• US data. US jobs report supported sentiment. This & ‘hawkish’ comments by RBA’s Hauser helped AUD outperform. AUD at levels last traded in Feb ’23.

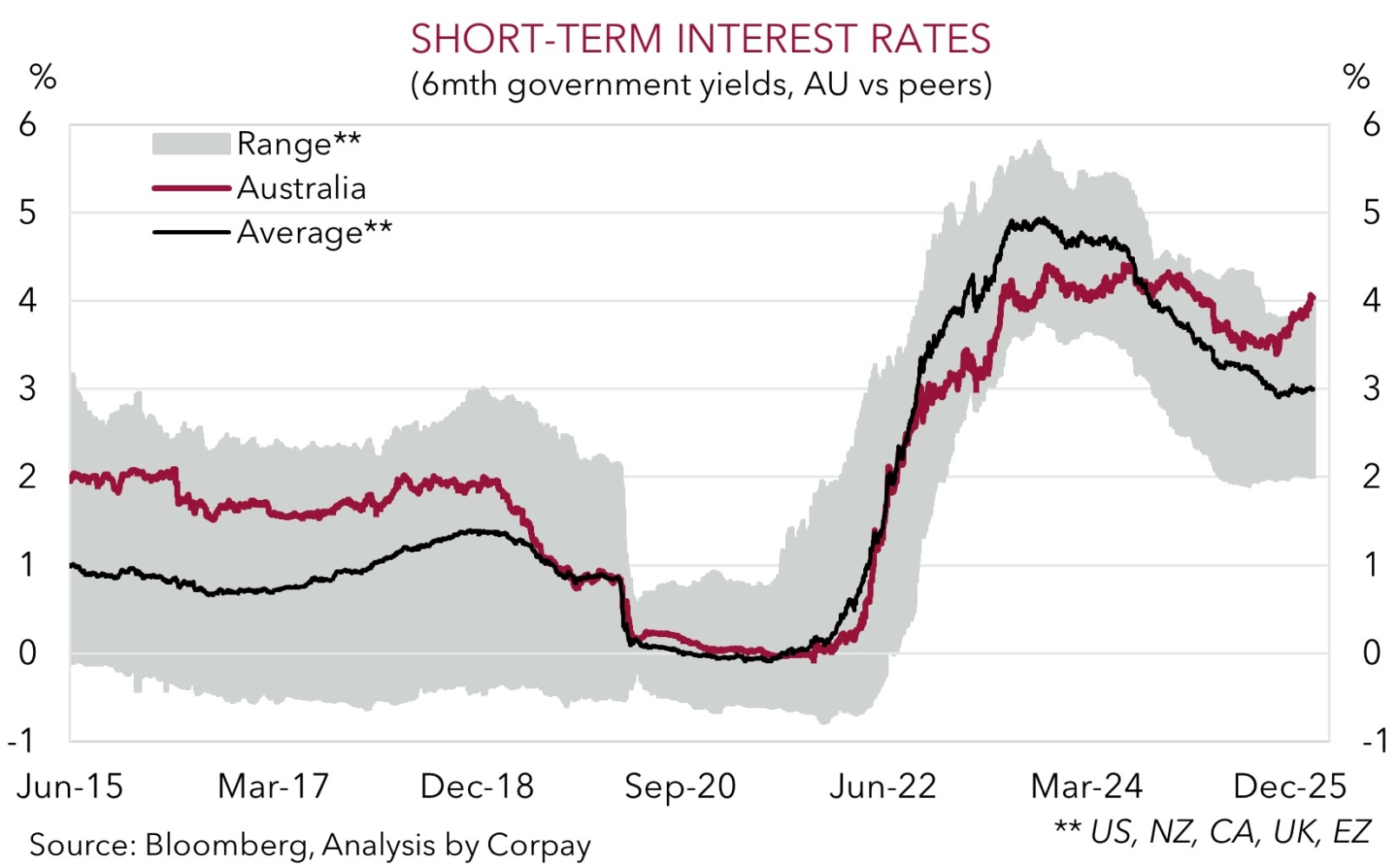

• Rate repricing. Markets factoring in another RBA hike by August. Relative interest rates are AUD supportive. But has it moved up too fast?

Global Trends

There was a more positive tone across markets overnight with better-than-expected US jobs data allaying fears about the state of the economy and supporting sentiment. While US equities retraced their initial positive reaction the S&P500 still recorded a modest gain (+0.1%). US bond yields rose with the larger jump at the front end of the curve (US 2yr yields +6bps) reflecting reduced US Fed rate cut expectations. Across commodities, base metals like copper (+1.1%) and energy prices (WTI crude oil +1.2%) increased, while in FX it was a more mixed picture. Once again, while the USD index ticked up thanks to some strength against the EUR (now ~$1.1870), GBP (now ~$1.3622), and CAD (now ~1.3575), this was counteracted by another pull-back in USD/JPY (the second most traded currency). At ~153.24 USD/JPY is ~2.8% below Monday morning’s post Japanese election peak with the undervalued JPY continuing to recoup lost ground and USD/JPY converging towards where fundamentals such as yield spreads suggest it should be. Elsewhere, cyclical growth linked currencies like the NZD held up (now ~$0.6047) and the AUD outperformed over the past 24hrs (now ~$0.7123, highs since early-February 2023).

Data wise, US non-farm payrolls rose by 130,000, double consensus predictions, and the unemployment rate declined to 4.3% even after accounting for an increase in the labor force participation rate. A substantial share of the January job growth was in health care and social assistance, but nevertheless it further supports the US Fed’s recent assessment that the labor market is stabilising, making a March interest rate cut less likely, in our view. Markets agree with the another US Fed rate reduction now not fully priced in until the late-July meeting. We believe the US Fed will sit on the sidelines for a while, but more policy easing down the track should still be anticipated. The topline January US jobs data was better than predicted, yet under the surface cracks are still visible. Jobs growth in economic sensitive ‘cyclical sectors’ has slowed to a crawl over the past year, and forward indicators such as hiring intentions and job openings suggest this underlying trend may not turn around soon. At the same time, growth headwinds from higher costs/import prices remain.

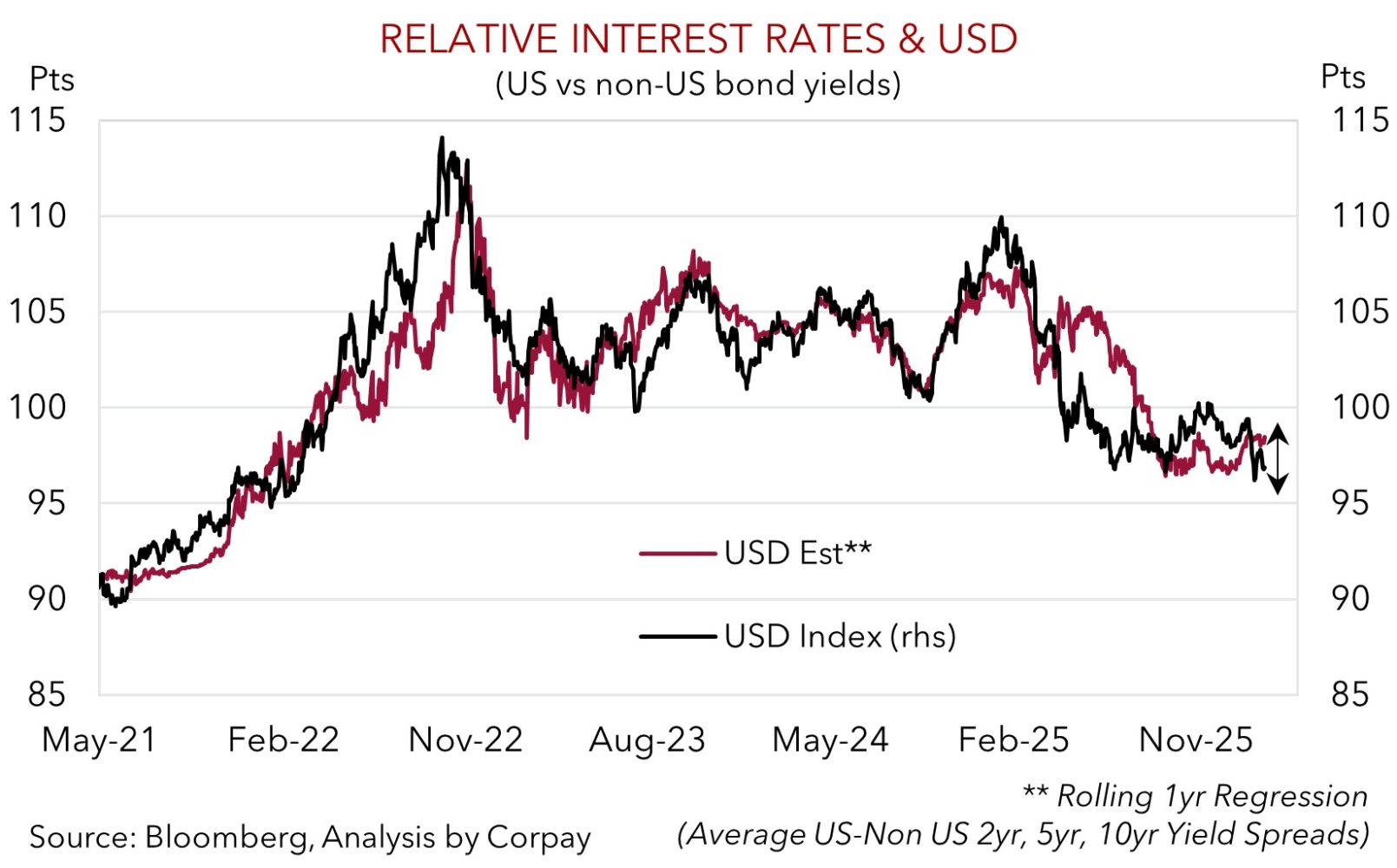

Looking ahead, in the US weekly initial jobless claims (a timely gauge of how many people are applying for unemployment benefits) are due tonight (12:30am AEDT), and CPI data is out later in the week (Friday night AEDT). On balance, we feel signs US inflation remains sticky could further reinforce views the Fed is on hold the next few months. Hence, there is scope for the USD to lift to reflect the recent ‘hawkish’ interest rate repricing. As shown, the USD index is tracking below levels implied by interest rate differentials.

Trans-Tasman Zone

The improved risk sentiment on the back of positive US jobs data has helped the NZD consolidate near the upper end of its multi-month range (now ~$0.6047). The AUD has extended its upswing with it touching its highest level since early-February 2023 (now ~$0.7123). Relative strength on the cross-rates provided the AUD a helping hand with the AUD rising by ~0.7-0.9% versus the EUR, GBP, NZD, CAD, and CNH. In level terms AUD/EUR (now ~0.60) is at its highest point since last March, AUD/NZD is at the top of the range occupied since mid-2013 (now ~1.1778), while AUD/GBP (now ~0.5229) and AUD/CNH (now ~4.9206) are at respective ~19-month peaks.

The ’hawkish’ vibes from the RBA and shift in relative interest rates in Australia’s favour continues to underpin the AUD. Yesterday RBA Deputy Governor Hauser reiterated the main messages from the February rate hike meeting: (a) inflation is too high and the RBA can’t let it persist; (b) global growth is stronger than was feared; (c) financial conditions don’t appear as ‘restrictive’ as earlier assessed; and (d) the level of demand has been stronger than expected, especially relative to supply. Today, RBA Governor Bullock testifies to the Senate Estimates committee (9am AEDT) and Assistant Governor Hunter speaks on the labour market (3:45pm AEDT). We would expect a similar tone/message to be delivered about the state of play and prospect of another rate increase given inflation dynamics.

Things have moved a long way in a short space of time. Forward-looking markets are almost fully pricing in another RBA rate hike by June, with close to 1.5 increases baked in by year-end. Expectations matter in markets, and with a “hawkish” interest rate outlook factored in we think this tailwind for the AUD may have largely run its course, and there is a risk some of the heat comes out of the AUD in the near-term after such a strong run. Indeed, the AUD is ‘overbought’ on technical/momentum indicators such as relative strength indices, and it is a bit above where our ‘fair value’ estimates are tracking. Moreover, with the negative economic effects of higher interest rates also set to materialise over coming months we continue to think ~$0.72 may be a ceiling for the AUD.