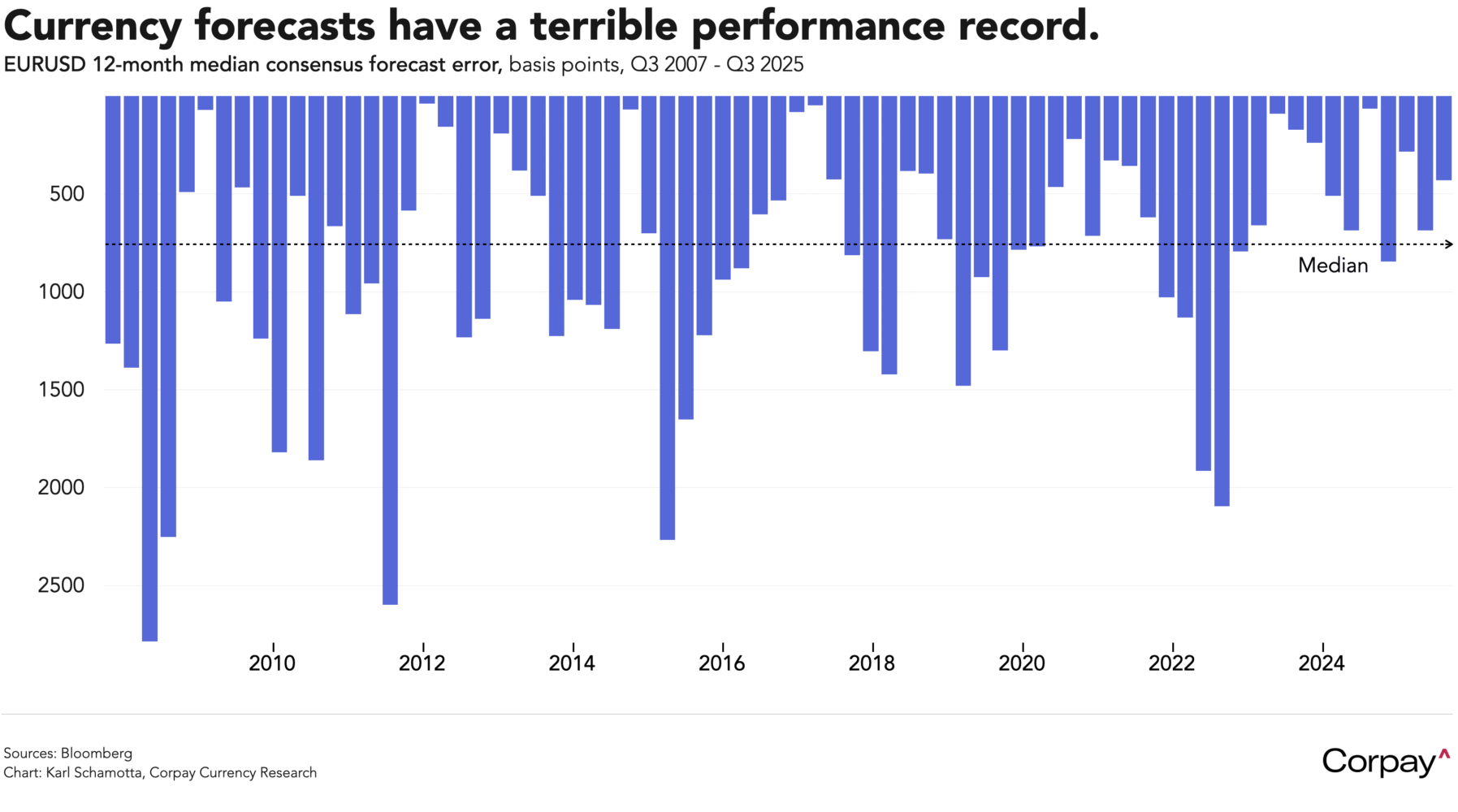

But, as we often observe, God invented economists to make weather forecasters look good, and then invented currency strategists to make the economists look good. As the chart below illustrates, long-run foreign exchange forecasts are rarely accurate, with the absolute error in 12-month euro-US projections averaging seven and a half cents since the global financial crisis, while also being directionally wrong more than half of the time. A troop of dart-throwing monkeys could likely outperform a team of the world’s best currency strategists by avoiding the group-think that prevails across financial markets. For hedgers, this means that a strategy in which positions are placed on a rolling, layered basis will tend to outperform a forecast-driven approach over the long run.