The speed at which memes spread across the financial media can be astonishing. Since the Bank of England’s Huw Pill recently described the likely monetary policy trajectory as resembling Cape Town’s “Table Mountain” – steep on the sides, with a long plateau on top – in an August speech, sell-side analysts and commentators from major news publications have rushed to point out that the majority of mountain climbing deaths occur during the descent phase.

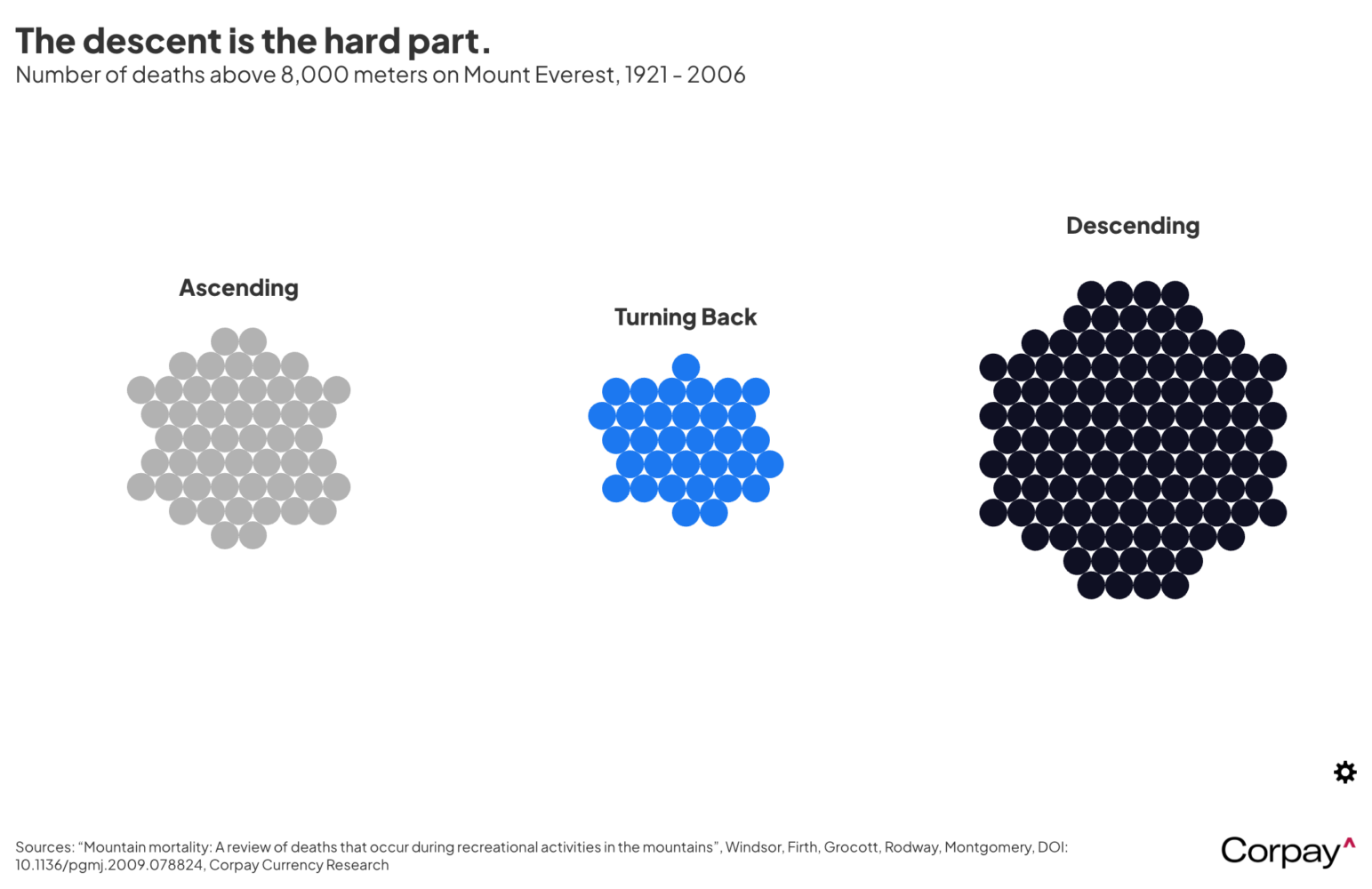

This is true. A 2008 study showed that 73 percent of the deaths occurring between 1921 and 2006 on Mount Everest happened when climbers were descending or turning back from the peak. Just 15 percent died during the ascent.

The historical record suggests that we are entering the most dangerous period of the monetary cycle, when the lagging effects of a difficult climb hit an exhausted economy and stress the global financial system. Contra Mr. Pill’s optimism, policy “plateaus” are extremely rare, with accidents typically occurring within months of a peak in rates, and negative outcomes multiplying on the way down.

Market participants would be well advised to tread carefully, looking through the current period of low volatility and talk of “soft landings” to what comes next. Hedging currency risk could be absolutely crucial at this juncture, with avalanches and rockfalls becoming more likely – and almost impossible to see coming.

But we also would observe that avoiding the climb entirely might be the key to higher survival rates. Perfectly good views, hot toddies, and more comfortable surroundings can be found in ski chalets at lower elevations. If central banks avoided pulling out all the unconventional policy stops and pushing rates into negative real territory during each economic downturn, we might be dealing with less extreme financial imbalances, and a more natural business cycle.