The dollar is edging higher against most major peers as yields firm in the wake of yesterday’s heavy US data slate. Ten-year Treasury rates have nudged up, equity futures are coming under mild pressure ahead of the North American open, and the Canadian dollar, euro, sterling, and yen are all trading with a softer tone. With no major economic releases on today’s calendar, investors will be focused on remarks from Federal Reserve Governor Christopher Waller—highly influential, and to our knowledge, still in the running as a potential successor to Jerome Powell—which could prove market-moving, particularly if he signals a clear preference for more policy easing in light of yesterday’s data.

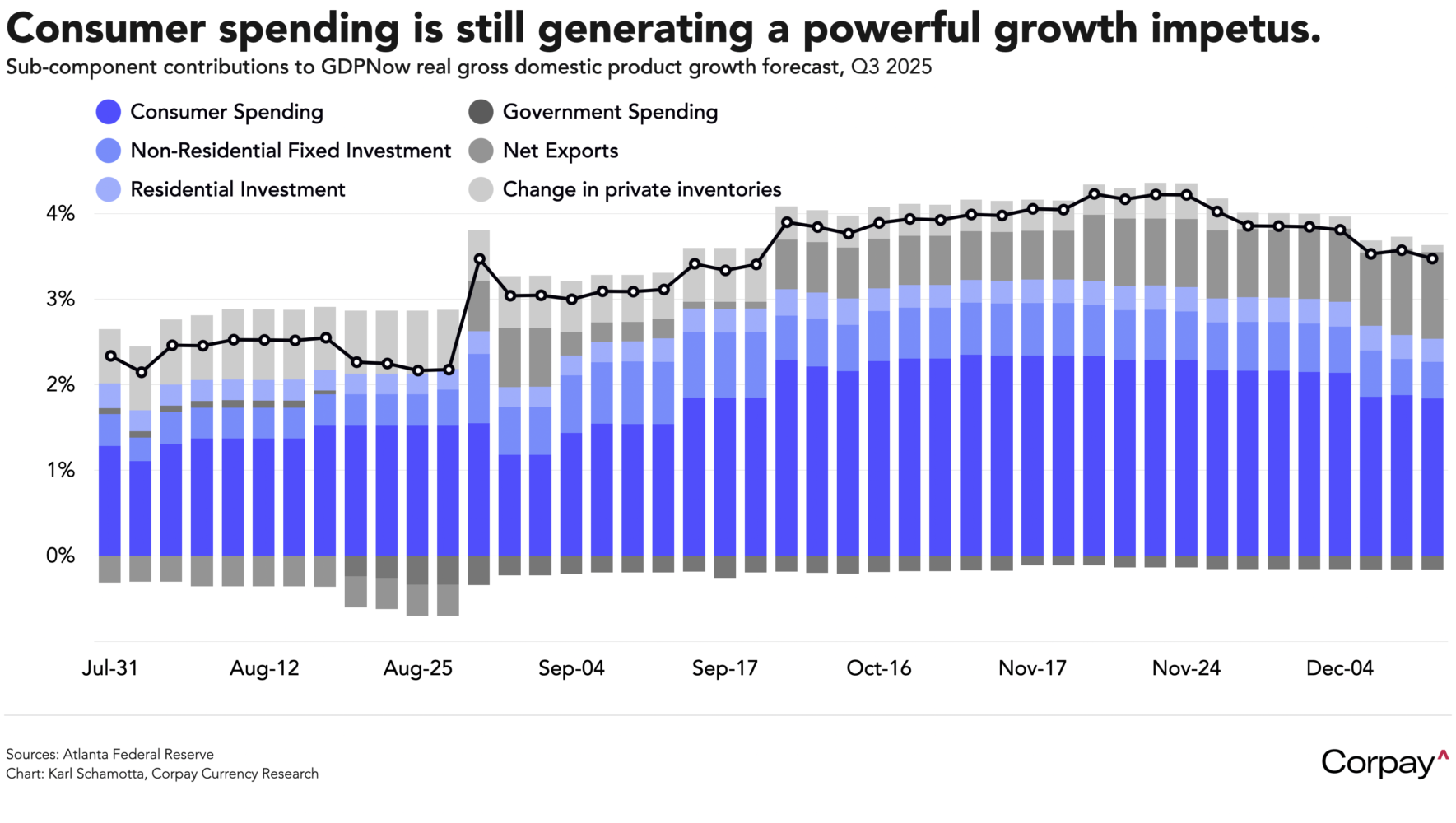

The long-delayed data showed US labour markets continuing to cool at an orderly pace even as consumer spending holds up better than sentiment surveys would suggest. The October and November non-farm payrolls reports showed a cumulative -41,000 jobs shed over the two-month period, and the unemployment rate climbed to 4.6 percent—a four-year high—but losses were heavily concentrated in federal government employment, with the private sector adding 121,000 roles (mostly in healthcare, social assistance, and construction), and the jobless rate was partly lifted by an unusually-large number of new entrants to the workforce. Although headline receipts were soft, “control group” retail sales climbed strongly in October, suggesting that underlying consumer demand remains relatively robust. Incorporating updated data, the Atlanta Fed’s GDPNow forecasting model is pointing to a 3.5-percent growth rate in the third quarter, with consumer spending contributing roughly 1.84 percent to the headline number.

The British pound is trading sharply lower after inflation declined by far more than expected in November, firming market expectations on more easing from the Bank of England. According to the Office for National Statistics, the all-items consumer price index climbed 3.2 percent in the year to November, down from 3.6 percent in October, and well below economist forecasts. The unexpected deceleration was largely driven by a softening in food prices—a category notorious for its volatility—but the core measure also slowed, translating into a rise in market-implied odds on a rate cut at tomorrow’s central bank meeting, and a drop in longer-term policy expectations.

The Japanese yen remains on the back foot even after export data surprised to the upside, reinforcing the view that the economy is weathering Donald Trump’s trade war more effectively than many had feared. Finance Ministry figures show shipments to the United States and the European Union rising by 8.8 percent and 19.6 percent respectively over the year to November, more than offsetting softer demand from China and pushing overall exports up 6.1 percent year over year. The resilience of external demand should strengthen the case for further policy normalisation from the Bank of Japan and temper downside risks to the broader Japanese economy, but fiscal concerns—exacerbated by a report overnight suggesting that the government plans to expand its stimulus plans to 120 trillion yen in fiscal 2026—are keeping yields and the currency under pressure.

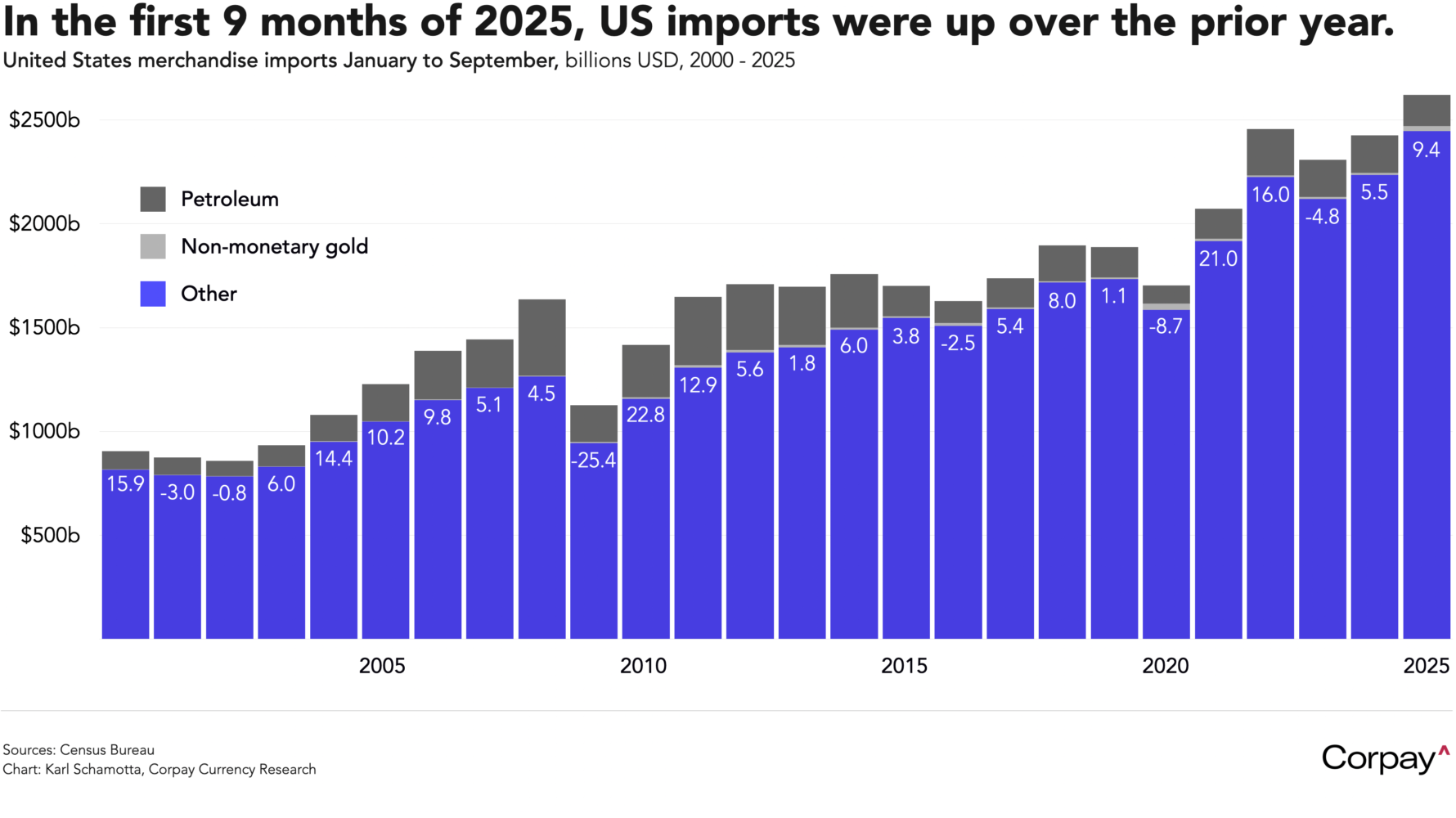

Japan’s data underscores the extent to which statistical noise and “bullwhip effects” related to tariff front-running have obscured deeper fundamentals this year. The outlook for 2026 remains uncertain—trade barriers may yet exert a heavier drag, or consumer demand could falter, tipping the global economy into a downturn. But neither outcome materialised in 2025: in the United States, nominal goods imports excluding petroleum and non-monetary gold rose 9.4 percent in the nine months to September compared with the same period a year earlier.

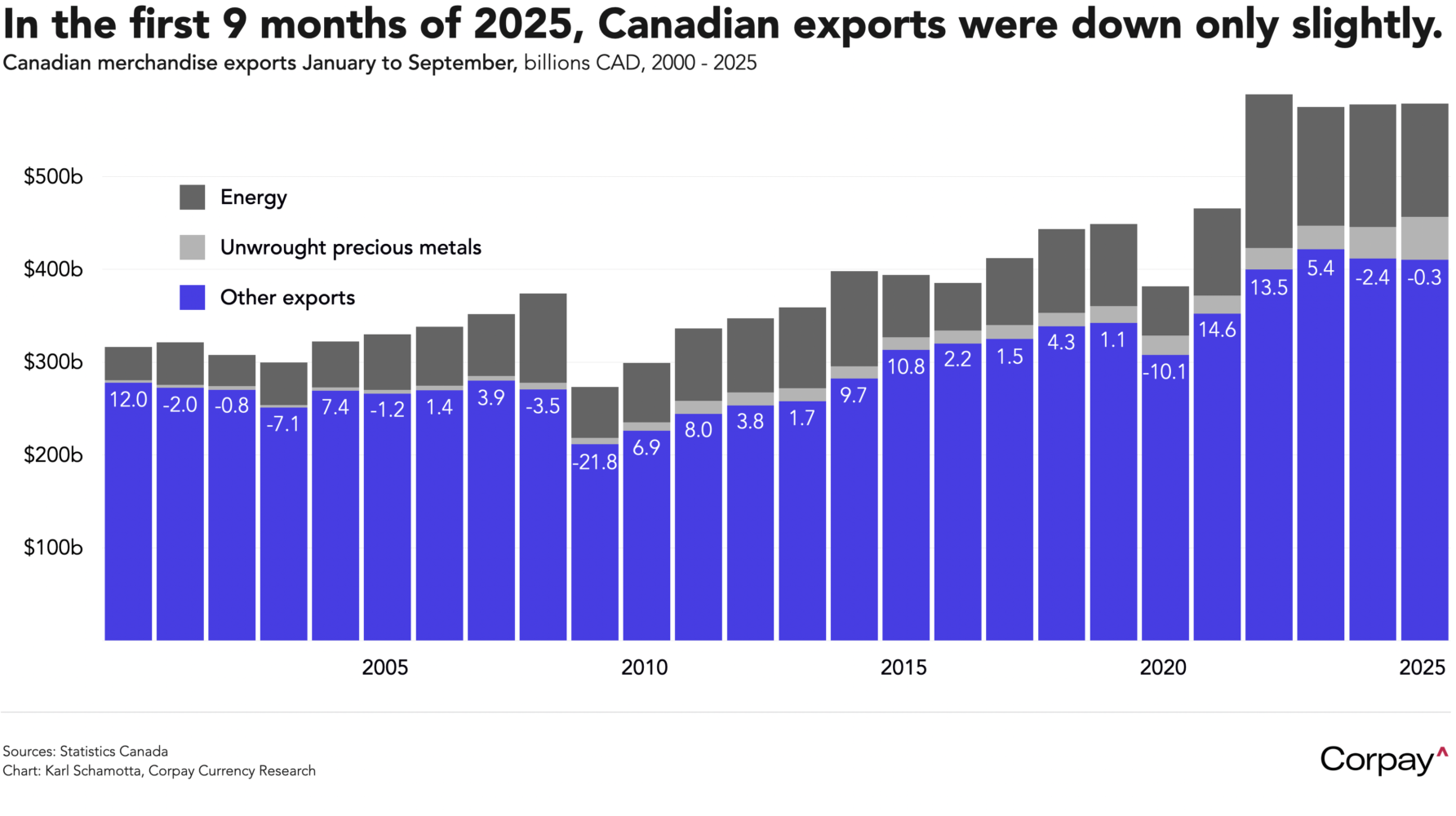

In Canada, where economic policy uncertainty levels briefly reached levels unsurpassed in any other major economy in recent decades, outbound shipments have held up relatively well. Nominal goods exports excluding energy and unwrought precious metals were down just -0.3 percent in the nine months to September over the same period last year—essentially unchanged.

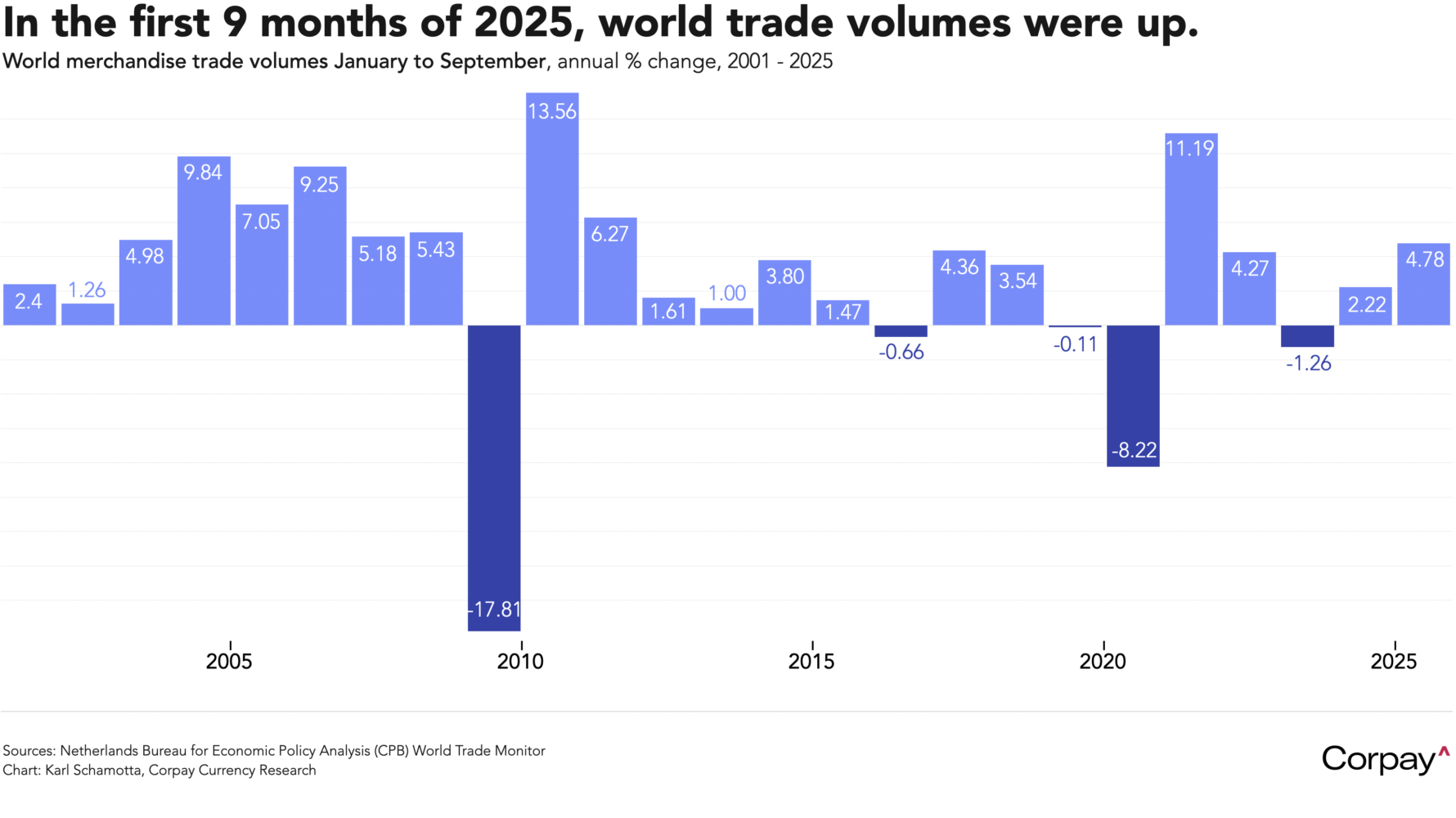

From a global standpoint, the story is similar, with global trade volumes up 4.8 percent in the nine months to September over the same period last year.

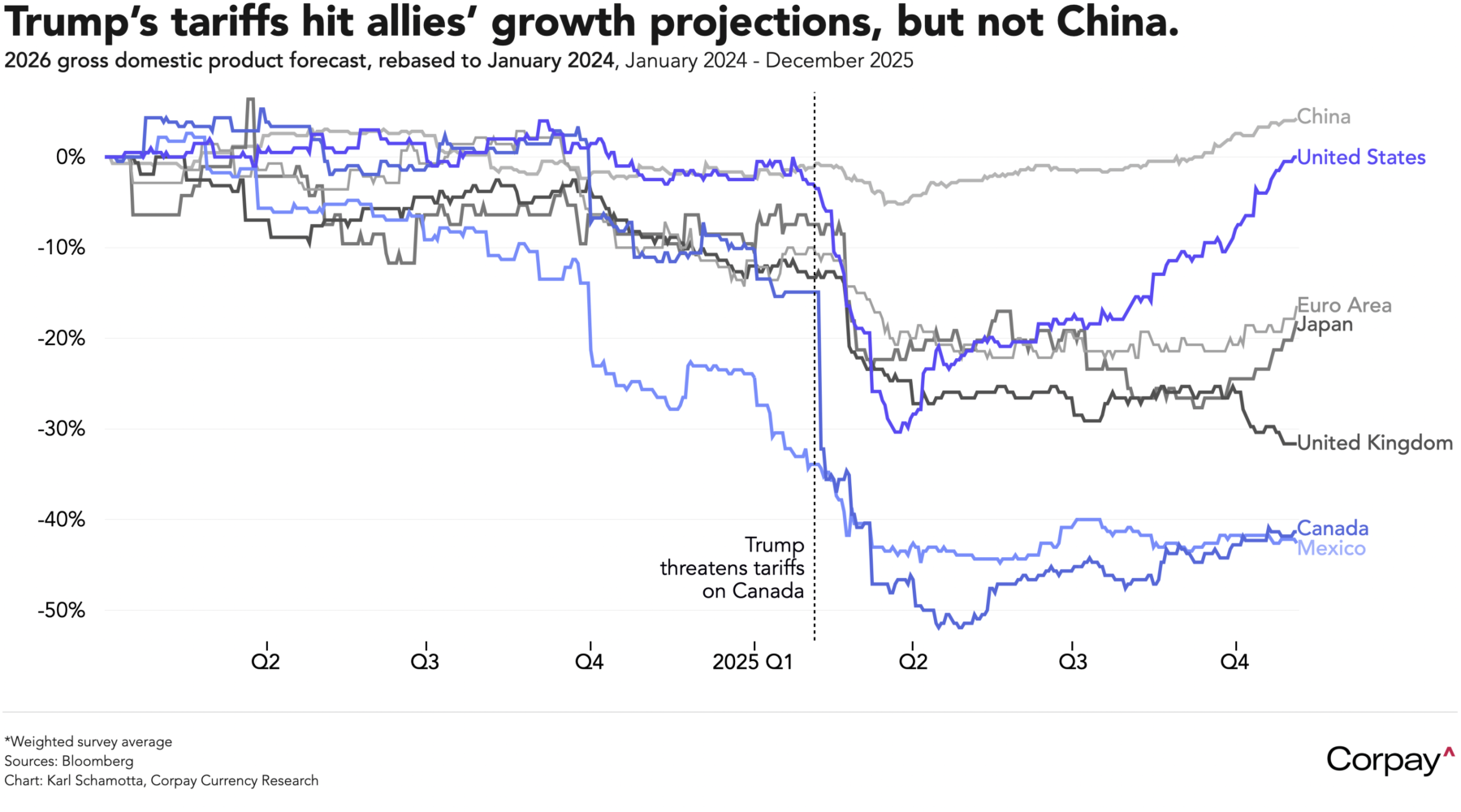

This is at odds with consensus economic forecasts, which dropped dramatically for most US allies when the tariffs were announced in the early spring, and haven’t really recovered—even as expectations for Chinese growth have climbed. We’re not sure how this divergence between economic perceptions and realities will be closed, but it likely represents an opportunity for forward-thinking businesses that take a broader global view.