• US CPI. Cooling US inflation helped stabilise risk sentiment. US bond yields dipped. USD tread water, as did the NZD. AUD drifted a bit lower on Friday.

• Event radar. US holiday tonight. Lunar New Year started. RBNZ meets this week (Weds). US GDP (Fri night AEDT) & AU jobs data also out (Thurs).

Global Trends

There was a mixed performance across markets at the end of last week with encouraging US inflation data in the driver’s seat. US equities stabilised on Friday after the previous sessions tech/AI-led selloff. Nevertheless, the S&P500 still recorded its 4th, albeit small, decline in the past 5 weeks. US bond yields fell with the 2yr and 10yr rates declining ~5bps. The policy expectations driven US 2yr yield is now tracking at the bottom of the range it has occupied since Q4 2022. In FX, the USD index consolidated with EUR treading water near ~$1.1872 and USD/JPY hovering at the lower end of its 3-month range (now ~152.67). GBP nudged up (now ~$1.3644), the NZD was range bound (now ~$0.6027) ahead of this week’s RBNZ meeting (Weds), and the AUD drifted a little lower (now ~$0.7071).

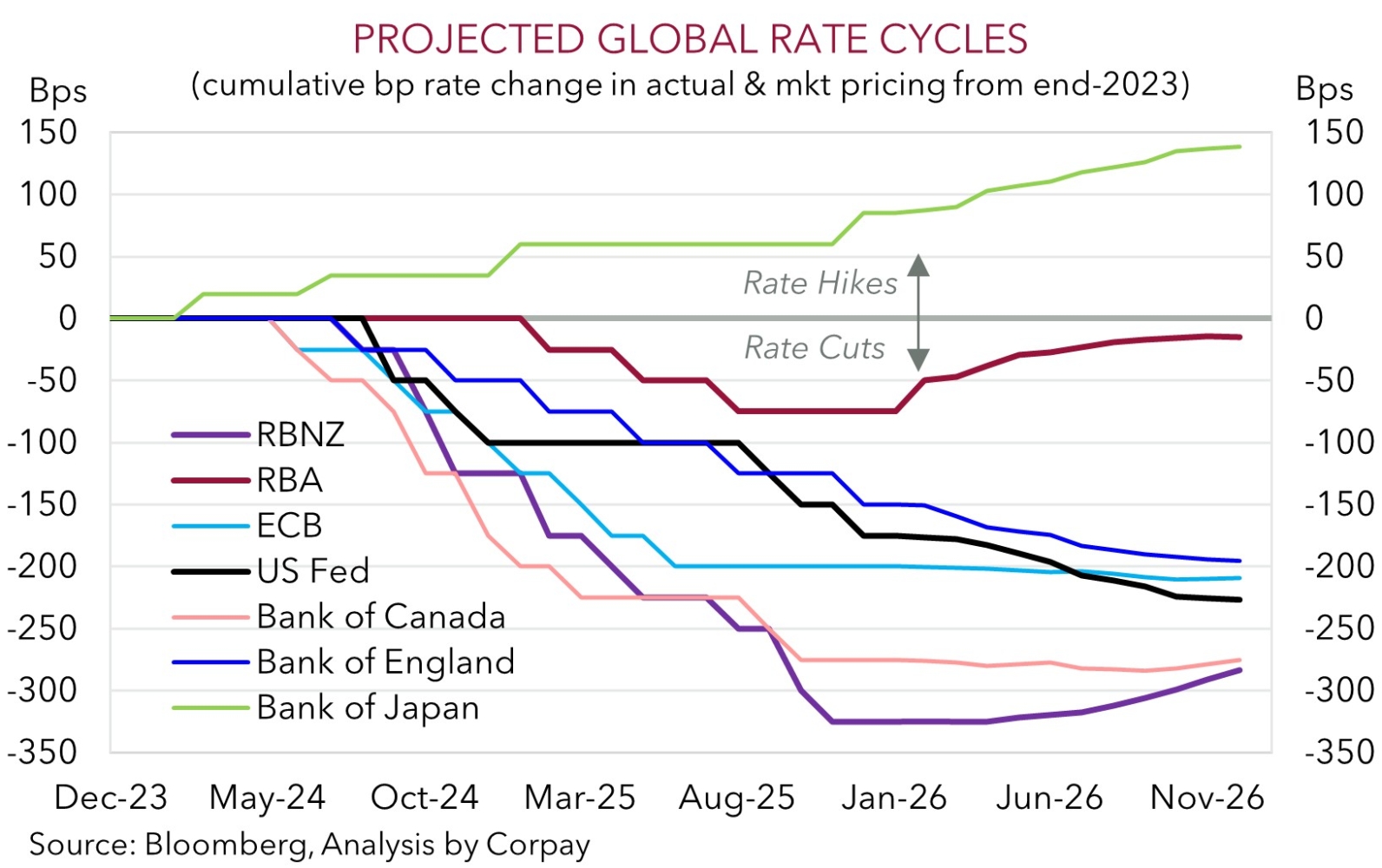

US headline CPI rose just 0.2% in January, the smallest rise since July, with lower energy prices a factor dragging on inflation. And although ‘services’ inflation was firm, an offsetting force was the stability in core ‘goods’ prices. US core CPI, which is impacted more by trends in services prices rather than ‘tariff’ effected goods, is now running at 2.5%pa, its slowest pace since early-2021. In response markets pulled forwards expectations for the next US Fed rate cut towards June, reversing the shift out that occurred because of the stronger than expected US jobs data earlier in the week. Markets are now fully discounting another US Fed rate reduction by July, with ~2.5 cuts factored in by year end. In our view, the mix of sluggish underlying US growth, labour market wobbles, and cooling inflation points to a further step down in US interest rates over the coming quarters.

It is likely to be a quiet start to the new week with US markets observing President’s Day holiday. The Lunar New Year period may also reduce trading activity and market liquidity across Asia this week. Looking ahead, the latest global business PMIs are due later this week (Friday), as is Q4 US GDP and the PCE deflator (the Fed’s preferred inflation gauge) (Fri night AEDT). On balance, the global PMIs could show momentum in the US has perked up a bit, and while US GDP growth might have slowed from its robust Q3 pace, some of that will be because of the prolonged government shutdown. US consumer spending (the engine room of the economy) looks like it was solid in Q4. If realised, we think this may give the USD some short-run support especially as it is still below our ‘fair value’ estimate.

Trans-Tasman Zone

The push-pull forces across markets generated by cooling US inflation resulted in little net movement in the NZD and AUD at the end of last week (see above). At ~$0.6027 the NZD remains within ~1% of its multi-month peak, and although the AUD eased a bit lower it is still tracking near the upper end of its multi-year range (now ~$0.7071). Some of the heat also came out of the AUD cross-rates with small declines (i.e. ~0.2-0.4%) recorded versus the EUR, JPY, GBP, NZD, CAD, and CNH. However, in level terms crosses like AUD/EUR, AUD/GBP, and AUD/CNH are within striking distance of their respective multi-month highs, while others such as AUD/JPY and AUD/NZD are around the top of their multi-year ranges.

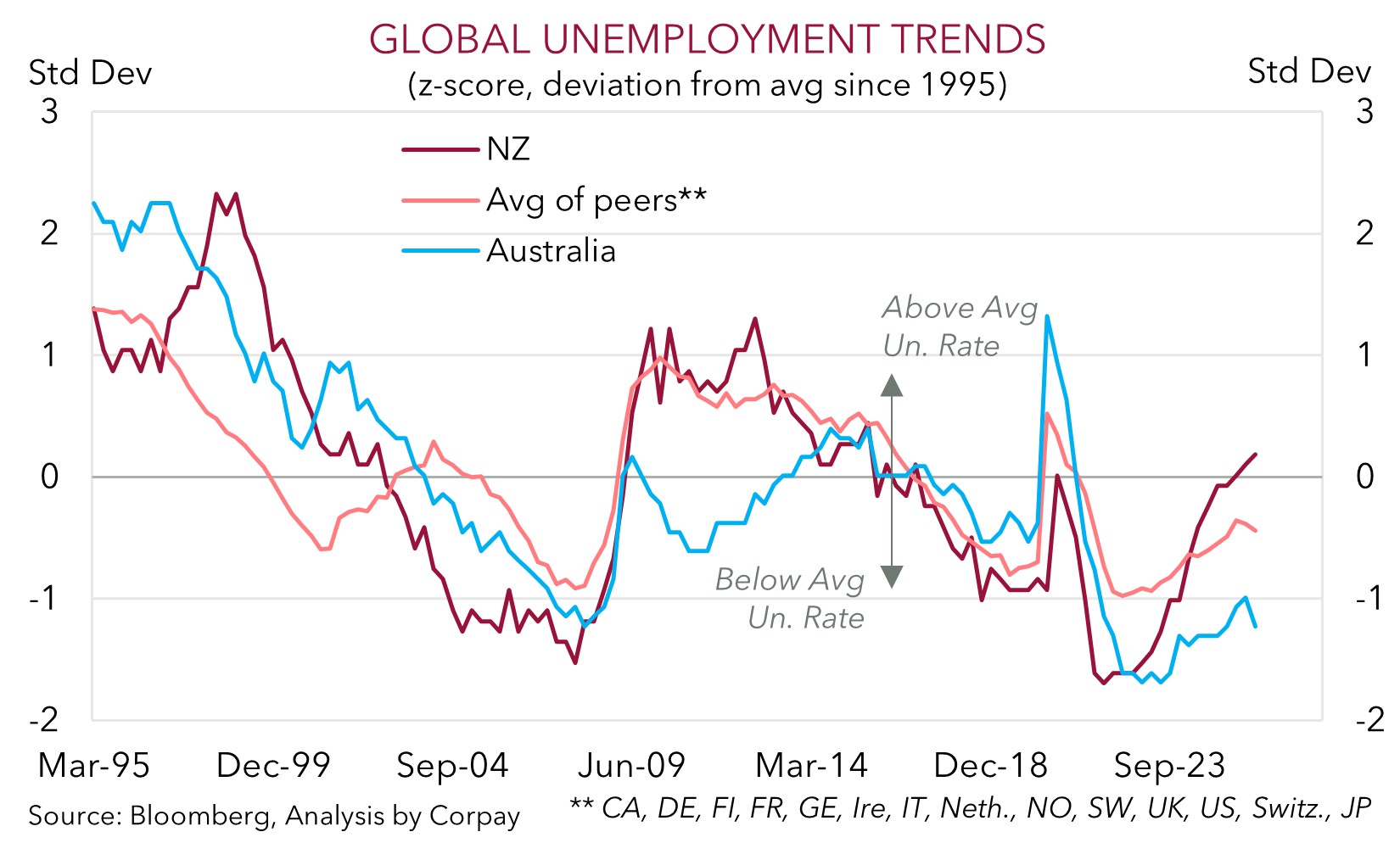

Across the Tasman this week focus will be on the RBNZ (Wednesday). This is not just the first meeting of the year, but also the first under the leadership of Governor Breman. The new RBNZ Governor is also due to speak on Friday. No change in interest rates is anticipated by the RBNZ. Recent NZ growth and inflation outcomes have been stronger than predicted. As such, we think the evolving trends could see the RBNZ remove the slight chance of more policy easing implied within its interest rate forecast track and sound more ‘neutral’ in its stance. However, we doubt things have progressed enough to see the RBNZ confidently flag the start of an eventual hiking cycle. This might disappoint ‘hawkish’ markets given a rate rise is pretty much baked in by October. If realised, we feel this might see the NZD give back a bit of ground in the near-term.

In Australia attention will be on the monthly labour force lottery (Thursday). After a strong December report, we think the January data might show some loosening in labour market conditions. Shifting seasonal job patterns after COVID have seen the unemployment rate rise by ~0.1-0.15%pts in the past 3 Januarys. A repeat in 2026 could see traders temper their bets looking for another RBA rate rise over the next few months (markets are assigning a ~80% chance the RBA hikes again by May). This in turn may exert some downward pressure on the AUD in the near-term after its strong start to the year. Indeed, the AUD is a little above where our ‘fair value’ estimates are tracking. Moreover, with the negative economic impacts of higher interest rates also set to materialise over coming months we continue to think ~$0.71-0.72 may be a ceiling for the AUD.