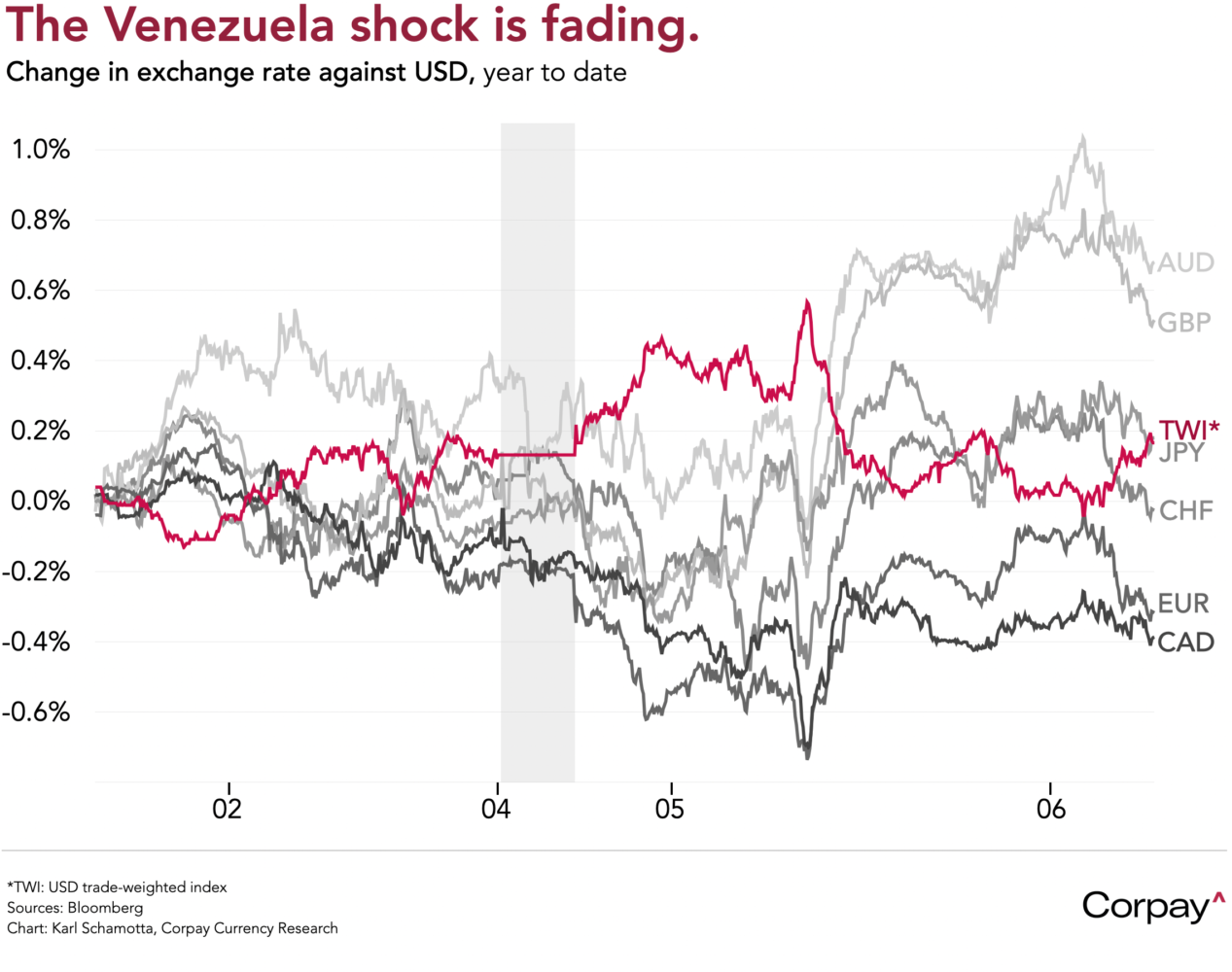

Good morning. Foreign exchange markets are giving back the weekend’s moves as Venezuela-related geopolitical concerns recede, shifting attention to US macro conditions. The trade-weighted dollar is moving sideways after a restrained round trip, while traditional havens—the yen and Swiss franc—are coming under light selling pressure, leaving the British pound and Australian dollar slightly ahead. Ten-year Treasury yields are steady near 4.17 per cent, equity futures are pointing to a flat open, and cross-asset implied volatility remains subdued.

Many of the biggest oil majors saw share prices rise yesterday, especially after Donald Trump suggested that the US might subsidise their efforts to rebuild Venezuelan production*, but crude prices are reverting to pre-attack levels as traders position for incremental changes in demand and supply balances that play out over years, if not decades.

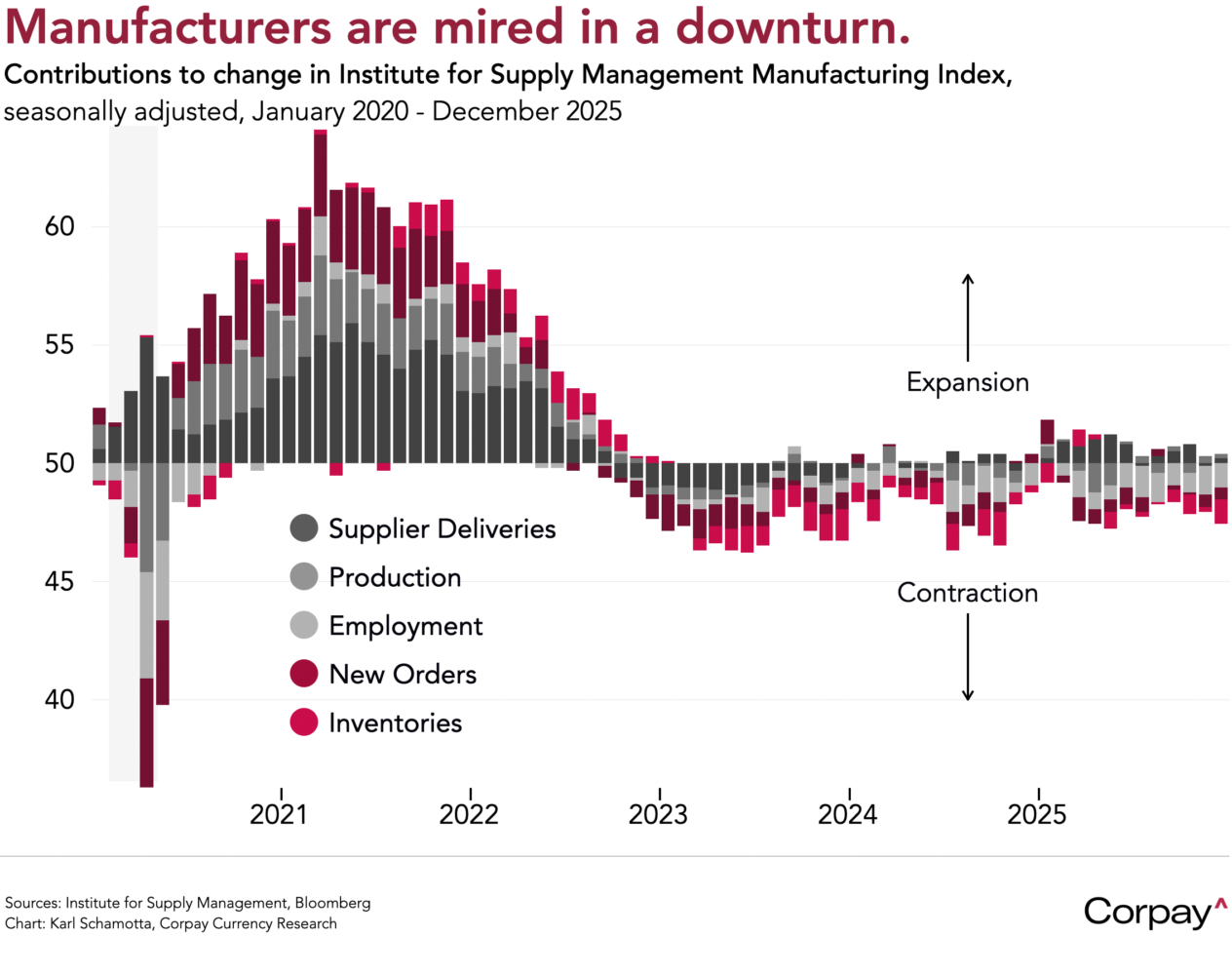

Weakness in the US factory sector worsened last month, surprising economists who had expected a modest seasonal recovery. Driven by softness in inventories and new orders, the Institute for Supply Management’s manufacturing purchasing manager index dropped by the most since late 2024, falling to 47.9 in December, from 48.2 in November. Customer stockpiles also shrank—suggesting that demand could pick up slightly in the months ahead—but the accompanying commentary pointed to a prolonged contraction. A firm in the machinery sector said “Trough conditions continue: depressed business activity, some seasonal but largely impacted by customer issues due to interest rates, tariffs, low oil commodity pricing and limited housing starts”, a chemical manufacturer noted “It has not been a great year. We have had some success holding the line on costs; however, real consumer spending is down and tariffs are ultimately to blame,” and an electrical supply business remarked “Morale is very low across manufacturing in general. The cost of living is very high, and component costs are increasing with folks citing tariffs and other price increases”.

Today will bring updates in S&P Global’s North American purchasing manager indices, but the data docket is bereft of first-tier numbers to trade on. Against a relatively-thin liquidity backdrop, market participants are likely to keep their powder dry in the run-up to Friday’s payrolls numbers on both sides of the 49th.

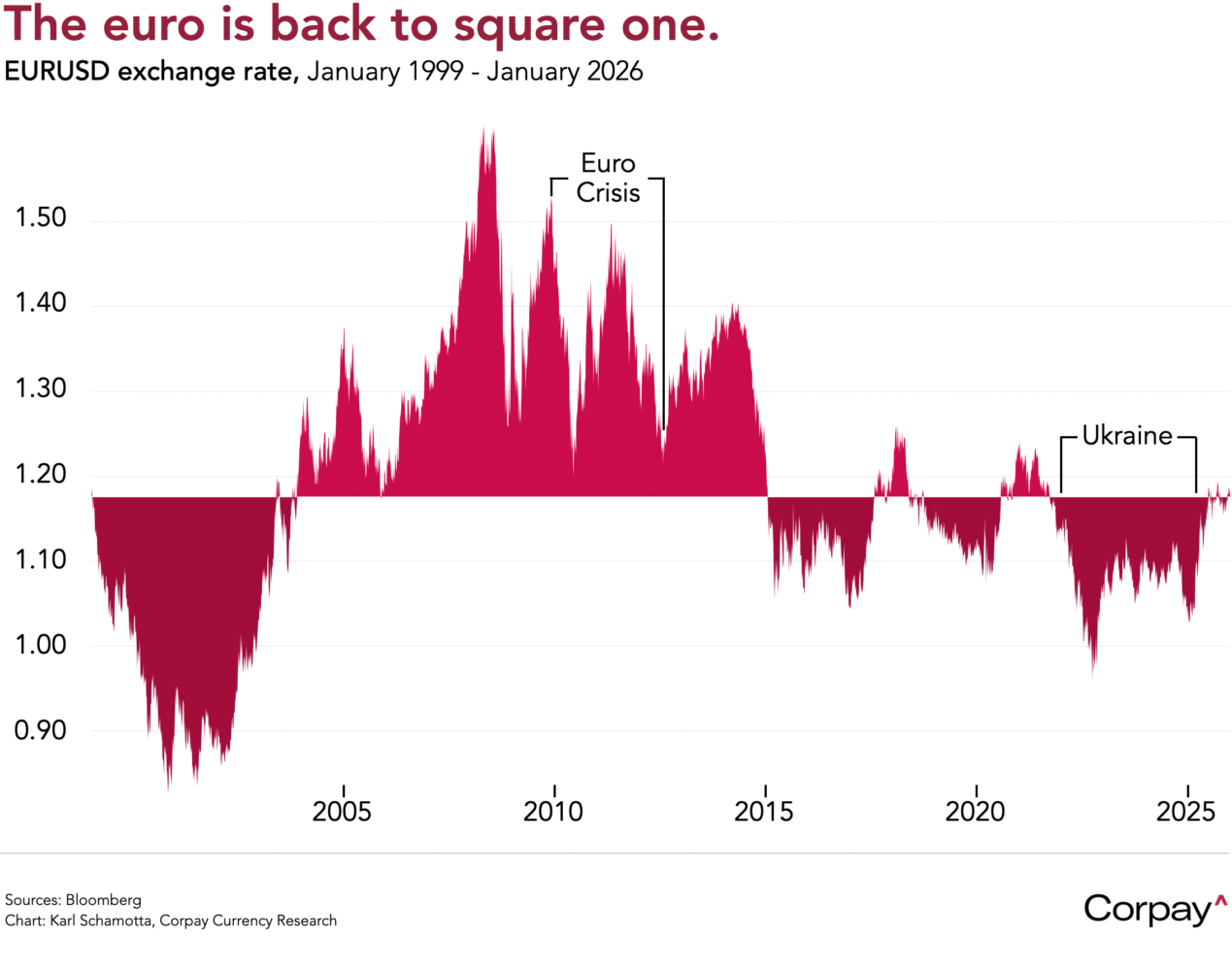

Across the pond, inflation numbers from France and Germany slowed slightly in December, giving the European Central Bank room to remain on the sidelines. In France, data released this morning showed harmonised inflation decelerating to its weakest levels in seven months, while state-level numbers in Germany pointed to an even bigger slowdown, undershooting forecasts and putting downward pressure on bond yields ahead of tomorrow’s bloc-wide print. We think this could translate into a more dovish tint to comments from policymakers in coming months, and assist in further delaying expectations for the next rate hike.

Against the dollar, the euro sits almost exactly where it began when the currency launched in January 1999, and the case for a new rally in 2026 looks flimsy. Should US growth and monetary policy views reprice in a hawkish direction over the coming months—as we expect—rate differentials may remain wide, keeping the common currency under pressure longer than the consensus expects. In our view, absent a surprising and self-sustaining rebound or move toward stronger fiscal coordination, any euro gains are likely to be narrower and more brittle this year, with risks more two-sided than markets currently assume.

*US economic policy in recent years is reminiscent of Reagan’s observation: “Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidise it”.