Foreign exchange markets are enjoying a brief period of respite, with most major pairs showing signs of mean reversion after the weekend’s sharp moves. The dollar is edging higher and measures of currency volatility are easing, even after President Trump issued fresh tariff threats against South Korea following similar warnings to Canada and Europe last week. Few expect the threats to be carried out, and many think the Supreme Court will place limits on such unilateral actions within the next month.

Yield curves in Canada and the US are holding firm ahead of tomorrow’s central bank decisions, suggesting that investors expect policymakers to deliver calming messages. A variety of factors, from demographic changes to tariff front-running effects, are leading officials to take a careful and gradual approach to setting rates, and fundamentals in both economies remain consistent with a cautiously optimistic outlook. If fireworks appear, they will appear on the political side as the Federal Reserve fends off attacks on its independence.

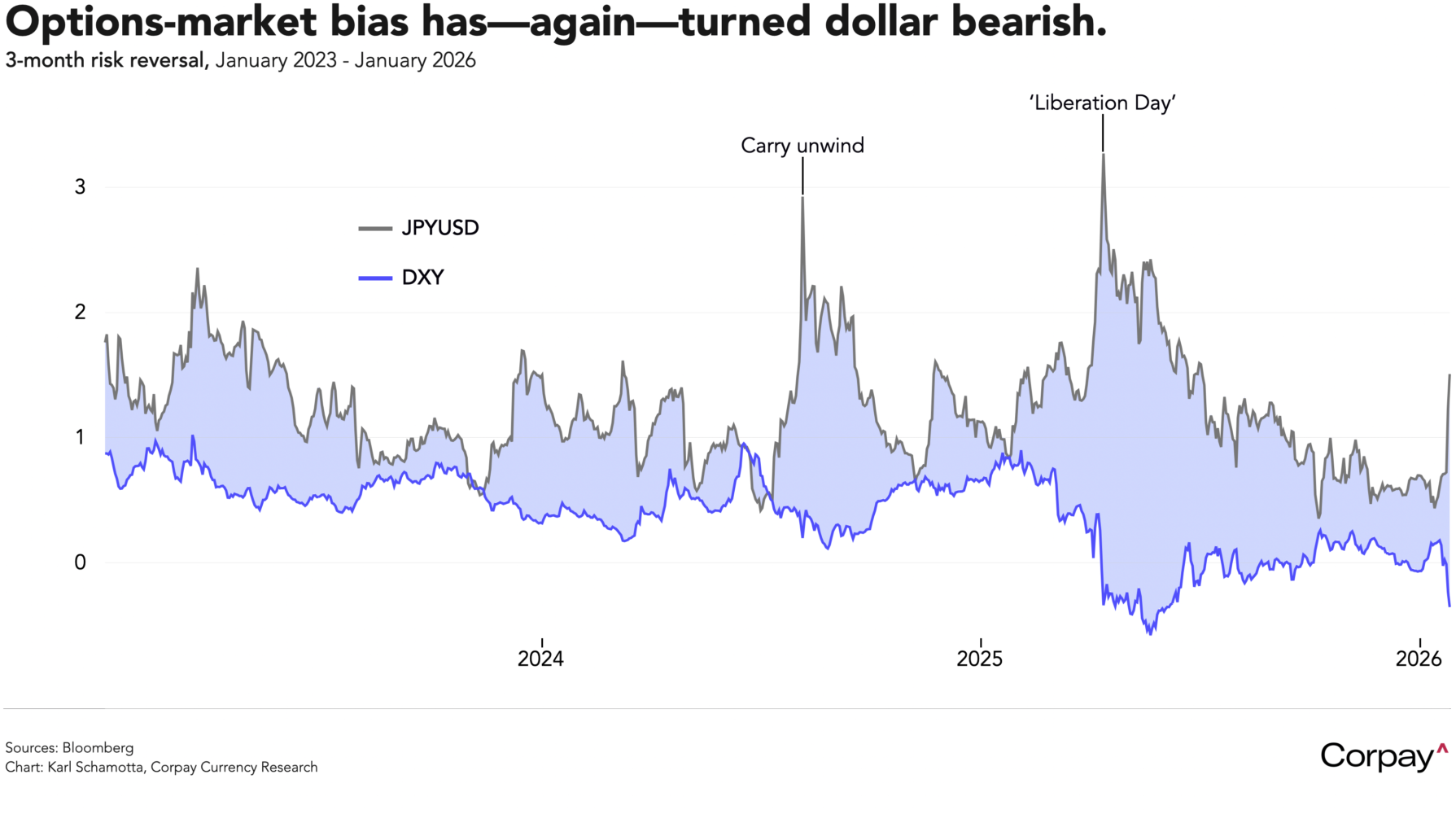

Positioning has turned profoundly dollar-bearish. Risk reversals—which measure skewness in option market positioning—are once again pointing to steep declines in the dollar, particularly against the yen, and talk of “debasement” has ratcheted up to deafening levels.

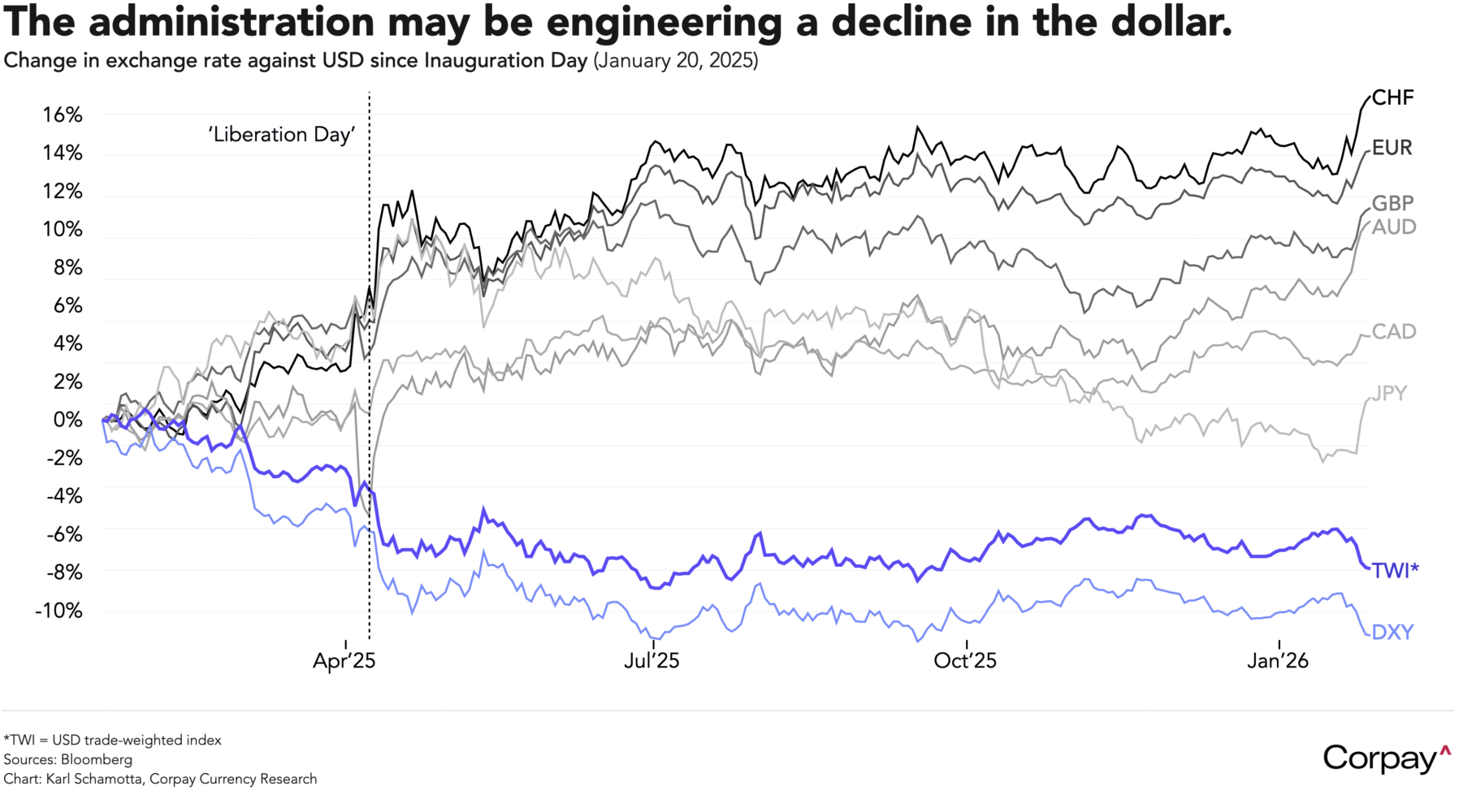

There are good reasons to suspect that the Trump administration is deliberately engineering a decline in the dollar’s value on foreign exchange markets. The intellectual positions advanced by officials like JD Vance, Stephen Miran, Scott Bessent, and Trump himself before taking office were largely consistent with the idea that the dollar’s overvaluation represents an “exorbitant burden” for US businesses, and policy actions over the last year have not been consistent with making the greenback great again. The currency has underperformed all of its major counterparts since Inauguration Day.

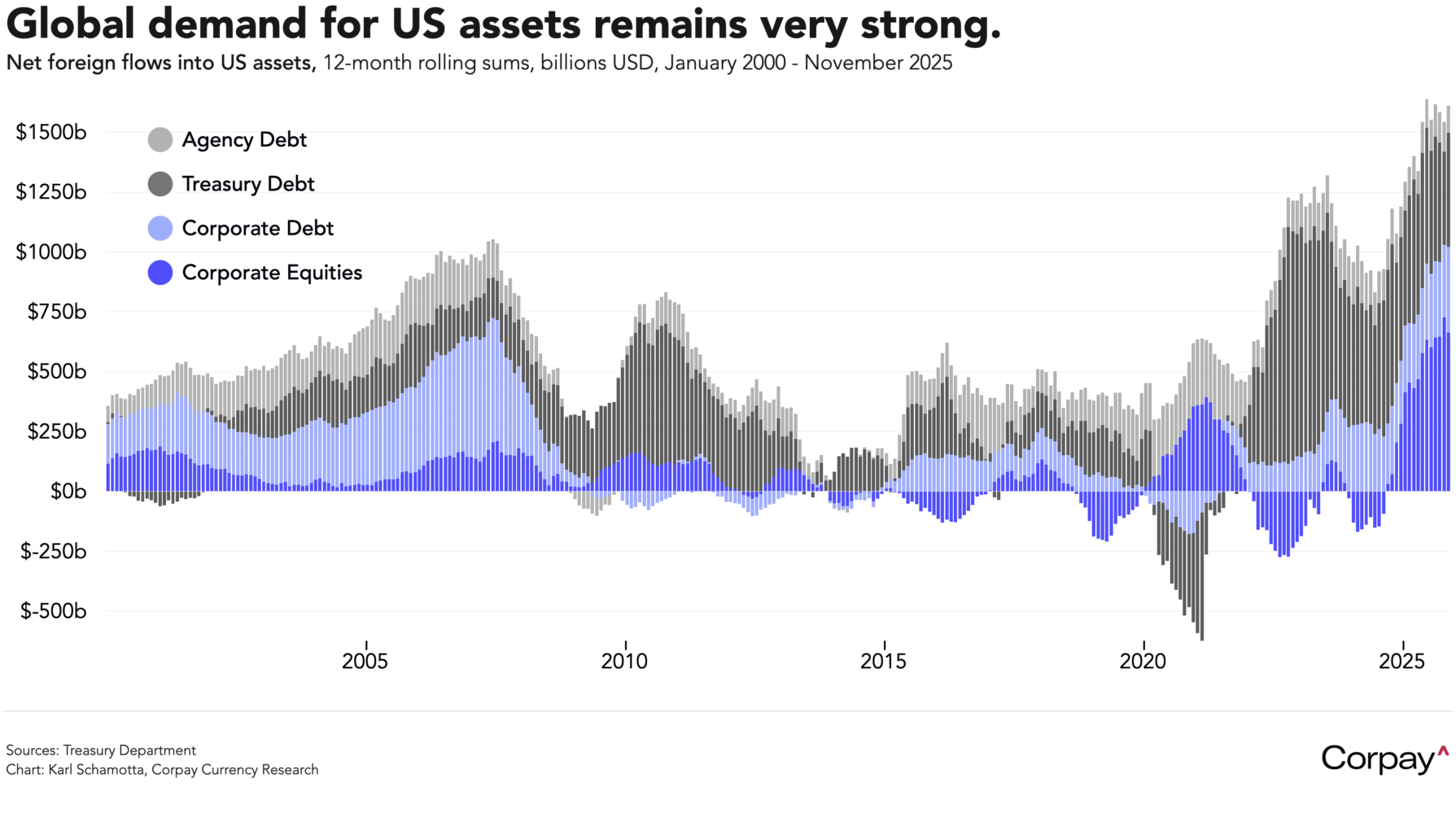

But the supplementary market signals that would accompany genuine currency debasement are conspicuously absent. Treasury yields remain stable, inflation expectations well-anchored, and the term premium—the additional compensation investors demand for bearing long-term interest rate risk—sits below 2014 levels. Although hedging volumes have increased as investors have grown more sceptical of American institutional stability, underlying capital flows into dollar-denominated assets have remained incredibly strong, underlining sustained appetite for US debt and equity instruments.

The gold price—often viewed as a barometer of flight from US assets—seems to be rising for reasons largely unrelated to dollar debasement fears. A persistent gap between prices in Shanghai and London reflects substantial demand from Chinese households seeking an alternative to beleaguered real estate markets, which have been stuck in a downturn for years. Stablecoin issuers have been accumulating reserves at a remarkable clip, with Tether reportedly acquiring 53 metric tons in the latter half of last year alone. Meanwhile, momentum-chasing speculators are piling in through exchange-traded funds, amplifying price movements in a pattern that resembles classic bubble dynamics more than a sober grasp of fundamentals.

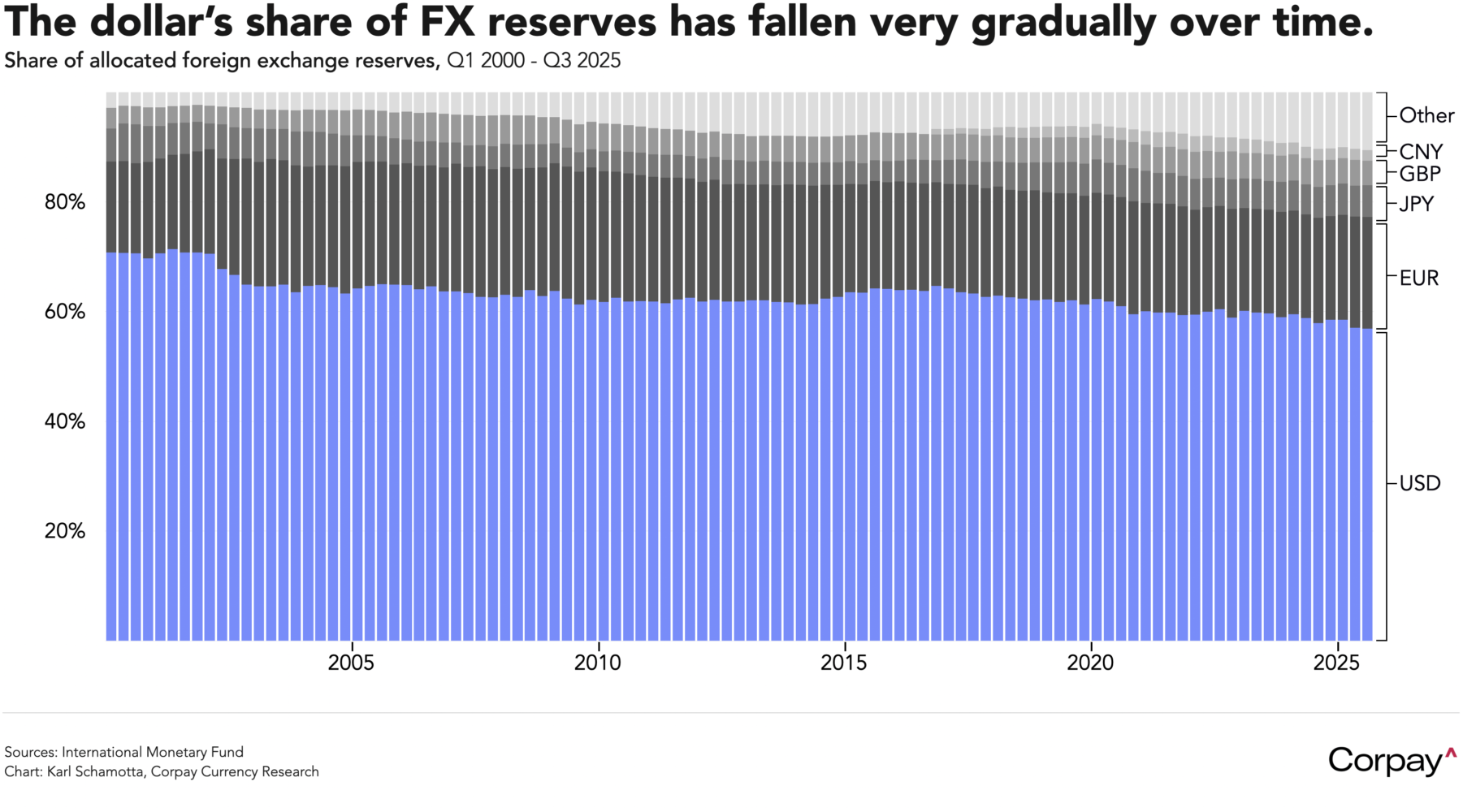

Central banks are not diversifying away from the dollar in any meaningful way. Higher valuations have lifted gold’s share of reserve assets, but new purchases have slowed sharply over the past two years. With emerging markets becoming more stable and China stepping back from currency intervention, global reserve accumulation has fallen sharply in the past decade. The dollar’s share of foreign exchange reserves—excluding gold—has declined only gradually, to about 56 percent from 70 percent in 2000, and remains well above the 48 percent recorded in 1990. This stability reflects the greenback’s outsized role in trade and cross-border debt flows, rather than any abstract assessment of its long-term return prospects.

The dollar is weakening for more prosaic reasons. Policy volatility and tariff threats from the Trump administration are expected to erode US economic outperformance, while the Federal Reserve appears poised to cut rates more aggressively than its counterparts abroad. Simultaneously, Washington’s protectionist pivot and diminished security commitments are spurring other nations to boost defence expenditure and sharpen their competitive focus, compressing the growth and interest rate differentials that previously favoured the greenback. Having entered 2025 in demonstrably overvalued territory, the trade-weighted dollar has merely retreated to 2023 levels—a textbook case of mean reversion rather than structural decline, let alone a crisis of confidence.

Bottom line: narrative-driven moves in foreign exchange markets are notoriously vulnerable to violent reversals, and the dollar’s recent decline could prove surprisingly evanescent. Trade—and hedge—accordingly.