Happy Thursday. The dollar is extending its advance for a third session after yesterday’s data underscored the US economy’s resilience, denting bearish conviction. Most major currency pairs remain rangebound, with the pound, euro and yen all holding broadly neutral technical positions against the greenback. Treasury yields are slightly higher, while equity markets are set to open a bit lower as investors weigh the Trump administration’s latest threats to intervene in the housing and defence sectors.

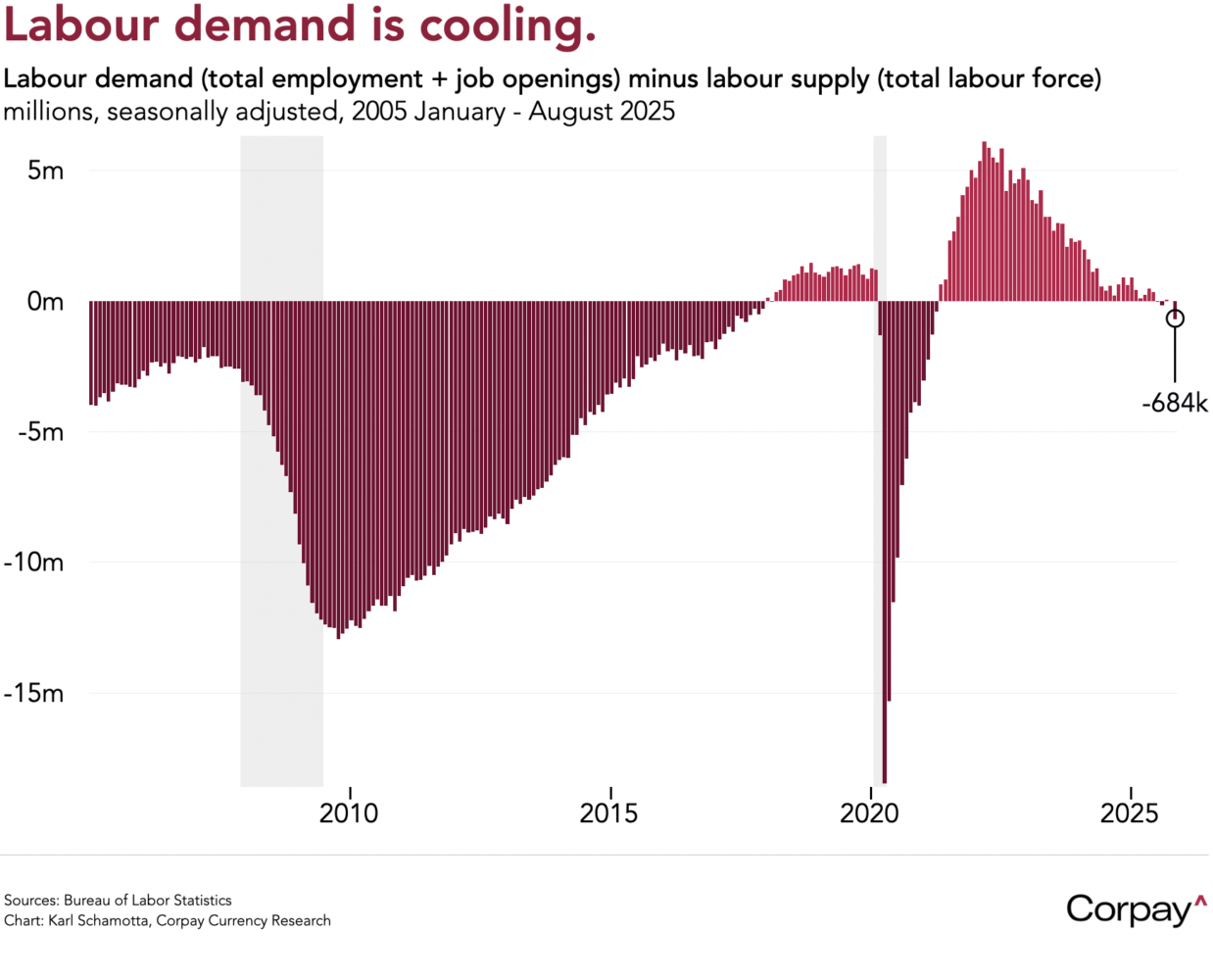

The latest Job Openings and Labor Turnover report delivered more evidence of a cooling in demand for workers, but layoffs remained low and the quits rate—often seen as a proxy for confidence—climbed slightly, suggesting that the non-linear deterioration feared by Federal Reserve officials is not yet playing out. The number of job openings fell sharply to 7.15 million in November—the second lowest print since the pandemic—and the prior month was revised lower to 7.45 million from the previous 7.67 million, adding to a drop in the hiring rate to underline a weakening in job creation. At the same time however, the quits rate rose to 2.0 percent from 1.9 percent previously, and the layoff-and-discharge rate fell to 1.1 percent from 1.2 percent, pointing to a reluctance to let employees go—something that could underpin stability in headline unemployment rates.

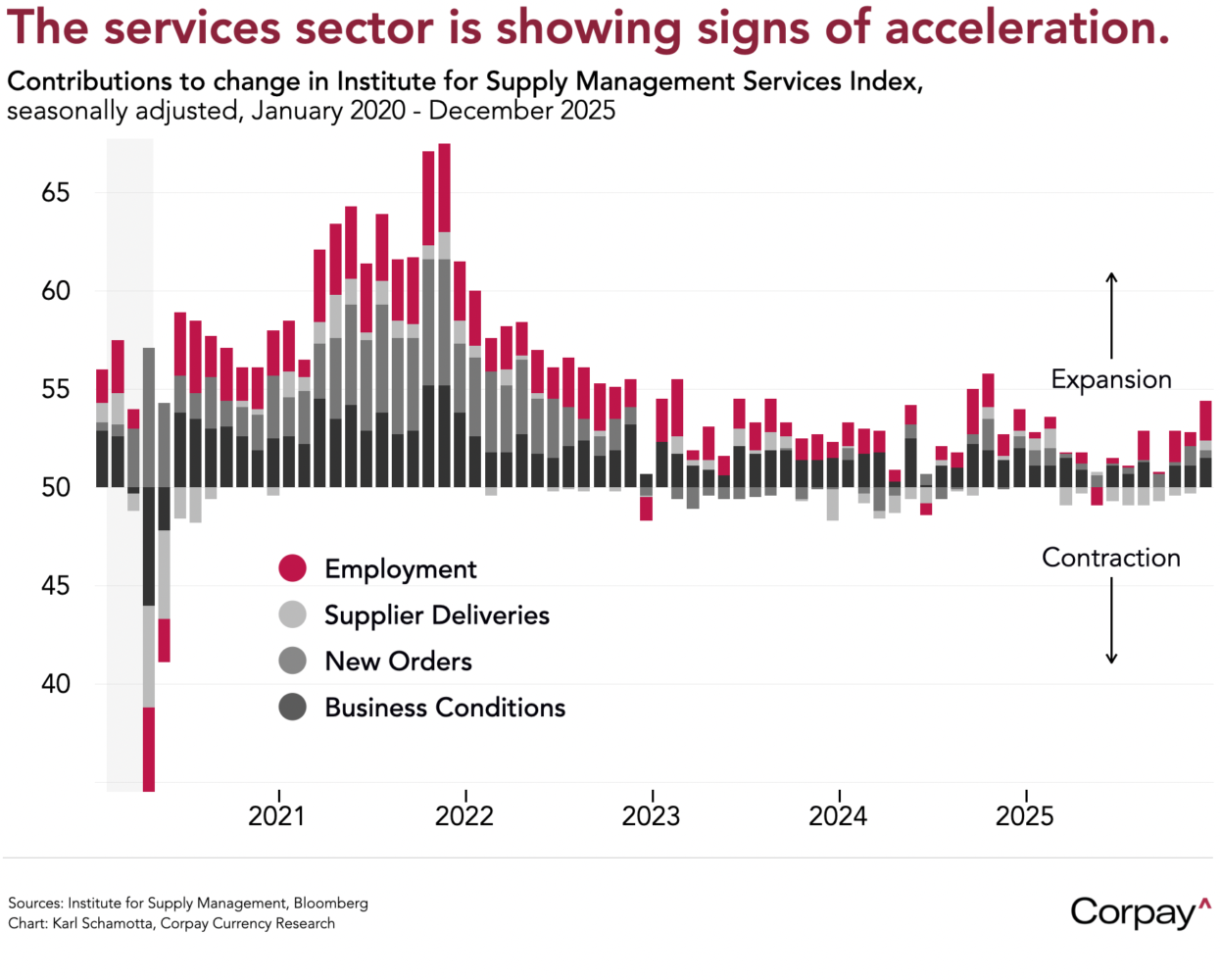

Perhaps more importantly, services activity showed clear signs of acceleration in December, with the Institute for Supply Management’s purchasing manager index topping all expectations in surveys conducted by the major data providers ahead of the release. The headline services index rose to 54.4 in December, up from 52.6 in the prior month—and well above the 50 threshold that separates expansion from contraction—as activity levels improved, new orders jumped, and employment snapped a six-month losing streak. Respondents expressed ongoing concerns about policy unpredictability, but reported solid sales during the holiday season, and generally noted that business conditions seemed healthy. The services sector drives roughly four-fifths of US economic activity.

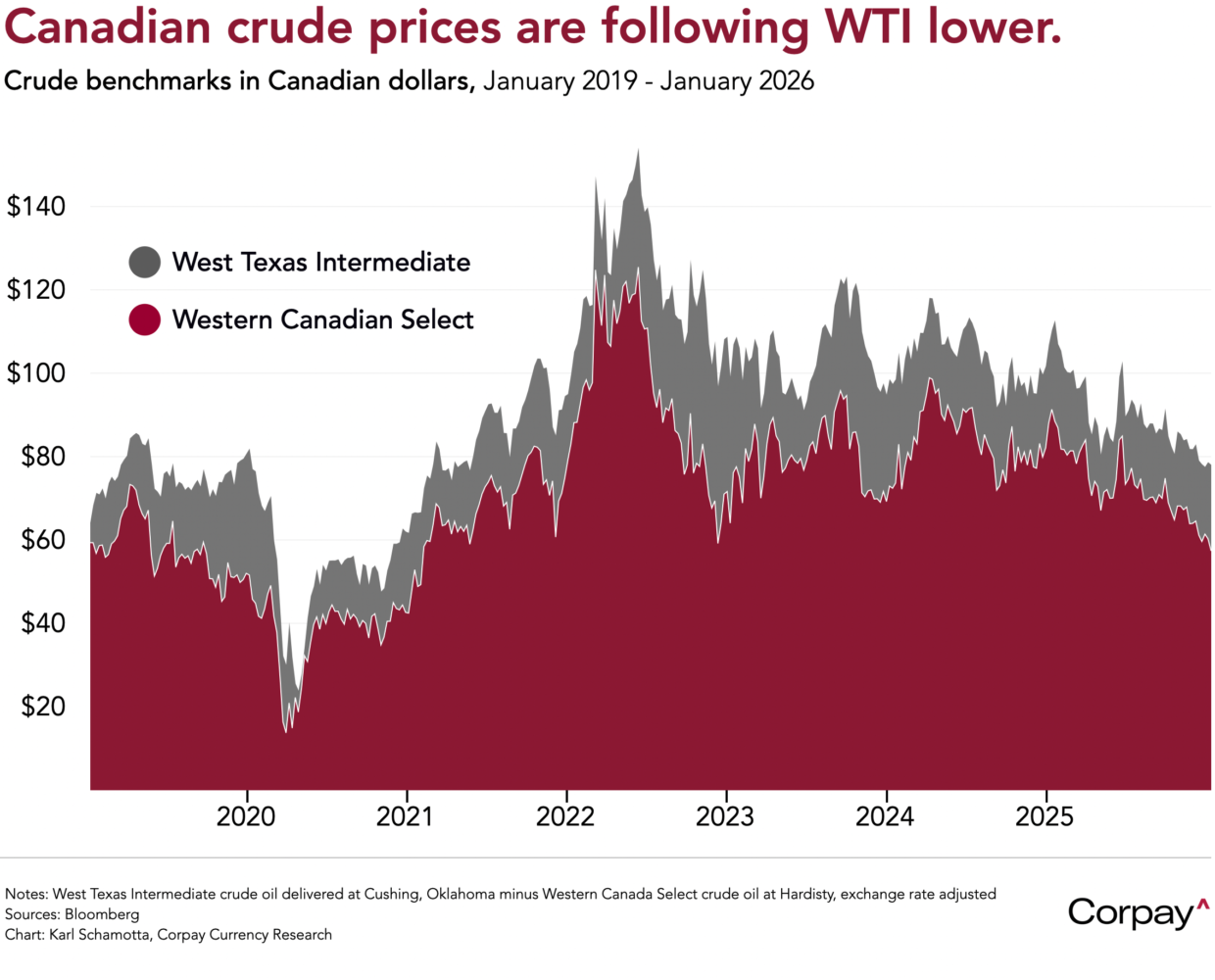

The Canadian dollar remains firmly on the defensive, trading north of its 200-day moving average and below key Bollinger Band support as market participants turn more bearish on its short-term prospects. With expectations for US growth and monetary policy settings ratcheting incrementally upward, rate gaps are again tilting in the greenback’s favour, but moves in oil markets also appear to be playing a role, contradicting our long-standing belief that the Canadian dollar should have evolved beyond its petro-currency reputation to become a real estate-levered proxy for financial conditions.

Global oil prices have slipped lower over the last year amid oversupplied conditions, and differentials between the West Texas Intermediate benchmark and Canadian grades delivered in Alberta and Houston have begun widening once again*, pointing to a weakening in distribution fundamentals. I suspect that benchmark moves in recent days could unwind as the US blockade against Venezuelan oil movement eases and cargoes make their way to global markets, and think concerns about a displacement of Canadian heavy oil in US markets are overwrought (most Canadian product is refined or consumed in the Midwest, not the Gulf), but there’s little likelihood of a renewed investment cycle playing out in the country’s energy sector as long as prices remain on their current trajectory.

Today’s session could be a quiet one as traders await tomorrow’s payrolls report, and position ahead of a potential decision from the US Supreme Court on the administration’s tariff regime. The US data docket includes weekly jobless claims, consumer credit, trade balance, and productivity numbers—all of which will be assessed for their bearing on tomorrow’s jobs release—and Mexico’s central bank will release a record of last month’s meeting, shedding light on how officials expect to shift direction in February. The peso has largely regained territory lost over the weekend when President Trump threw rhetorical threats at a number of Latin American** countries, but is finding its gains capped after inflation fell by more than expected in December, potentially helping shift the balance of opinion among policymakers toward providing more accommodation to a steadily-weakening real economy in the months ahead.

More broadly, markets are retracing year-end moves, but are still lacking a directional catalyst for bigger shifts in positioning. The US is still going through a Brexit-like erosion in long-term fundamentals, but an early-year reduction in bets against the dollar probably has further to go, with upside growth surprises beyond tomorrow’s all-important payrolls report carrying the potential for asymmetric upside moves. Against this backdrop, I would again warn that the volatility expectations currently priced into markets look too low.

*Note that differentials narrowed last year as new pipeline capacity came online, easing transport cost gaps.

**Mexico may be physically and economically located in North America, but from a US political standpoint, still tends to be lumped in with its cultural cousins in Latin America.