Happy Fed Day to those who celebrate. Global risk assets are drifting lower, yields are a touch firmer, and the dollar is trading in the middle of its recent trading range as investors await what is widely expected to be a third consecutive “hawkish cut” from the Federal Reserve this afternoon.

Data published yesterday showed US labour markets cooling, but not at an alarming rate. On the positive side of the ledger, the number of job openings surged to 7.67 million in October from 7.23 million in August, but this may have been driven by pre-holiday staffing increases. The hires rate moved higher in September, but then slipped back to post-pandemic lows in October, the layoff and discharge rate inched up, and the quits rate—a proxy for worker confidence—fell, aligning with sentiment surveys that are showing a rise in concern over job market prospects.

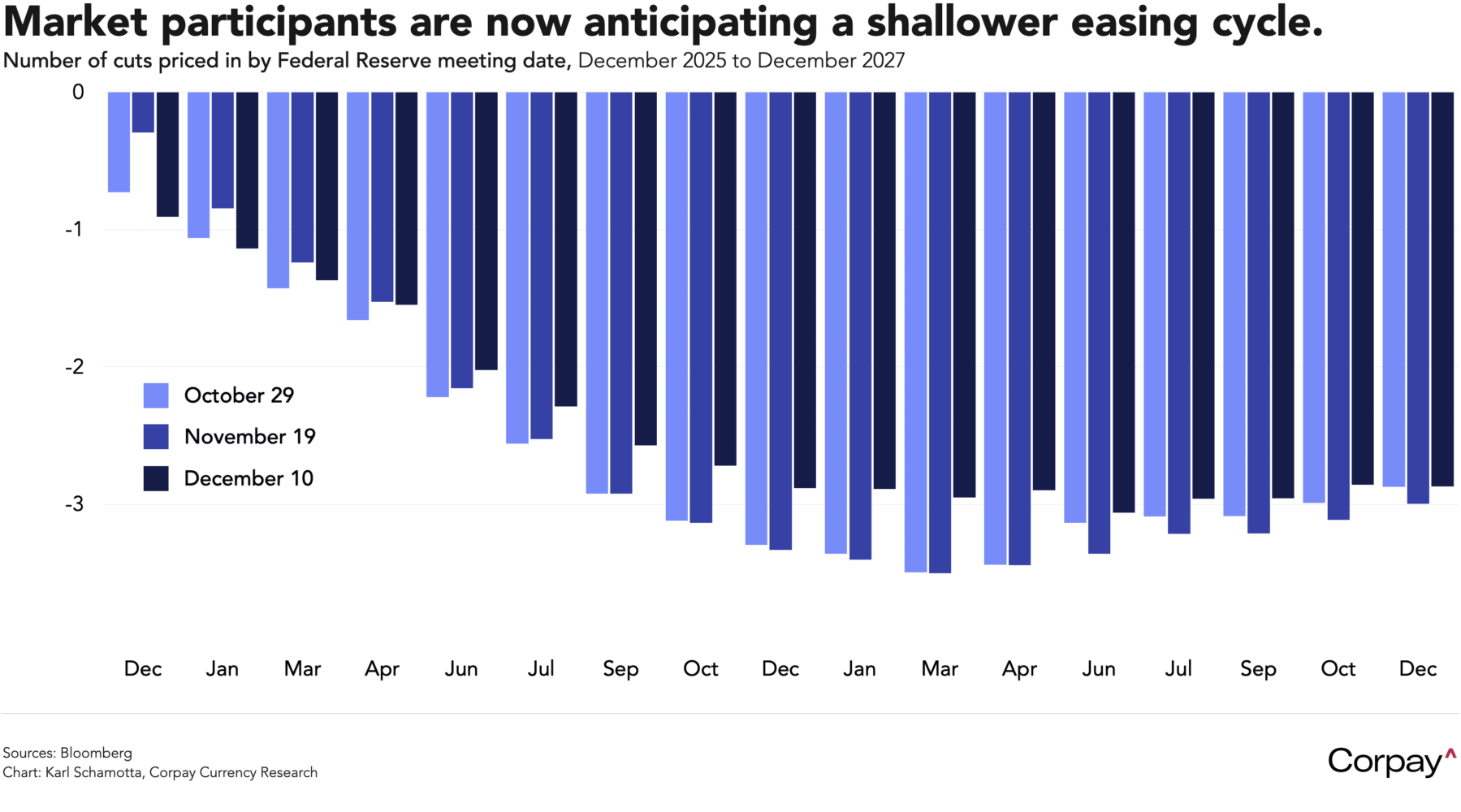

Broadly speaking, market participants have ratcheted back monetary easing expectations since the Fed’s October meeting, but remain convinced policymakers will deliver at least two rate cuts after today’s move. Treasury yields and the dollar could move sharply in the minutes after this afternoon’s announcement as markets parse the number of dovish and hawkish dissenters, the “dot plot” projections, and comments made during the press conference for any evidence that this assumption is wrong. We have no strong views going in—there are very plausible arguments for easing or maintaining policy—but would caution market participants that positioning is tilted toward a hawkish tone from Powell, so a dovish surprise could generate more travel in markets than the opposite.

On the slightly-colder side of the border, the Canadian dollar is struggling to extend its post-jobs-number rally, suggesting that market participants have joined us in expecting a degree of dovish push-back from Bank of Canada Governor Tiff Macklem after this morning’s policy decision. To our knowledge, no professional forecaster is expecting a move on interest rates today, given Canada’s still-stubborn inflation backdrop, a policy rate that is already well into neutral territory, and signs of resilience in labour markets. But with investors moving to price in a rate hike for 2026—and at least one major bank calling for two—policymakers may seek to ward off an undesirable tightening in financial conditions by casting doubt on the economy’s underlying strength. There’s two-way price risk going into the post-decision press conference.

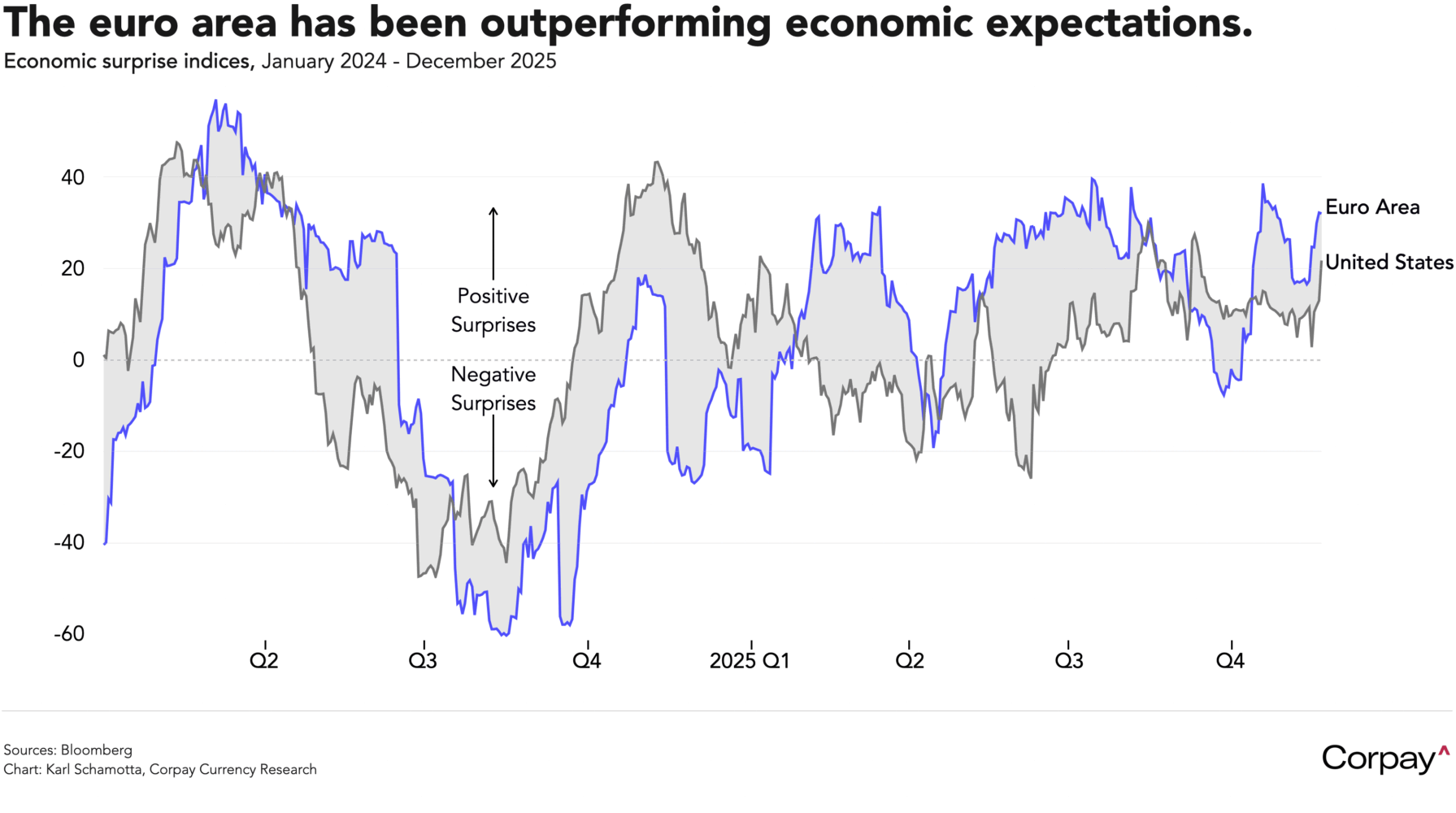

A hawkish repricing is rolling across rate curves around the world as investors mark up the likelihood of central bank rate hikes next year. After similar moves in New Zealand, Australia, Japan, and Canada, the euro area became the latest to see swap markets beginning to price in a 2026 hike this morning when Christine Lagarde told a Financial Times conference she expects the European Central Bank to again raise its growth forecast when officials meet next week. Boosted by an energy price slump and Germany’s fiscal reforms, measures of consumer and business confidence in the common currency zone are beginning to recover after a multi-dimensional series of shocks in recent years, and after a brief reversal, economic surprise indices—which measure the difference between forecasts and realised data—are again outperforming their American equivalents. This might not last long—fiscal spending efforts are notorious for delivering disappointing results—but could keep the euro well supported into year end.

The next shoe to drop could be in the US itself, where a number of powerful tailwinds might lead to a temporary upgrade in growth, inflation, and interest rate expectations in the early new year. With artificial intelligence infrastructure investment increasing, fiscal stimulus flowing via tax cuts and spending increases, financial conditions remaining in extremely accommodative territory, wage gains continuing, tariffs on the verge of a potential rollback, and policy uncertainty falling from its highs, it seems reasonable to expect an uptick in measures of economic performance in the first months of 2026. We don’t expect this to last given that there are many reasons to suspect that growth will slow over the course of the year, but a temporary reappraisal of the Fed’s easing trajectory—with cuts seen coming at a slower cadence and reaching terminal levels earlier than currently expected—could generate some lift under a beleaguered dollar in the first quarter.