• Equity wobbles. Fresh valuation concerns weighed on US equities on Friday. AUD & NZD lost a bit of ground, but still rose over the past week.

• Event Radar. NZ GDP is out (Thurs). US jobs data, retail sales, & CPI due this week. ECB looks set to hold, BoE could cut, & BoJ might hike rates.

Global Trends

Outside of a narrowly based pullback in US equities on Friday stemming from fresh valuation concerns across the AI sector (S&P500 -1.1%, NASDAQ -1.7%) other market moves were modest. Indeed, even after accounting for Friday’s dip the S&P500 is not that far from record highs. Elsewhere, long end US bond yields edged higher (10yr rate +4bps) and the curve steepened with no major data catalysts behind the moves. Oil (WTI crude -0.5%) and base metals (copper -2.3%, iron ore -1.2%) lost ground and FX markets were relatively subdued with the USD Index consolidating. EUR tread water (now ~$1.1740), while GBP slipped back (now ~$1.3379) after another weak monthly UK GDP print and USD/JPY nudged up (now ~155.87). The weakness in equities flowed through to cyclical currencies with the NZD (now ~$0.5789) and AUD (now ~$0.6645) a touch lower, although both recorded gains over the week.

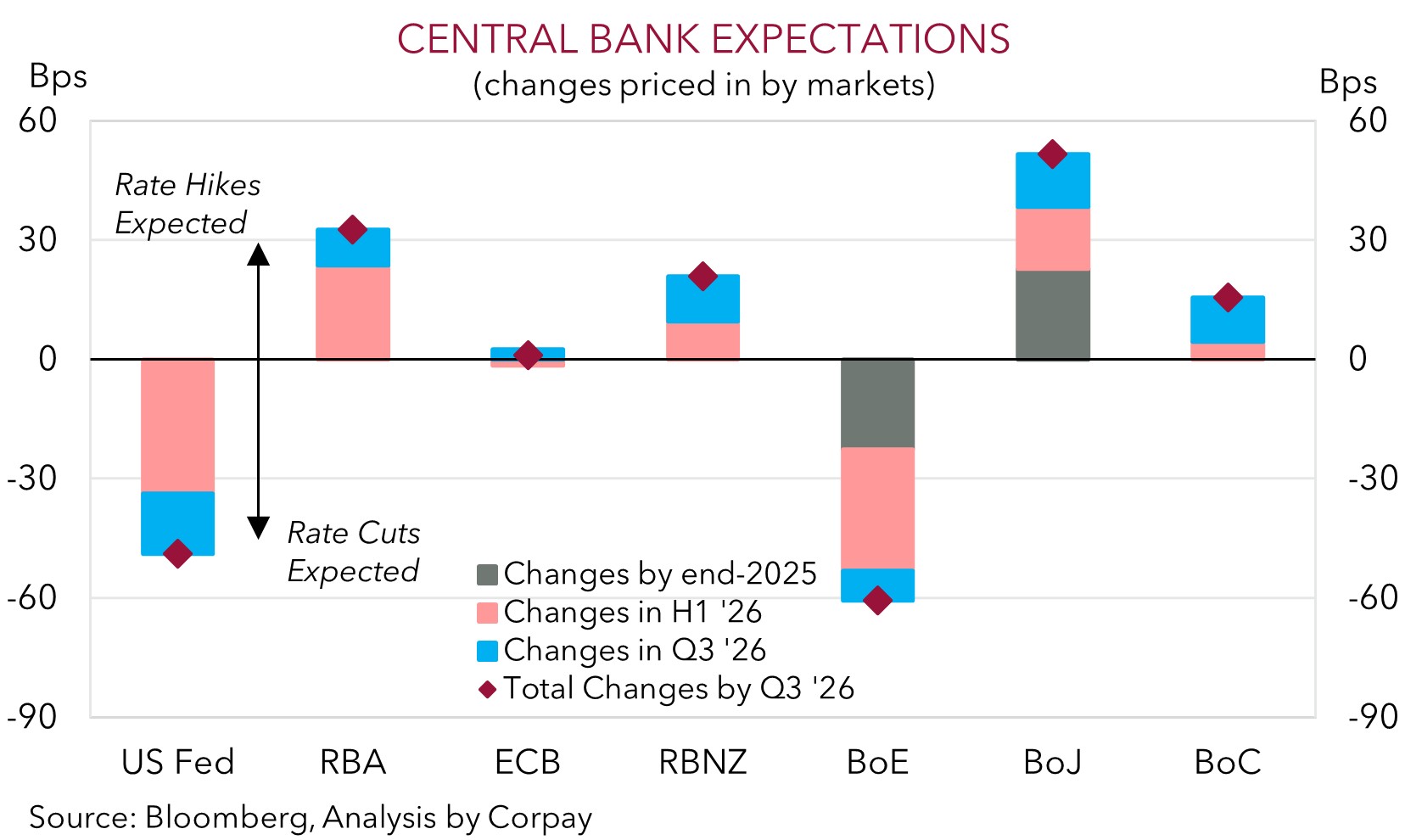

It is a busy week on the macro front. In the US November non-farm payrolls, retail sales figures for the pre-Black Friday October period (both Tuesday night AEDT), and the first CPI data in a few months is due (Thursday night AEDT). In Asia, the monthly China data batch is out today (1pm AEDT), the global business PMIs are released later in the week (Wednesday), and there are a few major central banks meeting. The ECB looks set to hold steady, while the Bank of England is forecast to cut rates by 25bps (both Thursday night AEDT), and there are expectations the Bank of Japan delivers a rate hike (Friday).

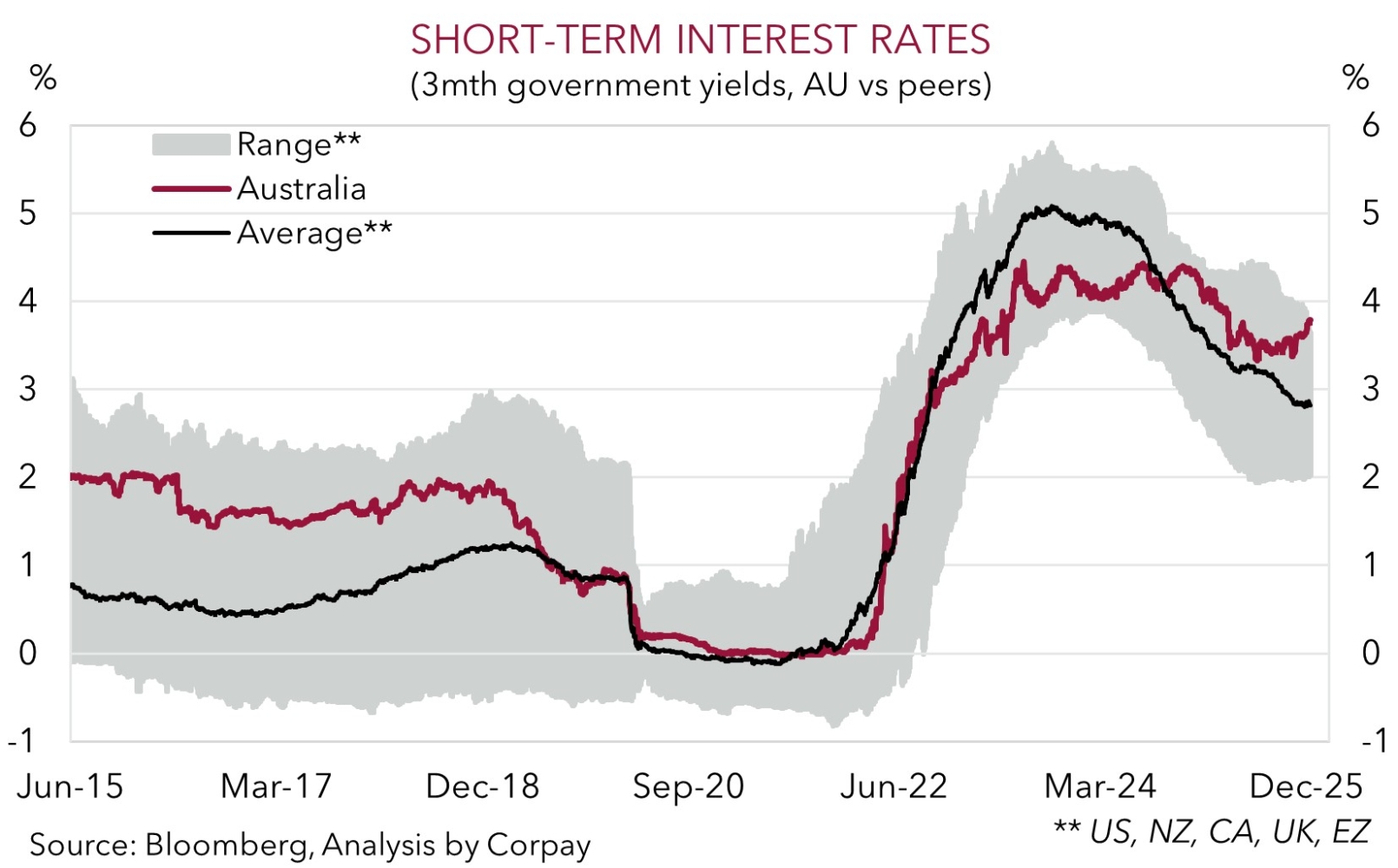

In terms of the US data given the impacts of the prolonged government shutdown as well as spillovers from higher import costs/tariffs, retail sales are predicted to be sluggish and labour market conditions might have softened further. This type of mix, coupled with signs of contained inflation pressures could, in our view, bolster expectations for another US Fed rate cut in Q1 2026. Markets are currently only fully discounting the next US Fed reduction by mid-year. We believe this and ‘hawkish’ vibes from the ECB and/or BoJ may exert downward pressure on the USD. We remain of the opinion that the US Fed could end up delivering more rate reductions than policymakers/markets now think. Over the medium-term, we expect the step down in US interest rates to drag on the USD.

Trans-Tasman Zone

The modest pull-back in US equities on Friday due to fresh valuation concerns, and weaker base metal prices exerted a bit of downward pressure on AUD and NZD (see above). That said, both still recorded gains over the week with the AUD (now ~$0.6645) not that far from its year-to-date highs and the NZD (now ~$0.5789) more than ~3.8% from its late-November low. Similarly, the AUD lost a bit of ground on the major cross-rates with falls of ~0.1-0.3% recorded against the EUR, JPY, GBP, CAD, and CNH. But that comes after a solid run. AUD/EUR (now ~0.5662) remains near the upper end of its multi-month range, as is AUD/GBP (now ~0.4966), while AUD/CNH (now ~4.6897) is above its 1-year average. AUD/JPY (now ~103.57) is hovering around levels last traded in mid-2024.

It is a quiet week data-wise in Australia with the business PMIs and consumer confidence due (Tuesday). In NZ, Q3 GDP is out (Thurs) and based on partial indicators a sizeable snapback in growth after the large fall the previous quarter is likely. On the back of the RBNZ’s aggressive rate cuts momentum looks to be turning the corner. NZ GDP could come in well above the RBNZ’s expectations (mkt ~0.8%qoq, RBNZ ~0.4%qoq). If realised, we think the signs of an improving NZ economy should boost the case for the next move by the RBNZ being up not down, albeit in H2 2026 according to interest rate markets. This may give the NZD a boost and might see AUD/NZD lose some altitude, in our view.

In terms of the AUD, external forces should be in the drivers seat this week with China data out today (1pm AEDT), several US data points on the schedule including the jobs report (Tuesday night AEDT) and CPI (Thursday night AEDT), and a few central banks meeting (ECB & BoE on Thursday night AEDT, BoJ on Friday). On net, as discussed above, we think there is a risk the US data underwhelms and central banks like the ECB and BoJ are somewhat ‘hawkish’. This combination may weigh on the USD and in turn give the AUD support. Over the medium-term, we continue to see the AUD grinding up into the high-$0.60s with more favourable yield spreads between Australia and others such as the US a factor. As our chart shows, short-term Australian interest rates are diverging from other developed nations. For more see Market Musing: RBA & AUD – Stars Aligning.