Good morning. The dollar is edging lower even after yesterday’s stronger-than-expected jobs data drove a hawkish repricing in US growth and monetary policy expectations. Treasury yields are holding steady, North American equity indices are setting up for a mixed open, and most major currency pairs—including the Australian and Canadian dollars, the British pound, and the euro—are trading within tightly-defined ranges.

January’s headline payrolls figure came in nearly double consensus forecasts and unemployment fell unexpectedly, reducing market-implied odds of an early rate cut, lifting 10-year yields and triggering a sharp dollar rally. The surface details looked positive: 130,000 new jobs against a 65,000 consensus, unemployment down to 4.3 percent from 4.4 percent, and wage growth accelerating to 0.4 percent.

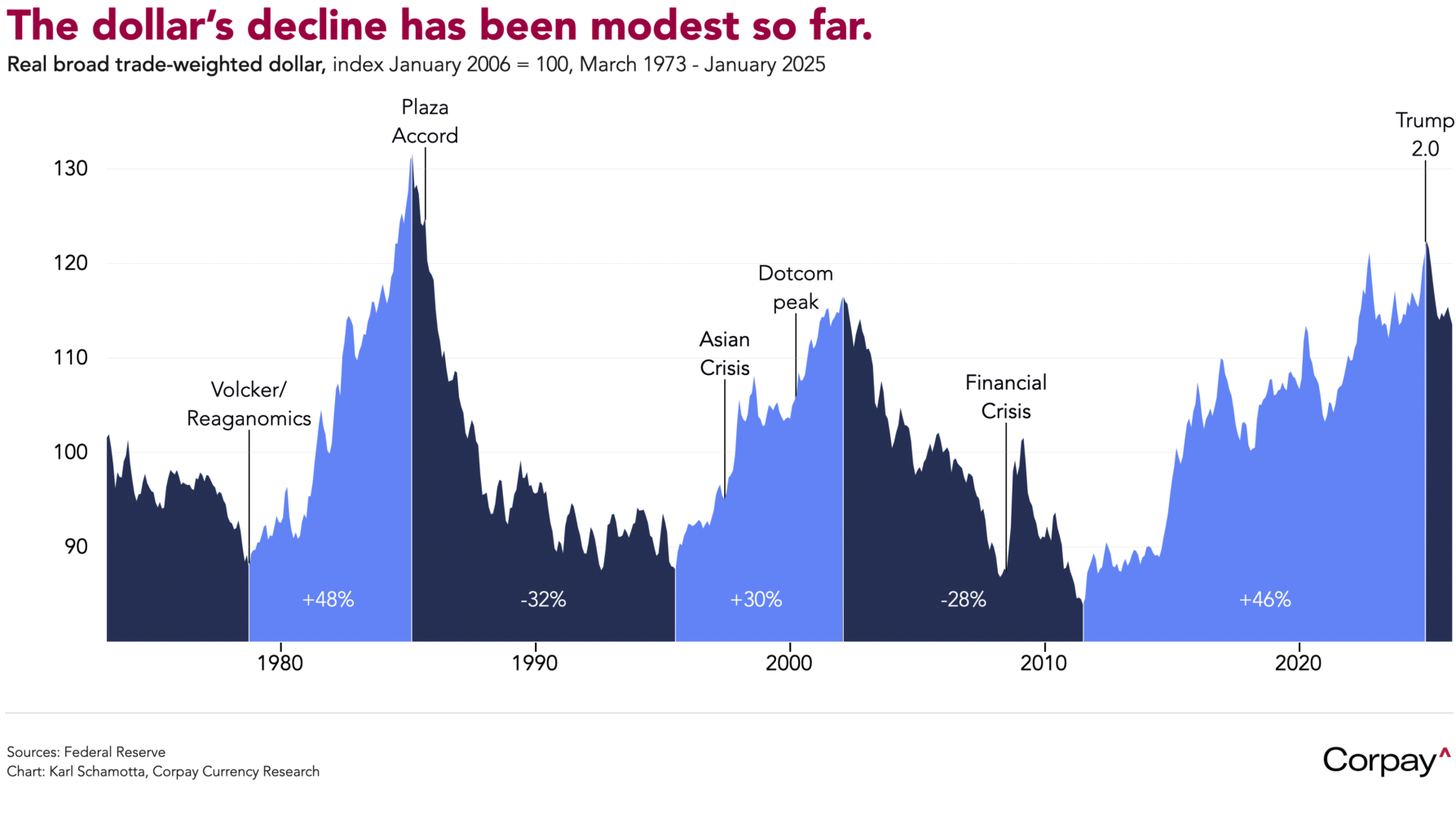

Yet the dollar’s gains proved fleeting. By the close, the greenback had fallen against a basket of major peers, suggesting investors were not comfortable abandoning the “sell America”—or perhaps more accurately, “hedge America”—trade just yet.

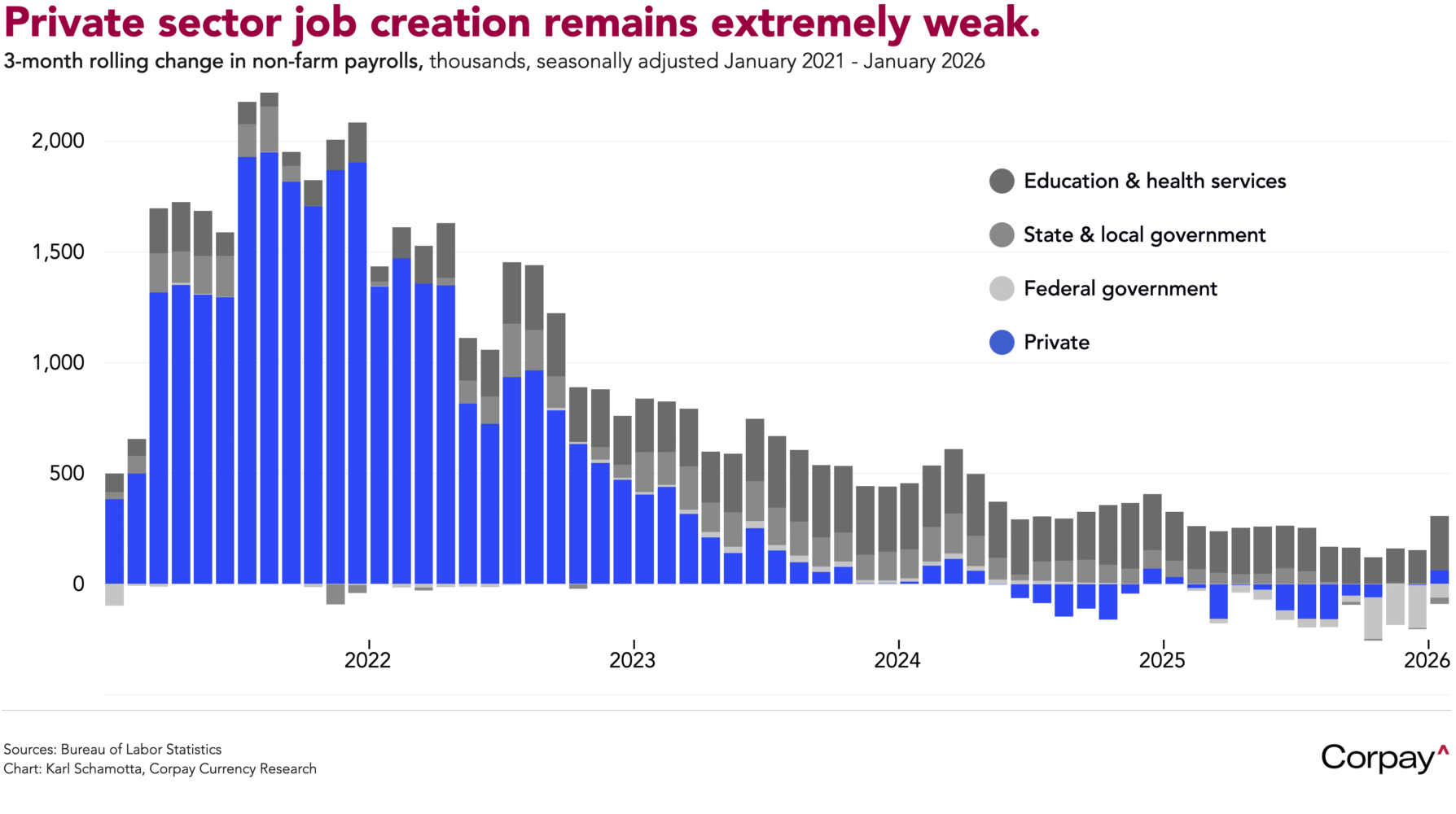

This may reflect scepticism about the labour market’s foundations. Revisions subtracted a seasonally adjusted 403,000 jobs over 2025, lowering monthly job creation to the slowest pace outside a recession or pandemic in decades. Although there has been some improvement in recent months, hiring outside the government, education, and healthcare sectors remains extremely weak.

Bullishness on the yen may also be playing a role. Sanae Takaichi’s weekend victory has spurred large flows into Japanese assets, as investors seek exposure to an economy showing signs of emerging from decades of decline, and to bond markets gradually normalising after years of intervention. The yen has erased all its pre-election losses, and positioning is turning positive, suggesting speculators expect further gains.

But the dollar’s retreat comes even as interest rate markets hold their post-release moves, and against a broad basket of currencies beyond the yen. That points to entrenched bearishness, and serves as a warning to those—ourselves included—who have been expecting stronger US fundamentals to play a supportive role. By historical standards, the greenback’s decline so far remains modest, leaving scope for further downside if the mood doesn’t shift.

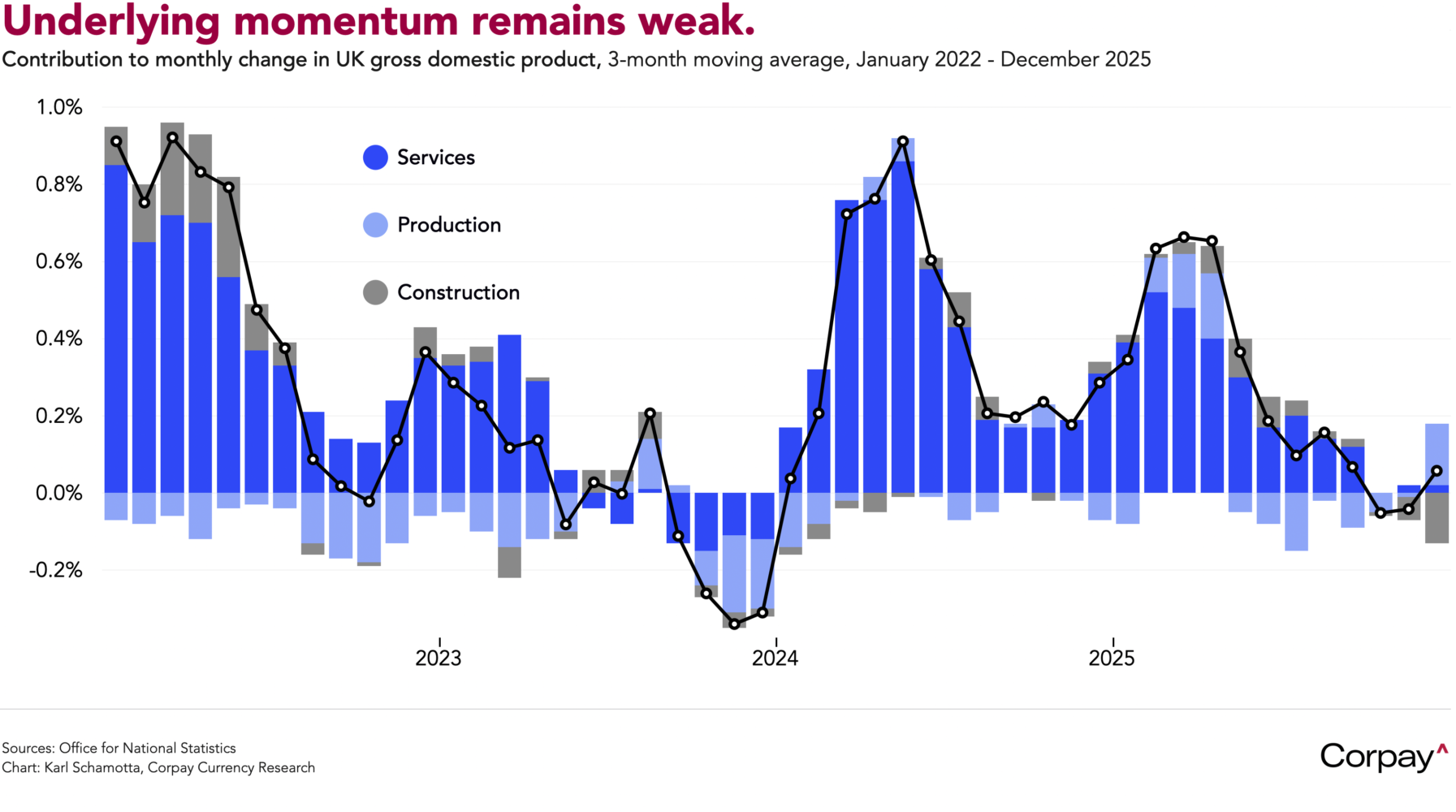

The British pound is little changed after the economy ended 2025 on a soft note, keeping easing expectations anchored near levels set after last week’s surprisingly-dovish Bank of England decision. Output grew by just 0.1 percent in the fourth quarter of 2025 and 1.3 percent for the year as a whole, as government spending and household consumption failed to fully offset weakness in business investment and construction activity. Economists expect another modest improvement in the months ahead—marking a sixth consecutive year of seasonal outperformance—as fiscal uncertainties wear off, labour markets stabilise, and lower rates pass through, but optimists are few and far between as the government tumbles into another leadership crisis and global uncertainty levels remain high. The pound’s recent gains look fragile.

The House of Representatives last night voted to revoke the “national emergency” Donald Trump used to implement tariffs on Canada, with six Republicans joining their Democratic counterparts in support. The president is expected to veto any legislation that reaches his desk, but the action suggests that unease is growing within his own party over the role that the highly regressive taxes* might play in midterm elections later this year. Researchers at the Federal Reserve Bank of New York this morning said nearly 90 percent of the tariffs’ economic cost has been borne by US firms and consumers thus far, and surveys show the majority of Americans oppose the measures, suggesting that Republican candidates could suffer losses in November’s vote.

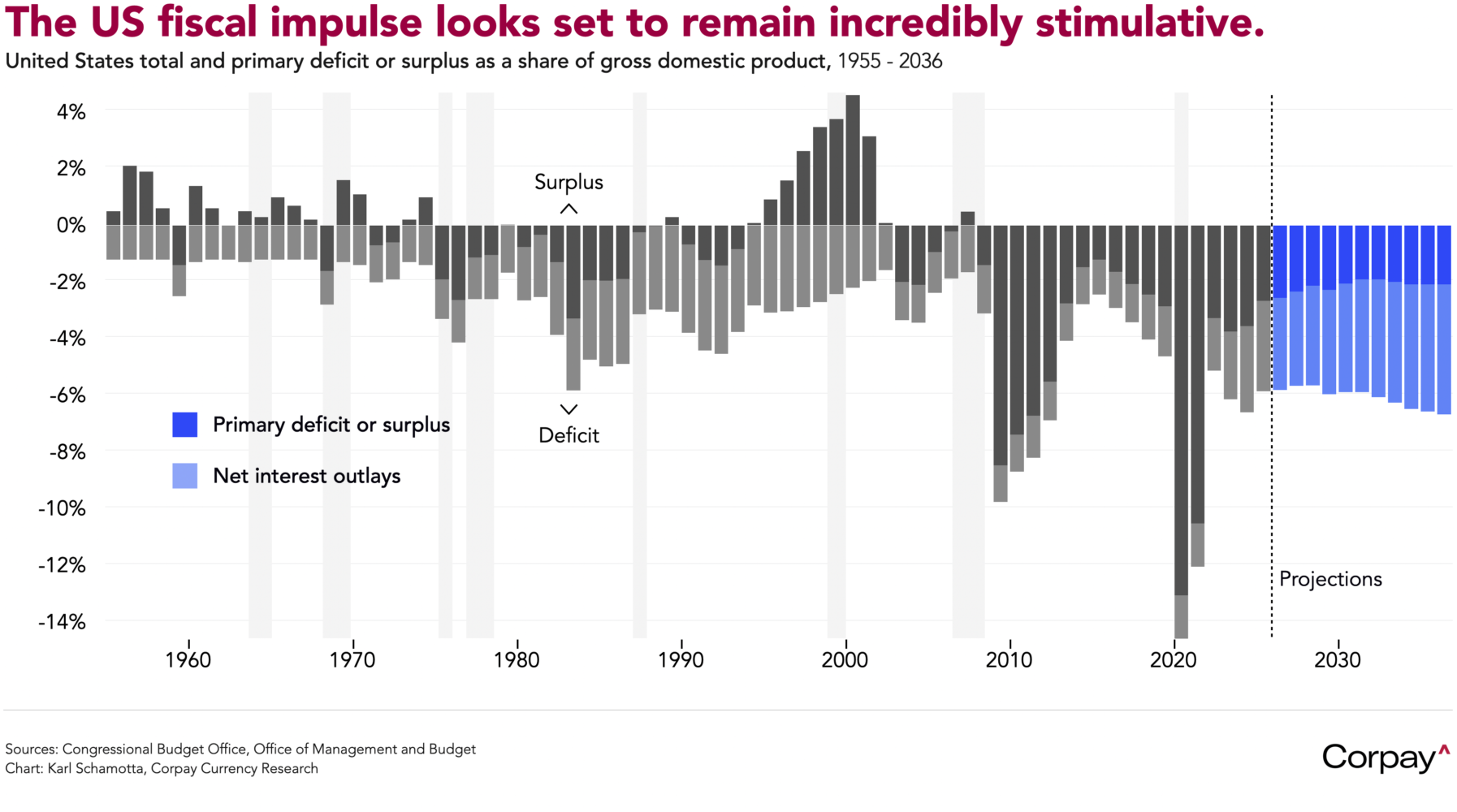

Against this backdrop, a Supreme Court decision on tariffs, which could come as early as the 20th, could have far-reaching market implications. By forcing the administration to rely on narrower legal avenues for implementation—and giving the president a convenient off-ramp—a business-friendly judgment could help to lift the cloud of negative sentiment that has settled on the American economy, leaving investors to build a short-term bullish-dollar thesis around continuing productivity gains and an extraordinarily-positive fiscal outlook. Updated numbers published by the Congressional Budget Office yesterday show the US continuing to run deficits previously only hit during recessions or wars, generating a powerful impetus for underlying growth.

*At the risk of oversimplifying the issue, tariffs act like consumption taxes, forcing lower-income households—that spend a larger share of income on consumption—to bear a disproportionate share of the cost.

**US spending and taxation levels remain deeply unsustainable, but in the here and now, more government spending and less taxation implies stronger corporate earnings, returns to capital, and household incomes, at least at the top of the distribution.